Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 171:

In 1992, hail damaged several of ABC Co.'s vans. Hailstorms had frequently inflicted similar damage to ABC's vans. Over the years, ABC had saved money by not buying hail insurance and either paying for repairs, or selling damaged vans and then replacing them. In 1992, the damaged vans were sold for less than their carrying amount. How should the hail damage cost be reported in ABC's 1992 financial statements?

A. The actual 1992 hail damage loss as an extraordinary loss, net of income taxes.

B. The actual 1992 hail damage loss in continuing operations, with no separate disclosure.

C. The expected average hail damage loss in continuing operations, with no separate disclosure.

D. The expected average hail damage loss in continuing operations, with separate disclosure.

-

Question 172:

On August 31, 1992, ABC Co. decided to change from the FIFO periodic inventory system to the weighted average periodic inventory system. ABC is on a calendar year basis. The cumulative effect of the change is determined:

A. As of January 1, 1992.

B. As of August 31, 1992.

C. During the eight months ending August 31, 1992, by a weighted average of the purchases.

D. During 1992 by a weighted average of the purchases.

-

Question 173:

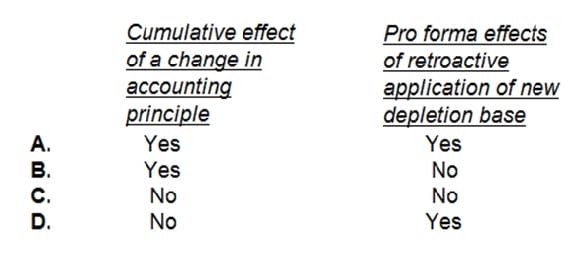

During 1992, ABC Co. increased the estimated quantity of copper recoverable from its mine. ABC uses the units of production depletion method. As a result of the change, which of the following should be reported in ABC's 1992 financial statements?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 174:

On January 2, 1989, ABC Co. purchased a machine for $264,000 and depreciated it by the straight-line method using an estimated useful life of eight years with no salvage value. On January 2, 1992, ABC determined that the machine had a useful life of six years from the date of acquisition and will have a salvage value of $24,000. An accounting change was made in 1992 to reflect the additional data. The accumulated depreciation for this machine should have a balance at December 31, 1992, of:

A. $176,000

B. $160,000

C. $154,000

D. $146,000

-

Question 175:

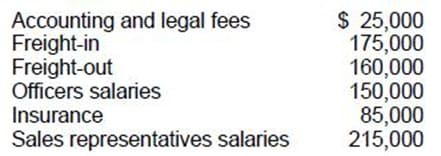

The following costs were incurred by ABC Co., a manufacturer, during 1992:

What amount of these costs should be reported as general and administrative expenses for 1992?

A. $260,000

B. $550,000

C. $635,000

D. $810,000

-

Question 176:

The cumulative effect of a change in accounting estimate should be shown separately:

A. On the income statement above income from continuing operations.

B. On the income statement after income from continuing operations and before extraordinary items.

C. On the retained earnings statement as an adjustment to the beginning balance.

D. It should not be recorded separately on any financial statement.

-

Question 177:

If a company is not presenting comparative financial statements, the correction of an error in the financial statements of a prior period should be reported, net of applicable income taxes, in the current:

A. Retained earnings statement after net income but before dividends.

B. Retained earnings statement as an adjustment of the opening balance.

C. Income statement after income from continuing operations and before extraordinary items.

D. Income statement after income from continuing operations and after extraordinary items.

-

Question 178:

On November 1, 20X2, ABC Co. contracted to dispose of an industry segment. Throughout 20X2 the segment had operating losses. These losses were expected to continue until the segment's disposition. If a loss is projected on final disposition, how much of the operating losses should be included in the loss from discontinued operations reported in ABC's 20X2 income statement?

I. Operating losses for the period January 1 to October 31, 20X2.

II. Operating losses for the period November 1 to December 31, 20X2.

III.

Estimated operating losses for the period January 1 to February 28, 20X3.

A.

II only.

B.

II and III only.

C.

I and III only.

D.

I and II only.

-

Question 179:

On January 2, 20X5, to better reflect the variable use of its only machine, ABC, Inc. elected to change its method of depreciation from the straight-line method to the units of production method. The original cost of the machine on January 2, 20X3, was $50,000, and its estimated life was 10 years. ABC estimates that the machine's total life is 50,000 machine hours. Machine hours usage was 8,500 during 20X4 and 3,500 during 20X3. ABC's income tax rate is 30%. ABC should report the accounting change in its 20X5 financial statements as a(n):

A. Cumulative effect of a change in accounting principle of $2,000 in its income statement.

B. Adjustment to beginning retained earnings of $2,000.

C. Cumulative effect of a change in accounting principle of $1,400 in its income statement.

D. None of the above.

-

Question 180:

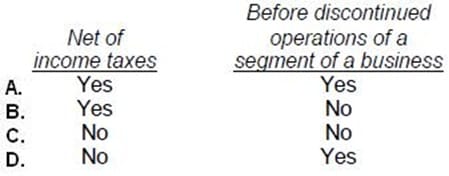

An extraordinary item should be reported separately on the income statement as a component of income:

A. Option A

B. Option B

C. Option C

D. Option D

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.