Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jul 08, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 671:

Under the Revised Model Business Corporation Act, which of the following must be contained in a corporation's articles of incorporation?

A. Quorum voting requirements.

B. Names of stockholders.

C. Provisions for issuance of par and nonpar shares.

D. The number of shares the corporation is authorized to issue.

-

Question 672:

Under the Revised Model Business Corporation Act, which of the following statements regarding a corporation's bylaws is(are) correct?

I. A corporation's initial bylaws shall be adopted by either the incorporators or the board of directors.

II.

A corporation's bylaws are contained in the articles of incorporation.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 673:

ABC Corp. wants to acquire the entire business of XYZ Corp. Which of the following methods of business combination will best satisfy ABC's objectives without requiring the approval of the shareholders of either corporation?

A. A merger of XYZ into ABC, whereby XYZ shareholders receive cash or ABC shares.

B. A sale of all the assets of XYZ, outside the regular course of business, to ABC, for cash.

C. An acquisition of all the shares of XYZ through a compulsory share exchange for ABC shares.

D. A cash tender offer, whereby ABC acquires at least 90% of XYZ's shares, followed by a short-form merger of XYZ into ABC.

-

Question 674:

Which of the following statements is(are) correct regarding the methods a target corporation may use to ward off a takeover attempt?

I. The target corporation may make an offer ("self-tender") to acquire stock from its own shareholders.

II.

The target corporation may seek an injunction against the acquiring corporation on the grounds that the attempted takeover violates federal antitrust law.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 675:

ABC Corp. is incorporated in State A. Under the Revised Model Business Corporation Act, which of the following activities engaged in by ABC requires that ABC obtain a certificate of authority to do business in State B?

A. Maintaining bank accounts in State B.

B. Collecting corporate debts in State B.

C. Hiring employees who are residents of state B.

D. Maintaining an office in State B to conduct intrastate business.

-

Question 676:

Which of the following parties generally has the most management rights?

A. Minority shareholder in a corporation listed on a national stock exchange.

B. Limited partner in a general partnership.

C. Member of a limited liability company.

D. Limited partner in a limited partnership.

-

Question 677:

Jeb, a member in A and B LLC, sold his interest in the LLC to Chris without obtaining the other members' consent. Absent an agreement to the contrary, Chris:

I. May participate in the management of A and B.

II. May receive Jeb's share of A and B's profits.

III.

Is not entitled to anything since Jeb did not obtain the other members' consent.

A.

I only.

B.

I and II only.

C.

II only.

D.

III only.

-

Question 678:

A member of a limited liability company may generally do all of the following, except:

A. Transfer his membership in the company without the consent of the other members.

B. Participate in the management of the company absent an agreement to the contrary.

C. Have limited liability.

D. Order office supplies for the company.

-

Question 679:

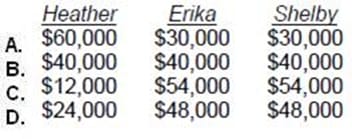

Heather, Erika, and Shelby are members in ABC LLC. Heather works 40 hours per week and Erika and Shelby work 20 hours per week. Heather contributed $30,000 to the LLC and Erika and Shelby contributed $60,000 each. Erika and Shelby have each originated 45% of the LLC's business and Heather has originated the other 10%. Absent an agreement to the contrary, how will the LLC's $120,000 profits be divided among the members?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 680:

Heather, Erika, and Shelby are members in ABC LLC. Heather works 40 hours per week and Erika and Shelby work 20 hours per week. Heather contributed $30,000 to the LLC and Erika and Shelby contributed $60,000 each. Erika and Shelby have each originated 45% of the LLC's business and Heather has originated the other 10%. Absent an agreement to the contrary among the owners, who controls the management of the ABC LLC?

A. Heather, because she works the most.

B. Erika and Shelby equally because they contributed the most.

C. Heather, Erika, and Shelby in proportion to their ownership interests.

D. Erika and Shelby, because they originate most of the work.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.