Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 11:

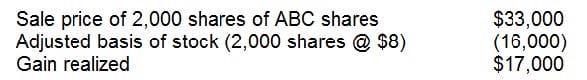

ABC Corp. is an accrual-basis calendar-year corporation with 100,000 shares of voting common stock issued and outstanding as of December 28, 1996. On Friday, December 29, 1996, XYZ surrendered 2,000 shares of ABC stock to ABC in exchange for $33,000 cash. XYZ had no direct or indirect interest in ABC after the stock surrender. Additional information follows:

What amount of income did XYZ recognize from the stock surrender?

A. $33,000 dividend.

B. $25,000 dividend.

C. $18,000 capital gain.

D. $17,000 capital gain.

-

Question 12:

The uniform capitalization method must be used by:

I. Manufacturers of tangible personal property.

II.

Retailers of personal property with $2 million dollars in average annual gross receipts for the 3 preceding years.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 13:

Among which of the following related parties are losses from sales and exchanges not recognized for tax purposes?

A. Father-in-law and son-in-law.

B. Brother-in-law and sister-in-law.

C. Grandfather and granddaughter.

D. Ancestors, lineal descendants, and all in-laws.

-

Question 14:

Ryan, age 57, is single with no dependents. On July 1, 1997, Ryan's principal residence was sold for the net amount of $500,000 after all selling expenses. Ryan bought the house in 1963 and occupied it until sold. On the date of sale, the house had a basis of $180,000. Ryan does not intend to buy another residence. What is the maximum exclusion of gain on sale of the residence that may be claimed in Ryan's 1997 income tax return?

A. $320,000

B. $250,000

C. $125,000

D. $0

-

Question 15:

For a cash basis taxpayer, gain or loss on a year-end sale of listed stock arises on the:

A. Trade date.

B. Settlement date.

C. Date of receipt of cash proceeds.

D. Date of delivery of stock certificate.

-

Question 16:

Hall, a divorced person and custodian of her 12-year old child, filed her 1990 federal income tax return as head of a household. She submitted the following information to the CPA who prepared her 1990 return:

•

In 1990, Hall sold an antique that she bought in 1980 to display in her home. Hall paid $800 for the

antique and sold it for $1,400, using the proceeds to pay a court ordered judgment.

The $600 gain that Hall realized on the sale of the antique should be treated as:

A.

Ordinary income.

B.

Long-term capital gain.

C.

An involuntary conversion.

D.

A nontaxable antiquities transaction.

-

Question 17:

Fred Berk bought a plot of land with a cash payment of $40,000 and a mortgage of $50,000. In addition, Berk paid $200 for a title insurance policy. Berk's basis in this land is:

A. $40,000

B. $40,200

C. $90,000

D. $90,200

-

Question 18:

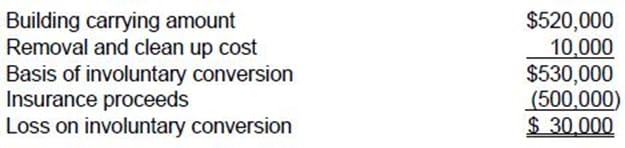

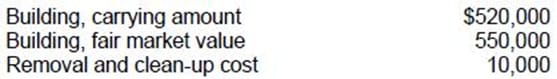

On December 31, 1989, a building owned by ABC Corp. was totally destroyed by fire. The building had fire insurance coverage up to $500,000. Other pertinent information as of December 31, 1989 follows:

During January 1990, before the 1989 financial statements were issued, ABC received insurance proceeds of $500,000. On what amount should ABC base the determination of its loss on involuntary conversion?

A. $520,000

B. $530,000

C. $550,000

D. $560,000

-

Question 19:

A cash basis taxpayer should report gross income:

A. Only for the year in which income is actually received in cash.

B. Only for the year in which income is actually received whether in cash or in property.

C. For the year in which income is either actually or constructively received in cash only.

D. For the year in which income is either actually or constructively received, whether in cash or in property.

-

Question 20:

Doris and Lydia are equal partners in the capital and profits of Agee and Nolan, but are otherwise unrelated. The following information pertains to 300 shares of ABC Corp. stock sold by Lydia to Agee and Nolan: The amount of long-term capital loss that Lydia realized in 1988 on the sale of this stock was:

A. $5,000

B. $3,000

C. $2,500

D. $0

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.