CPA-TEST Exam Details

-

Exam Code

:CPA-TEST -

Exam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, Regulation -

Certification

:AICPA Certifications -

Vendor

:AICPA -

Total Questions

:1241 Q&As -

Last Updated

:

AICPA CPA-TEST Online Questions & Answers

-

Question 1:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

Tom received $10,000, consisting of $5,000 each of principal and interest, when he redeemed a Series EE savings bond in 1994. The bond was issued in his name in 1990 and the proceeds were used to pay for Laura's college tuition. Tom

had not elected to report the yearly increases in the value of the bond.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 2:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

In 1994, Joan received $3,500 as beneficiary of the death benefit, which was provided by her brother's employer. Joan's brother did not have a nonforfeitable right to receive the money while living.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 3:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

The Moores received a stock dividend in 1994 from ABC Corp. They had the option to receive either cash or ABC stock with a fair market value of $900 as of the date of distribution. The par value of the stock was $500.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 4:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

The Moores received $8,400 in gross receipts from their rental property during 1994. The expenses for the residential rental property were:

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 5:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

In 1994, Joan received $1,300 in unemployment compensation benefits. Her employer made a $100 contribution to the unemployment insurance fund on her behalf.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 6:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

During 1994, the Moores received a $2,500 federal tax refund and a $1,250 state tax refund for 1993 overpayments. In 1993, the Moores were not subject to the alternative minimum tax and were not entitled to any credit against income tax. The Moores' 1993 adjusted gross income was $80,000 and itemized deductions were $1,450 in excess of the standard deduction. The state tax deduction for 1993 was $2,000.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 7:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

Tom's 1994 wages were $53,000. In addition, Tom's employer provided group-term life insurance on Tom's life in excess of $50,000. The value of such excess coverage was $2,000.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 8:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

The Moores received a $500 security deposit on their rental property in 1994. They are required to return the amount to the tenant.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 9:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

In 1992, Joan received an acre of land as an inter-vivos gift from her grandfather. At the time of the gift, the land had a fair market value of $50,000. The grandfather's adjusted basis was $60,000. Joan sold the land in 1994 to an unrelated

third party for $56,000.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 -

Question 10:

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

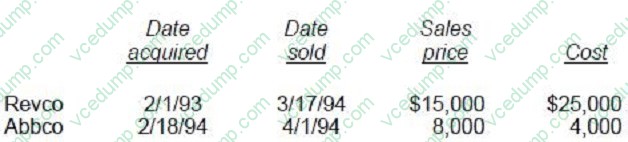

The Moores had no capital loss carryovers from prior years. During 1994, the Moores had the following stock transactions, which resulted in a net capital loss:

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.