Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 61:

UV entered into a five year non-cancellable operating lease for an asset two years ago. Lease payments are settled annually in arrears.

At the year end, UV no longer requires this leased asset as they have decided to discontinue the product line that it was used for.

At this date UV had made two out of the five lease payments.

Which of the following statements about the unavoidable lease payments is true in accordance with IAS 37 Provisions, Contingent Liabilities and Assets?

A. A provision should be recognised for the unavoidable lease payments with a corresponding charge to profit or loss.

B. A provision should be recognised for the unavoidable lease payments with a corresponding charge to other comprehensive income.

C. The amount of the unavoidable lease payments should be disclosed in the financial statements with no corresponding accounting entry.

D. The amount of the unavoidable lease payments should be ignored in the financial statements.

-

Question 62:

The IAS definitions of financial instruments dictate their classification between debt and equity. Which of of the following factors might this classification impact? Select ALL that apply.

A. Financial risk

B. Profitability

C. Profit distribution

D. Liquidity

-

Question 63:

KL issued $100,000 of 6% convertible debentures at par on 1 January 20X7. These debentures are redeemable at par or can be converted into 5 shares for each $100 of nominal value of debentures on 31 December 20X9.

The share price on 1 January 20X7 is $18 a share. The share price is expected to grow at a rate of 7% a year.

The expected redemption value for each $100 nominal value of debentures on the date of conversion is:

A. $110.25

B. $103.04

C. $100.00

D. $90.00

-

Question 64:

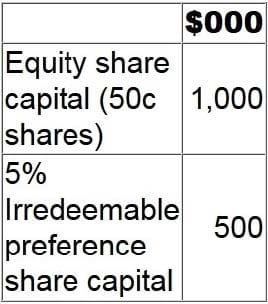

The financial statements of ST at 31 December 20X9 include the following balances in respect of shares classed as equity:

The profit after tax for the year ended 31 December 20X9 is $200,000. What is ST's basic EPS for the year to 31 December 20X9?

A. 8.8 cents

B. 17.5 cents

C. 20.0 cents

D. 10.0 cents

-

Question 65:

Which THREE of the following statements are true in relation to financial assets designated as fair value through profit or loss under IAS 39 Financial Instruments: Recognition and Measurement?

A. Shares in another entity held for short term trading purposes fall within this category.

B. Transaction costs in relation to these assets are expensed to profit or loss on acquisition.

C. Transaction costs in relation to these assets are added to the initial cost of the asset on acquisition.

D. The gain or loss on the subsequent measurement of these assets is recorded within other comprehensive income.

E. The gain or loss on the subsequent measurement of these assets is recorded within profit for the year.

F. Once the asset has been subsequently measured to fair value an impairment review is undertaken.

-

Question 66:

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year.

Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

A. The dividend paid in the year was reduced in order to pay for new assets.

B. Surplus cash was used to pay a special dividend in addition to the normal dividend in the year.

C. The profit for the year fell significantly and the dividend per share stayed the same.

D. To compensate investors for the reduction in share price a higher dividend per share was paid.

-

Question 67:

FG has a weighted average cost of capital of 12% based on its existing:

1.

level of gearing of 30% (measured as debt/(debt + equity));

2.

business operations.

This would be used as an appropriate discount factor to assess which of the following significant projects?

A. A project in an industry in which FG does not currently operate, funded wholly by equity.

B. A project to extend FG's existing operations, funded wholly by debt.

C. A project in an industry in which FG does not currently operate, funded 30% with debt and 70% with equity.

D. A project to extend FG's existing operations, funded 30% with debt and 70% with equity.

-

Question 68:

LM and JK operate in the same country and prepare their financial statements to 30 June 20X6 in accordance with International Accounting Standards. On 27 June 20X6 both entities raised $1 million cash by issuing debt instruments with

identical terms and conditions. Prior to this issue both entities were financed entirely by equity.

At 30 June 20X6 the gearing ratios, calculated as Debt/Equity x 100%, were as follows:

LM: 30%

JK: 65%

Which of the following independent options would explain the difference between LM and JK's year-end gearing?

A. LM revalued its land and buildings upwards in the year; JK has performed no revaluations.

B. LM made a bonus issue from retained earnings in the year; JK issued no shares in the year.

C. LM had 100,000 $1 shares at the year end; JK had 200,000 50c shares in issue at the year end.

D. LM held no investments in other entities; JK revalued its available for sale investments upwards in the year.

-

Question 69:

XY purchased $100,000 of quoted 8% bonds in the current year which it intends to hold until redemption.

Which of the following identifies the correct classification and subsequent measurement basis for this financial instrument?

A. A loans and receivables financial asset subsequently measured at fair value with gains and losses in reserves.

B. A held to maturity financial asset subsequently measured at amortised cost.

C. A loans and receivables financial asset subsequently measured at amortised cost.

D. A held to maturity financial asset subsequently measured at fair value with gains and losses in reserves.

-

Question 70:

A group presents its financial statements in A$.

The goodwill of its only foreign subsidiary was measured at B$100,000 at acquisition. There have been no impairments to this goodwill.

Exchange rates (where A$/B$ is the number of B$'s to each A$) are as follows:

The value of goodwill to be included in the group's statement of financial position in respect of its foreign subsidiary for the year ended 31 December 20X4 is:

A. A$75,758.

B. A$66,667.

C. A$150,000.

D. A$132,000.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.