Exam Details

Exam Code

:CPA-REGULATIONExam Name

:CPA RegulationCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:69 Q&AsLast Updated

:Jun 10, 2025

Test Prep Test Prep Certifications CPA-REGULATION Questions & Answers

-

Question 51:

During 2001, Adler had the following cash receipts:

What is the total amount that must be included in gross income on Adler's 2001 income tax return?

A. $18,000

B. $18,400

C. $19,500

D. $19,900

-

Question 52:

Freeman, a single individual, reported the following income in the current year:

Guaranteed payment from services rendered to a partnership $50,000 Ordinary income from a S corporation $20,000

What amount of Freeman's income is subject to self-employment tax?

A. $0

B. $20,000

C. $50,000

D. $70,000

-

Question 53:

John and Mary were divorced in 1991. The divorce decree provides that John pay alimony of $10,000 per year, to be reduced by 20% on their child's 18th birthday. During 1992, John paid $7,000 directly to Mary and $3,000 to Spring College for Mary's tuition. What amount of these payments should be reported as income in Mary's 1992 income tax return?

A. $5,600

B. $8,000

C. $8,600

D. $10,000

-

Question 54:

On February 1, 1993, Hall learned that he was bequeathed 500 shares of common stock under his father's will. Hall's father had paid $2,500 for the stock in 1990. Fair market value of the stock on February 1, 1993, the date of his father's death, was $4,000 and had increased to $5,500 six months later. The executor of the estate elected the alternate valuation date for estate tax purposes. Hall sold the stock for $4,500 on June 1, 1993, the date that the executor distributed the stock to him. How much income should Hall include in his 1993 individual income tax return for the inheritance of the 500 shares of stock, which he received from his father's estate?

A. $5,500

B. $4,000

C. $2,500 D. $0

-

Question 55:

On December 1, 1992, Michaels, a self-employed cash basis taxpayer, borrowed $100,000 to use in her business. The loan was to be repaid on November 30, 1993. Michaels paid the entire interest of $12,000 on December 1, 1992. What amount of interest was deductible on Michaels' 1993 income tax return?

A. $12,000

B. $11,000

C. $1,000

D. $0

-

Question 56:

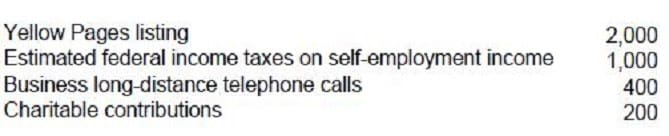

Rich is a cash basis self-employed air-conditioning repairman with 1993 gross business receipts of $20,000. Rich's cash disbursements were as follows:

What amount should Rich report as net self-employment income?

A. $15,100

B. $14,900 C. $14,100

D. $13,900

-

Question 57:

During 1993 Kay received interest income as follows:

On U.S. Treasury certificates $4,000 On refund of 1991 federal income tax 500

The total amount of interest subject to tax in Kay's 1993 tax return is:

A. $4,500

B. $4,000

C. $500

D. $0

-

Question 58:

In a tax year where the taxpayer pays qualified education expenses, interest income on the redemption of qualified U.S. Series EE Bonds may be excluded from gross income. The exclusion is subject to a modified gross income limitation and a limit of aggregate bond proceeds in excess of qualified higher education expenses. Which of the following is (are) true?

I. The exclusion applies for education expenses incurred by the taxpayer, the taxpayer's spouse, or any person whom the taxpayer may claim as a dependent for the year.

II. "Otherwise qualified higher education expenses" must be reduced by qualified scholarships not includible in gross income.

A. I only.

B. II only.

C. Both I and II.

D. Neither I nor II.

-

Question 59:

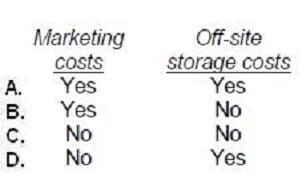

Under the uniform capitalization rules applicable to property acquired for resale, which of the following costs should be capitalized with respect to inventory if no exceptions are met?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 60:

Which payment(s) is(are) included in a recipient's gross income?

I. Payment to a graduate assistant for a part-time teaching assignment at a university. Teaching is not a requirement toward obtaining the degree.

II.

A grant to a Ph.D. candidate for his participation in a university-sponsored research project for the benefit of the university.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFNS

Commission on Graduates of Foreign Nursing SchoolsCLEP-BUSINESS

CLEP Business: Financial Accounting, Business Law, Information Systems & Computer Applications, Management, Marketing

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-REGULATION exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.