Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 71:

A statement of cash flows for a development stage enterprise:

A. Is the same as that of an established operating enterprise and, in addition, shows cumulative amounts from the enterprise's inception.

B. Shows only cumulative amounts from the enterprise's inception.

C. Is the same as that of an established operating enterprise, but does not show cumulative amounts from the enterprise's inception.

D. Is not presented.

-

Question 72:

Financial reporting by a development stage enterprise differs from financial reporting for an established operating enterprise in regard to footnote disclosures:

A. Only.

B. And expense recognition principles only.

C. And revenue recognition principles only.

D. And revenue and expense recognition principles.

-

Question 73:

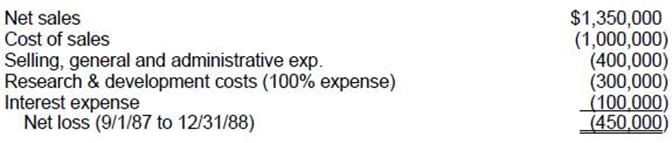

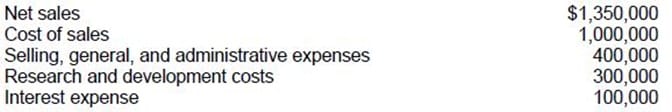

ABC Corp. was a development stage enterprise from its inception on September 1, 1987 to December 31, 1988. The following information was taken from ABC's accounting records for the above period:

For the period September 1, 1987 to December 31, 1988, what amount should ABC report as net loss?

A. $ 50,000

B. $150,000

C. $350,000

D. $450,000

-

Question 74:

Deficits accumulated during the development stage of a company should be:

A. Reported as organization costs.

B. Reported as a part of stockholders' equity.

C. Capitalized and written off in the first year of principal operations.

D. Capitalized and amortized over a five year period beginning when principal operations commence.

-

Question 75:

ABC Corp., a publicly-owned corporation, is subject to the requirements for segment reporting. In its

income statement for the year ended December 31, 1991, ABC reported revenues of $50,000,000,

operating expenses of $47,000,000, and net income of $3,000,000. Operating expenses include payroll

costs of $ 15,000,000. ABC's combined identifiable assets of all industry segments at December 31, 1991,

were $40,000,000.

In its 1991 financial statements, ABC should disclose major customer data if sales to any single customer

amount to at least:

A. $300,000

B. $1,500,000

C. $4,000,000

D. $5,000,000

-

Question 76:

ABC, Inc. is a multidivisional corporation, which has both intersegment sales and sales to unaffiliated customers. ABC should report segment financial information for each division meeting which of the following criteria?

A. Segment operating profit or loss is 10% or more of consolidated profit or loss.

B. Segment operating profit or loss is 10% or more of combined operating profit or loss of all company segments.

C. Segment revenue is 10% or more of combined revenue of all the company segments.

D. Segment revenue is 10% or more of consolidated revenue.

-

Question 77:

ABC Corp. has three manufacturing divisions, each of which has been determined to be a reportable segment. In 1989, Clay division had sales of $3,000,000, which was 25% of ABC's total sales, and had operating costs of $1,900,000, as reported to the CFO. In 1989, ABC incurred operating costs of $500,000 that were not directly traceable to any of the divisions. In addition, ABC incurred corporate interest expense of $300,000 in 1989. In reporting segment information, what amount should be shown as Clay's operating profit for 1989?

A. $875,000

B. $900,000

C. $975,000

D. $1,100,000

-

Question 78:

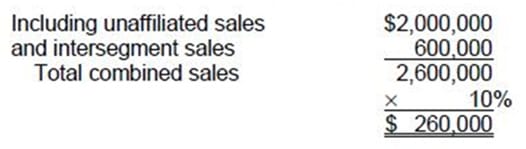

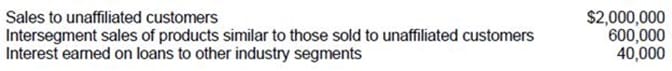

The following information pertains to ABC Corp. and its divisions for the year ended December 31, 1988:

ABC and all of its divisions are engaged solely in manufacturing operations. ABC has a reportable segment if that segment's revenue exceeds:

A. $264,000

B. $260,000

C. $204,000

D. $200,000

-

Question 79:

An inventory loss from a market price decline occurred in the first quarter, and the decline was not expected to reverse during the fiscal year. However, in the third quarter the inventory's market price recovery exceeded the market decline that occurred in the first quarter. For interim financial reporting, the dollar amount of net inventory should:

A. Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the decrease in the first quarter.

B. Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the market price recovery.

C. Decrease in the first quarter by the amount of the market price decline and not be affected in the third quarter.

D. Not be affected in either the first quarter or the third quarter.

-

Question 80:

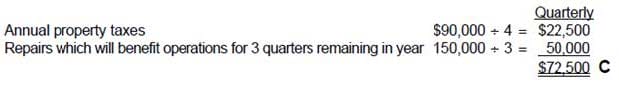

On March 15, 1992, ABC Co. paid property taxes of $90,000 on its office building for the calendar year 1992. On April 1, 1992, ABC paid $150,000 for unanticipated repairs to its office equipment. The repairs will benefit operations for the remainder of 1992. What is the total amount of these expenses that ABC should include in its quarterly income statement for the three months ended June 30, 1992?

A. $172,500

B. $97,500

C. $72,500

D. $37,500

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.