Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jul 16, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 621:

Acorn and Bean were general partners in a farm machinery business. Acorn contracted, on behalf of the partnership, to purchase 10 tractors from ABC Corp. Unknown to ABC, Acorn was not authorized by the partnership agreement to make such contracts. Bean refused to allow the partnership to accept delivery of the tractors and ABC sought to enforce the contract. ABC will:

A. Lose because Acorn's action was beyond the scope of Acorn's implied authority.

B. Prevail because Acorn had implied authority to bind the partnership.

C. Prevail because Acorn had apparent authority to bind the partnership.

D. Lose because Acorn's express authority was restricted, in writing, by the partnership agreement.

-

Question 622:

In 1992, Anchor, Chain, and Hook created ABC Associates, a general partnership. The partners orally agreed that they would work full time for the partnership and would distribute profits based on their capital contributions. Anchor contributed $5,000; Chain $10,000; and Hook $15,000. For the year ended December 31, 1993, ABC Associates had profits of $60,000 that were distributed to the partners. During 1994, ABC Associates was operating at a loss. In September 1994, the partnership dissolved. In October 1994, Hook contracted in writing with XYZ Co. to purchase a car for the partnership. Hook had previously purchased cars from XYZ Co. for use by ABC Associates partners. ABC Associates did not honor the contract with XYZ Co. and XYZ Co. sued the partnership and the individual partners.

A. The ABC Associates oral partnership agreement was valid.

B. The ABC Associates oral partnership agreement was invalid because the partnership lasted for more than one year.

-

Question 623:

The limited liability of the shareholders of a closely-held corporation will most likely be disregarded if the shareholders:

A. Lend money to the corporation.

B. Are also corporate officers, directors, or employees.

C. Undercapitalized the corporation when it was formed.

D. Formed the corporation solely to limit their personal liability.

-

Question 624:

Grey and Carr entered into a written partnership agreement to operate a hardware store. Their agreement was silent as to the duration of the partnership. Grey wishes to withdraw from the partnership. Which of the following statements is correct?

A. Unless Carr consents to a withdrawal, Grey must apply to a court and obtain a decree allowing withdrawal.

B. Grey may not withdraw unless Carr consents.

C. Grey may withdraw only after notice of the proposed dissolution is given to all partnership creditors.

D. Grey may withdraw from the partnership at any time.

-

Question 625:

The apparent authority of a partner to bind the partnership in dealing with third parties:

A. Will be effectively limited by a formal resolution of the partners of which third parties are aware.

B. Will be effectively limited by a formal resolution of the partners of which third parties are unaware.

C. Would permit a partner to submit a claim against the partnership to arbitration.

D. Must be derived from the express powers and purposes contained in the partnership agreement.

-

Question 626:

Under the Revised Model Business Corporation Act, which of the following actions by a corporation would entitle a stockholder to dissent from the action and obtain payment of the fair value of his/her shares?

I. An amendment to the articles of incorporation that materially and adversely affects rights in respect of a dissenter's shares because it alters or abolishes a preferential right of the shares.

II.

Consummation of a plan of share exchange to which the corporation is a party as the corporation whose shares will be acquired, if the stockholder is entitled to vote on the plan.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 627:

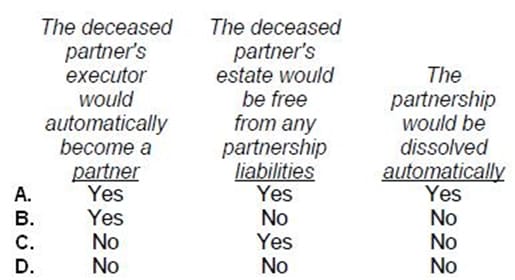

Unless otherwise provided in a general partnership agreement, which of the following statements is correct when a partner dies?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 628:

In a member managed LLC, the apparent authority of a member to bind the LLC in dealing with third parties:

A. Would permit a member to submit a claim against the LLC to arbitration.

B. Must be derived from the express powers and purposes contained in the operating agreement.

C. Will be effectively limited by a formal resolution of the members of which third parties are aware.

D. Will be effectively limited by a formal resolution of the members of which third parties are unaware.

-

Question 629:

Generally, a merger of two corporations requires:

A. That a special meeting be held and that notice and copy of the merger plan be given to all stockholders of both corporations.

B. Unanimous approval of the merger plan by the stockholders of both corporations.

C. Unanimous approval of the merger plan by the boards of both corporations.

D. That all liabilities owed by the absorbed corporation be paid before the merger.

-

Question 630:

A stockholder's right to inspect books and records of a corporation will be properly denied if the stockholder:

A. Wants to use corporate stockholder records for a personal business.

B. Employs an agent to inspect the books and records.

C. Intends to commence a stockholder's derivative suit.

D. Is investigating management misconduct.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.