Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 101:

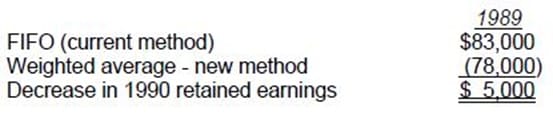

During 20X5, ABC Corp. made the following accounting changes:

What amount should be shown in the 20X5 retained earnings statement as an adjustment to the beginning balance?

A. $0

B. $30,000

C. $98,000

D. $128,000

-

Question 102:

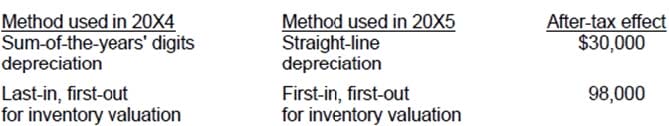

Goddard has used the FIFO method of inventory valuation since it began operations in 1987. Goddard decided to change to the weighted-average method for determining inventory costs at the beginning of 1990. The following schedule shows year-end inventory balances under the FIFO and weighted-average methods:

What amount, before income taxes, should be reported in the 1990 retained earnings statement as the cumulative effect of the change in accounting principle?

A. $5,000 decrease.

B. $3,000 decrease.

C. $2,000 increase.

D. $0.

-

Question 103:

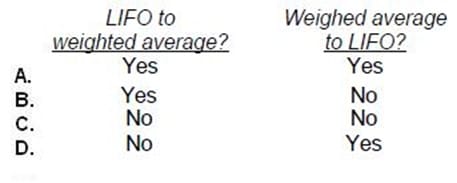

Is the cumulative effect of an inventory pricing change on prior years earnings reported on the financial statements for

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 104:

On January 1, 20X1, ABC Corp. purchased a machine having an estimated useful life of 10 years and no salvage. The machine was depreciated by the double declining balance method for both financial statement and income tax reporting. On January 1, 20X6, ABC changed to the straight-line method for financial statement reporting but not for income tax reporting. Accumulated depreciation at December 31, 20X5, was $560,000. If the straight-line method had been used, the accumulated depreciation at December 31, 20X5, would have been $420,000. ABC's enacted income tax rate for 20X6 and thereafter is 30%. The amount shown in the 20X6 income statement for the cumulative effect of changing to the straight-line method should be:

A. $98,000 debit.

B. $98,000 credit.

C. $140,000 credit.

D. $0.

-

Question 105:

ABC Corp.'s comprehensive insurance policy allows its assets to be replaced at current value. The policy has a $50,000 deductible clause. One of ABC's waterfront warehouses was destroyed in a winter storm. Such storms occur approximately every four years. ABC incurred $20,000 of costs in dismantling the warehouse and plans to replace it. The tax rate is 30%. The following data relate to the warehouse:

Current carrying amount $ 300,000 Replacement cost 1,100,000

What amount of gain should ABC report as a separate component of income before extraordinary items?

A. $1,030,000

B. $780,000

C. $730,000

D. $0

-

Question 106:

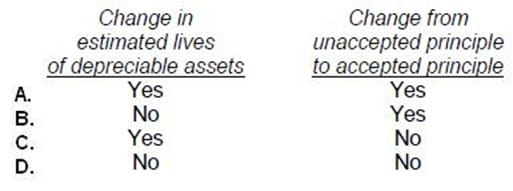

Which of the following should be reported as a prior period adjustment?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 107:

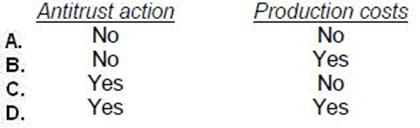

In 1990, ABC Co. incurred losses arising from its guilty plea in its first antitrust action, and from a substantial increase in production costs caused when a major supplier's workers went on strike. Which of these losses should be reported as an extraordinary item?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 108:

During 1990, ABC Co. had the following unusual financial events occur:

•

Bonds payable were retired five years before their scheduled maturity, resulting in a $260,000 gain. ABC has frequently retired bonds early when interest rates declined significantly.

•

A steel forming segment suffered $255,000 in losses due to hurricane damage. This was the fourth similar loss sustained in a 5-year period at that location.

•

A component of ABC's operations, steel transportation, was sold at a net loss of $350,000.

This was ABC's first divestiture of one of its operating segments.

Before income taxes, what amount should be disclosed as the gain (loss) from extraordinary items in

1990?

A. $0

B. $5,000

C. $(90,000) D. $(350,000)

-

Question 109:

During 1990, ABC Co. had the following unusual financial events occur:

•

Bonds payable were retired five years before their scheduled maturity, resulting in a $260,000 gain. ABC has frequently retired bonds early when interest rates declined significantly.

•

A steel forming segment suffered $255,000 in losses due to hurricane damage. This was the fourth similar loss sustained in a 5-year period at that location.

•

A component of ABC's operations, steel transportation, was sold at a net loss of $350,000.

This was ABC's first divestiture of one of its operating segments.

Before income taxes, what amount of gain (loss) should be reported separately as a component of income

from continuing operations in 1990?

A. $260,000

B. $5,000

C. $(255,000)

D. $(350,000)

-

Question 110:

A transaction that is unusual, but not infrequent, should be reported separately as a(an): A. Extraordinary item, net of applicable income taxes.

B. Extraordinary item, but not net of applicable income taxes.

C. Component of income from continuing operations, net of applicable income taxes.

D. Component of income from continuing operations, but not net of applicable income taxes.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.