Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jul 08, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 801:

Which of the following best describes the responsibility of the auditor to report significant deficiencies and material weaknesses in an audit of a nonissuer?

A. The auditor must communicate both significant deficiencies and material weaknesses.

B. The auditor must communicate material weaknesses, but need not disclose significant deficiencies.

C. The auditor must communicate significant deficiencies, but need not separately identify material weaknesses.

D. Neither significant deficiencies nor material weaknesses are required to be communicated.

-

Question 802:

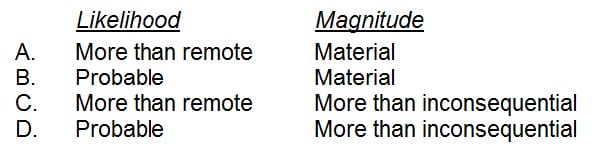

For a nonissuer, a control deficiency would be considered a material weakness when the likelihood and magnitude of potential financial statement misstatements are:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 803:

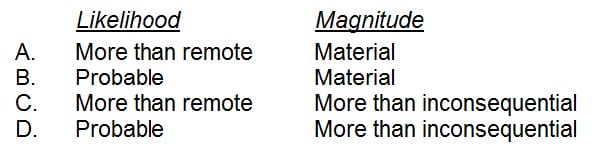

For a nonissuer, a control deficiency would be considered a significant deficiency when the likelihood and magnitude of potential financial statement misstatements are:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 804:

Management of ABC Industries, an issuer as defined under the Sarbanes-Oxley Act, believes it has eliminated a material weakness previously noted in its assessment of internal control, and has hired Henna and Company, CPAs, to attest to the improvements in internal control. Which of the following is true of this engagement?

A. It is required by PCAOB standards.

B. It is only required if ABC Industries elects to have an audit in accordance with PCAOB standards.

C. ABC's management must provide a written report to accompany Henna and Company's report.

D. It is required by generally accepted auditing standards.

-

Question 805:

Which of the following is true regarding significant deficiencies in internal control?

A. Auditors must search for them.

B. Auditors must communicate them to management and to those charged with governance.

C. They must be included in the financial statements.

D. They must be disclosed in footnotes.

-

Question 806:

Hannah, CPA, has been engaged to perform financial statement audits for three different clients. The first two clients, ABC Shop and XYZ Technologies, are both nonissuers, while the third client, DEF Industries, is an issuer. Hannah is required to follow PCAOB standards in her audit of DEF Industries. She has also been asked to conduct the XYZ audit in accordance with both generally accepted auditing standards and the auditing standards of the PCAOB. Regarding the ABC engagement, Hannah has decided to follow only generally accepted auditing standards, and not the standards of the PCAOB. Which of the following best describes the scope of Hannah's work related to internal control in these three engagements?

A. Hannah must express an opinion on the effectiveness of internal control in all three engagements.

B. Hannah must express an opinion on the effectiveness of internal control in both the DEF and XYZ engagements, but is not required to express such an opinion in the ABC engagement.

C. Hannah must express an opinion on the effectiveness of internal control in the DEF engagement, but is not required to express such an opinion in the XYZ and ABC engagements.

D. Hannah is not required to express an opinion on the effectiveness of internal control in any of the three engagements, since she was hired to perform a financial statement audit and not to report on internal control.

-

Question 807:

Rachel, CPA, is conducting an audit of ABC company, a nonissuer. Rachel has conducted her audit in accordance with generally accepted auditing standards, and she wishes to emphasize in her report that such standards do not require the same level of testing and reporting on internal control as is required for audits of issuers under the Sarbanes-Oxley Act. Which report modification would be most appropriate in this situation?

A. Only the scope paragraph should be modified.

B. An explanatory paragraph should be added following the opinion paragraph.

C. An explanatory paragraph should be added preceding the opinion paragraph, and the opinion paragraph should state, "Except for the matter discussed in the preceding paragraph..."

D. No report modification should be made in this scenario.

-

Question 808:

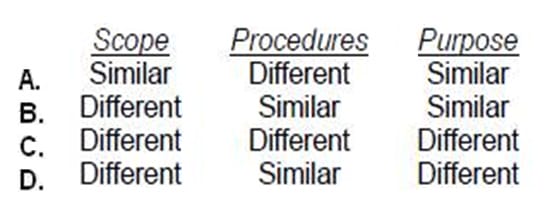

How do the scope, procedures, and purpose of an engagement to express a separate opinion on a nonissuer's internal control compare to those for obtaining an understanding of internal control and assessing control risk as part of an audit?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 809:

A letter issued on significant deficiencies relating to an entity's internal control observed during an audit of the financial statements of a nonissuer should include a:

A. Restriction on the use of the report.

B. Description of tests performed to search for material weaknesses.

C. Statement of compliance with applicable laws and regulations.

D. Paragraph describing management's evaluation of the effectiveness of internal control.

-

Question 810:

When communicating internal control related matters noted in an audit of a nonissuer, an auditor's report issued on significant deficiencies should indicate that:

A. Errors or fraud may occur and not be detected because there are inherent limitations in any internal control.

B. The issuance of an unqualified opinion on the financial statements may be dependent on corrective follow-up action.

C. A material weakness exists when the deficiencies noted were not detected within a timely period by employees in the normal course of performing their assigned functions.

D. The purpose of the audit was to report on the financial statements and not to provide assurance on internal control.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.