Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 141:

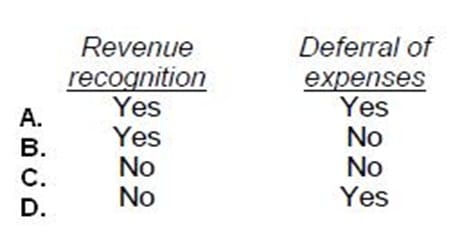

A development stage enterprise should use the same generally accepted accounting principles that apply to established operating enterprises for:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 142:

Which of the following types of entities are required to report on business segments?

A. Nonpublic business enterprises.

B. Publicly-traded enterprises.

C. Not-for-profit enterprises.

D. Joint ventures.

-

Question 143:

Which of the following factors determines whether an identified segment of an enterprise should be reported in the enterprise's financial statements under SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information?

I. The segment's assets constitute more than 10% of the combined assets of all operating segments.

II.

The segment's liabilities constitute more than 10% of the combined liabilities of all operating segments.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 144:

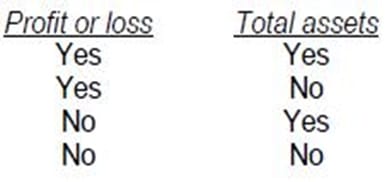

Which of the following should be disclosed for each reportable operating segment of an enterprise?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 145:

Which of the following qualifies as an operating segment?

A. Corporate headquarters, which oversees $1 billion in sales for the entire company.

B. North American segment, whose assets are 12% of the company's assets of all segments, and management reports to the chief operating officer.

C. South American segment, whose results of operations are reported directly to the chief operating officer, and has 5% of the company's assets, 9% of revenues, and 8% of the profits.

D. Eastern Europe segment, which reports its results directly to the manager of the European division, and has 20% of the company's assets, 12% of revenues, and 11% of profits.

-

Question 146:

In financial reporting of segment data, which of the following items is always used in determining a segment's operating income?

A. Income tax expense.

B. Sales to other segments.

C. General corporate expense.

D. Gain or loss on discontinued operations.

-

Question 147:

ABC Co. is a publicly-traded, consolidated enterprise reporting segment information. Which of the following items is a required enterprise-wide disclosure regarding external customers?

A. The fact that transactions with a particular external customer constitute more than 10% of the total enterprise revenues.

B. The identity of any external customer providing 10% or more of a particular operating segment's revenue.

C. The identity of any external customer considered to be "major" by management.

D. Information on major customers is not required in segment reporting.

-

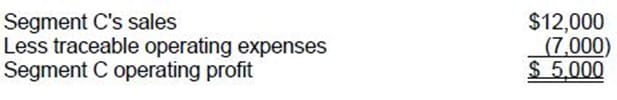

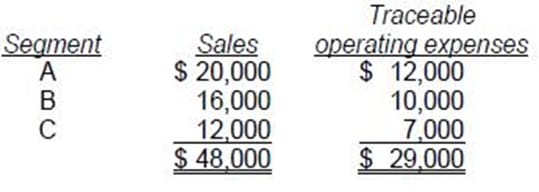

Question 148:

ABC Corp. discloses supplemental industry segment information. The following information is available for 1992:

Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200 General corporate expenses 4,800

Segment C's 1992 operating profit was:

A. $5,000

B. $3,200

C. $2,600

D. $2,000

-

Question 149:

What information should a public company present about revenues from its reporting segments?

A. Disclose separately the amount of sales to unaffiliated customers and the amount of intracompany sales.

B. Disclose as a combined amount sales to unaffiliated customers and intracompany sales between geographic areas.

C. Disclose separately the amount of sales to unaffiliated customers but not the amount of intracompany sales between geographic areas.

D. No disclosure of revenues from foreign operations need be reported.

-

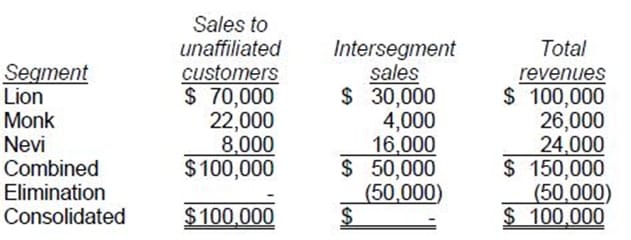

Question 150:

ABC Co.'s total revenues from its three operating segments were as follows: Which operating segment(s) is (are) deemed to be reportable segments?

A. None.

B. Lion only.

C. Lion and Monk only.

D. Lion, Monk, and Nevi.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.