Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 41:

Capital assets include:

A. A corporation's accounts receivable from the sale of its inventory.

B. Seven-year MACRS property used in a corporation's trade or business.

C. A manufacturing company's investment in U.S. Treasury bonds.

D. A corporate real estate developer's unimproved land that is to be subdivided to build homes, which will be sold to customers.

-

Question 42:

Leker exchanged a van that was used exclusively for business and had an adjusted tax basis of $20,000 for a new van. The new van had a fair market value of $10,000, and Leker also received $3,000 in cash. What was Leker's tax basis in the acquired van?

A. $20,000

B. $17,000

C. $13,000

D. $7,000

-

Question 43:

Under the uniform capitalization rules applicable to taxpayers with property acquired for resale, which of the following costs should be capitalized with respect to inventory if no exceptions have been met?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 44:

Smith made a gift of property to Thompson. Smith's basis in the property was $1,200. The fair market value at the time of the gift was $1,400. Thompson sold the property for $2,500. What was the amount of Thompson's gain on the disposition?

A. $0

B. $1,100

C. $1,300

D. $2,500

-

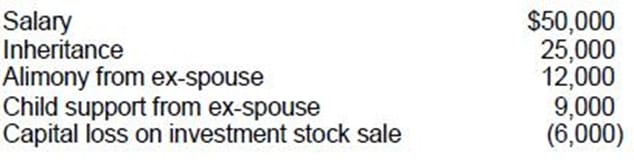

Question 45:

In the current year Jensen had the following items:

What is Jensen's AGI for the current year?

A. $44,000

B. $59,000

C. $62,000

D. $84,000

-

Question 46:

Which of the following is subject to the Uniform Capitalization Rules of Code Sec. 263A?

A. Editorial costs incurred by a freelance writer.

B. Research and experimental expenditures.

C. Mine development and exploration costs.

D. Warehousing costs incurred by a manufacturing company with $12 million in annual gross receipts.

-

Question 47:

Which one of the following will result in an accruable expense for an accrual-basis taxpayer?

A. An invoice dated prior to year end but the repair completed after year end.

B. A repair completed prior to year end but not invoiced.

C. A repair completed prior to year end and paid upon completion.

D. A signed contract for repair work to be done and the work is to be completed at a later date.

-

Question 48:

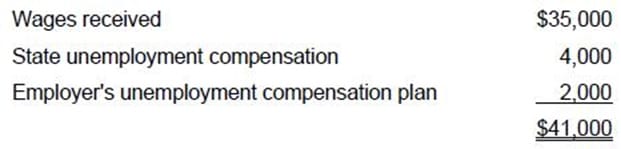

Porter was unemployed for part of the year. Porter received $35,000 of wages, $4,000 from a state unemployment compensation plan, and $2,000 from his former employer's company-paid supplemental unemployment benefit plan. What is the amount of Porter's gross income?

A. $35,000

B. $37,000

C. $39,000

D. $41,000

-

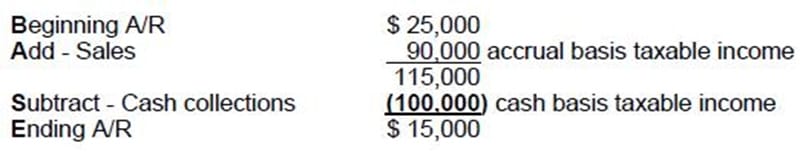

Question 49:

Mosh, a sole proprietor, uses the cash basis of accounting. At the beginning of the current year, accounts receivable were $25,000. During the year, Mosh collected $100,000 from customers. At the end of the year, accounts receivable were $15,000. What was Mosh's gross taxable income for the current year?

A. $75,000

B. $90,000

C. $100,000

D. $110,000

-

Question 50:

DAC Foundation awarded Kent $75,000 in recognition of lifelong literary achievement. Kent was not required to render future services as a condition to receive the $75,000. What condition(s) must have been met for the award to be excluded from Kent's gross income?

I. Kent was selected for the award by DAC without any action on Kent's part.

II.

Pursuant to Kent's designation, DAC paid the amount of the award either to a governmental unit or to a charitable organization.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.