Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jul 08, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 791:

The auditor's report on internal controls and compliance with laws and regulations in accordance with Government Auditing Standards (the Yellow Book), is required to include:

I. The scope of the auditor's testing of internal controls.

II.

Uncorrected misstatements that were determined by management to be immaterial.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 792:

Gail is auditing the financial statements of ABC, a publicly held company. Gail notes several deficiencies in internal control, and is trying to determine whether each deficiency constitutes a significant deficiency or a material weakness. Which best describes the framework Gail should use in making this evaluation?

A. A significant deficiency exists for weaknesses that are important enough to merit the attention of those responsible for financial reporting, and a material weakness exists when there is a reasonable possibility of material misstatement.

B. A significant deficiency exists when there is more than a remote chance of a more than inconsequential misstatement, and a material weakness exists when there is more than a remote chance of a material misstatement.

C. A significant deficiency exists when there is more than a remote chance of a more than inconsequential misstatement, and a material weakness exists when there is a reasonable possibility of material misstatement.

D. A significant deficiency exists for weaknesses that are important enough to merit the attention of those responsible for financial reporting, and a material weakness exists when there is more than a remote chance of a material misstatement.

-

Question 793:

In which case might an auditor of an issuer render a qualified opinion on internal control?

A. When there is a scope limitation.

B. When there is a material weakness in internal control.

C. Both "a" and "b".

D. Neither "a" nor "b".

-

Question 794:

For a nonissuer, a previously communicated significant deficiency that has not been corrected, ordinarily should be communicated again:

A. Only if the deficiency has a material effect on the auditor's assessment of control risk.

B. Unless the entity accepts that degree of risk because of cost-benefit considerations.

C. Only if the deficiency is considered a material weakness.

D. In writing, during the current audit.

-

Question 795:

Which of the following best describes an auditor's responsibility with respect to communicating internal control deficiencies of issuers?

A. The auditor is required to communicate all deficiencies in internal control to management, deficiencies that constitute a significant deficiency to the audit committee, and deficiencies that constitute a material weakness to the full board of directors.

B. The auditor is required to communicate all deficiencies in internal control to management, and deficiencies that constitute a significant deficiency or a material weakness to management and the audit committee.

C. The auditor is not required to communicate control deficiencies to management or the audit committee unless they constitute a significant deficiency or a material weakness.

D. The auditor is not required to communicate control deficiencies or significant deficiencies to management or the audit committee, but must communicate material weaknesses to both management and the audit committee.

-

Question 796:

Which of the following best describes the responsibility of the auditor to report significant deficiencies and material weaknesses in an attest engagement to examine the effectiveness of a nonissuer's internal control?

A. The auditor must communicate both significant deficiencies and material weaknesses.

B. The auditor must communicate material weaknesses, but need not disclose significant deficiencies.

C. The auditor must communicate significant deficiencies, but need not separately identify material weaknesses.

D. Neither significant deficiencies nor material weaknesses are required to be communicated.

-

Question 797:

Which of the following statements describes an auditor's obligation to identify deficiencies in the design or operation of internal control?

A. The auditor should design and apply tests of controls to discover significant deficiencies in internal control that could result in material misstatements.

B. The auditor need not search for significant deficiencies in internal control unless management requests an attestation that "no significant deficiencies in internal control were noted in the audit."

C. The auditor should search for significant deficiencies in internal control if the auditor expects that controls are operating effectively (i.e., if the auditor plans to rely on controls).

D. The auditor need not search for significant deficiencies in internal control but should document and communicate any such deficiencies that are discovered.

-

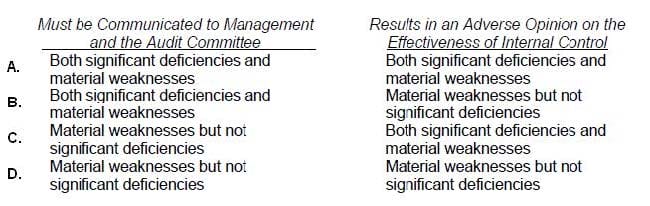

Question 798:

Which of the following best describes the responsibility of the auditor with respect to significant deficiencies and material weaknesses in an audit of an issuer?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 799:

In an audit of an issuer:

I. Management must assess and report on internal control.

II.

The auditor must assess and report on internal control.

A.

I only.

B.

II only.

C.

Either I or II.

D.

Both I and II.

-

Question 800:

In an audit of an issuer, the auditor must provide an opinion on which of the following?

I. The financial statements.

II. The audit committee's oversight of financial reporting and internal control.

III.

The effectiveness of internal control.

A.

I and III only.

B.

I, II, and III.

C.

I and II only.

D.

I only.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.