Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 131:

According to the FASB's conceptual framework, the process of reporting an item in the financial statements of an entity is:

A. Recognition.

B. Realization.

C. Allocation.

D. Matching.

-

Question 132:

Under FASB Statement of Financial Accounting Concepts #5, which of the following items would cause earnings to differ from comprehensive income for an enterprise in an industry not having specialized accounting principles?

A. Unrealized loss on investments in noncurrent marketable equity securities available for sale.

B. Unrealized loss on investments in current marketable equity securities held for trading.

C. Loss on exchange of nonmonetary assets without commercial substance.

D. Loss on exchange of nonmonetary assets with commercial substance.

-

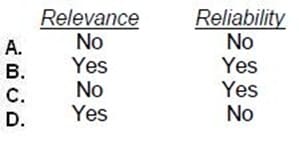

Question 133:

According to the FASB conceptual framework, predictive value is an ingredient of:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 134:

A change from the cost approach to the market approach of measuring fair value is considered to be what type of accounting change?

A. Change in accounting estimate.

B. Change in accounting principle.

C. Change in valuation technique.

D. Error correction.

-

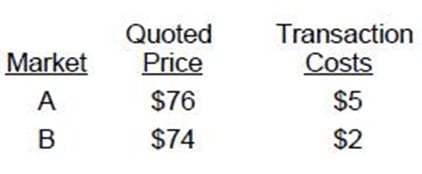

Question 135:

There are multiple active markets for a financial asset with different observable market prices:

There is no principal market for the financial asset. What is the fair value of the asset?

A. $71

B. $72

C. $74

D. $76

-

Question 136:

Which of the following statements is incorrect regarding the inputs that can be used to measure fair value?

I. Level I inputs are the most reliable fair value measurements and Level III inputs are the least reliable.

II. Level I measurements are quoted prices in active markets for identical or similar assets or liabilities.

III. A fair value measurement based on management assumptions only (no market data) would not be acceptable per GAAP.

IV.

The level in the fair value hierarchy of a fair value measurement is determined by the level of the highest level significant input.

A.

I only.

B.

I, II, IV.

C.

II, III, IV.

D.

I, II, III, IV.

-

Question 137:

Which of the following is not a valuation technique that can be used to measure the fair value of an asset or liability?

A. The market approach.

B. The impairment approach.

C. The income approach.

D. The cost approach.

-

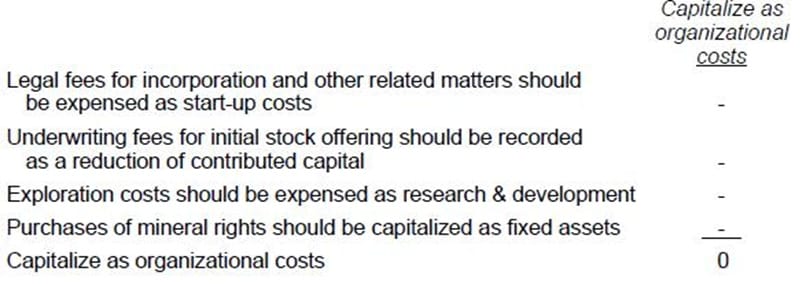

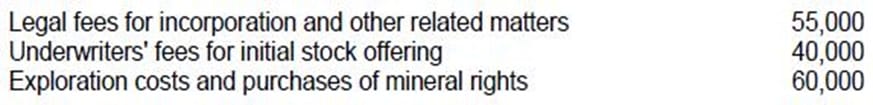

Question 138:

ABC Co., a development stage enterprise, incurred the following costs during its first year of operations:

ABC had no revenue during its first year of operation. What amount may ABC capitalize as organizational costs?

A. $115,000

B. $95,000

C. $55,000

D. $0

-

Question 139:

Which of the following statements regarding fair value is/are correct?

I. The fair value of an asset or liability is specific to the entity making the fair value measurement.

II. Fair value is the price to acquire an asset or assume a liability.

III. Fair value includes transportation costs, but not transaction costs.

IV.

The price in the principal market for an asset or liability will be the fair value measurement.

A.

I and II

B.

I and IV

C.

II and III

D.

III and IV

-

Question 140:

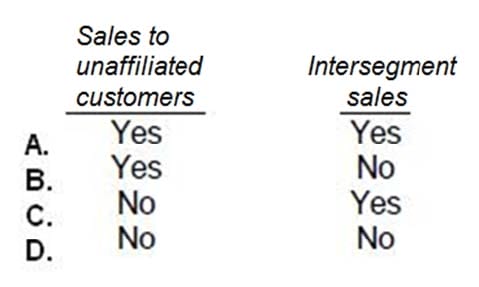

In financial reporting of segment data, which of the following must be considered in determining if an industry segment is a reportable segment?

A. Option A

B. Option B

C. Option C

D. Option D

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.