Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 121:

On January 1, 1991, ABC Co. installed cabinets to display its merchandise in customers' stores. ABC expects to use these cabinets for five years. ABC's 1991 multi-step income statement should include:

A. One-fifth of the cabinet costs in cost of goods sold.

B. One-fifth of the cabinet costs in selling, general, and administrative expenses.

C. All of the cabinet costs in cost of goods sold.

D. All of the cabinet costs in selling, general, and administrative expenses.

-

Question 122:

Which of the following accounting pronouncements is the most authoritative?

A. FASB Statement of Financial Accounting Concepts.

B. FASB Technical Bulletin.

C. AICPA Accounting Principles Board Opinion.

D. AICPA Statement of Position.

-

Question 123:

FASB Interpretations of Statements of Financial Accounting Standards have the same authority as the FASB:

A. Statements of Financial Accounting Concepts.

B. Emerging Issues Task Force Consensus.

C. Technical Bulletins.

D. Statements of Financial Accounting Standards.

-

Question 124:

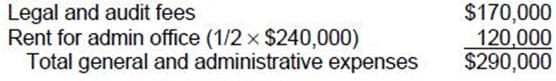

The following items were among those that were reported on ABC Co.'s income statement for the year ended December 31, 1989:

The office space is used equally by ABC's sales and accounting departments. What amount of the above listed items should be classified as general and administrative expenses in ABC's multiple-step income statement?

A. $290,000

B. $325,000

C. $410,000

D. $500,000

-

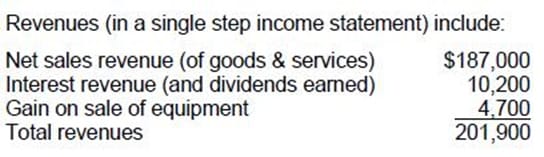

Question 125:

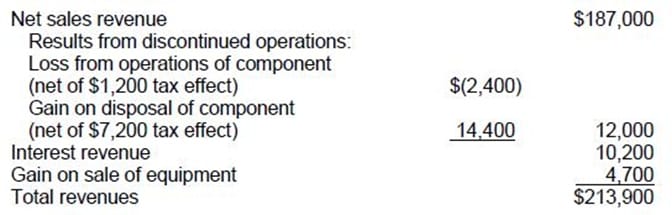

In ABC Food Co.'s 1990 single-step income statement, the section titled "Revenues" consisted of the following: In the revenues section of its 1990 income statement, ABC Food should have reported total revenues of:

A. $216,300

B. $215,400

C. $203,700

D. $201,900

-

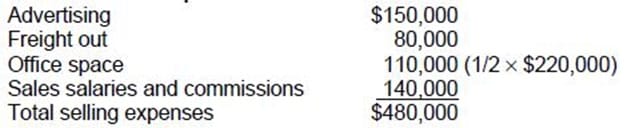

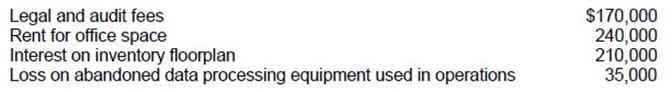

Question 126:

ABC Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 1989 included the following expense and loss accounts:

One-half of the rented premises is occupied by the sales department. ABC's total selling expenses for 1989 are:

A. $480,000

B. $400,000

C. $370,000

D. $360,000

-

Question 127:

According to the FASB conceptual framework, an entity's revenue may result from:

A. A decrease in an asset from primary operations.

B. An increase in an asset from incidental transactions.

C. An increase in a liability from incidental transactions.

D. A decrease in a liability from primary operations.

-

Question 128:

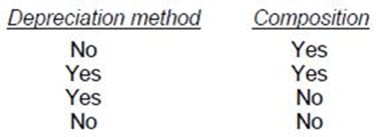

Which of the following facts concerning fixed assets should be included in the summary of significant accounting policies?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 129:

FASB's conceptual framework explains both financial and physical capital maintenance concepts. Which capital maintenance concept is applied to currently reported net income, and which is applied to comprehensive income?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 130:

According to the FASB conceptual framework, which of the following is an essential characteristic of an asset?

A. The claims to an asset's benefits are legally enforceable.

B. An asset is tangible.

C. An asset is obtained at a cost.

D. An asset provides future benefits.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.