Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 71:

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following: What is VW's interest cover for the year ended 30 September 20X7?

A. 4.5

B. 3.3

C. 4.1

D. 5.1

-

Question 72:

ST acquired 70% of the equity shares of DE for $87,500 on 30 September 20X5. At the date of acquisition the net assets of DE were $54,700 and the fair value of the non controlling interest was measured at $19,700. There has been no

impairment of goodwill.

On 30 September 20X9 ST disposed of its entire investment in DE for $262,500 when the net assets of DE were $96,250.

What is the gain or loss on disposal of DE that will be included in ST's consolidated profit or loss for the year ended 30 September 20X9?

A. $113,750 loss

B. $166,250 loss

C. $166,250 gain

D. $113,750 gain

-

Question 73:

What is the total comprehensive income attributable to the shareholders of GHI that will be presented in GHI's consolidated statement of changes in equity for the year ended 31 December 20X4?

A. $2,780,000

B. $2,880,000

C. $2,875,000

D. $3,260,000

-

Question 74:

An accountant acting under their Code of Ethics would do which THREE of the following?

A. Resist pressure from the directors to recognise revenue on sales where the risks and rewards have not transferred to the customer.

B. Report material conflicts of interest to a more senior level.

C. Reject a justified change to a depreciation policy that increases profitability.

D. Accept a recommendation from the audit committee to increase segregation of duties within the finance department.

E. Make a provision for a liability of uncertain timing or amount, requested by the directors, where there is NOT a present obligation.

F. Accept a director's instruction to remove one element of their remuneration from the directors' remuneration report.

-

Question 75:

AB and CD are separate entities that prepare financial statements to 31 May using international accounting standards. AB and CD provide technical support services to the financial services industry and operate in the same country. The financial statements are identical except for the following:

1.

AB purchased all operating equipment, paying $100,000, using a 5 year bank loan. The useful life of the equipment was 5 years.

2.

CD signed an operating lease agreement for all operating equipment for 5 years paying $20,000 per year.

Both entities charge all expenses relating to the equipment to cost of sales.

From the information provided, which of the following ratios would be reliably comparable for AB and CD?

A. Gross profit margin

B. Return on capital employed

C. Non current asset turnover

D. Profit before tax margin

-

Question 76:

JK has calculated its inventory holding period:

Which THREE of the following would have contributed to the above movement in inventory holding period?

A. JK's main supplier offered a significant one-off discount for purchases made in March 20X8.

B. In January 20X8 a major competitor entered the market in which JK operates.

C. A substantial contract is due to be dispatched early in April 20X8.

D. JK is enforcing stringent inventory control techniques following management instructions.

E. JK suffered industrial action by its production staff in the period December 20X7 to February 20X8.

F. It has been difficult to obtain one of JK's main components due to import issues with its overseas supplier.

-

Question 77:

AB and FG incorporated on 1 January 20X1 in the same country and had similar investment in net assets. Both entities are financed entirely by equity. In the year to 31 December 20X1 both entities generated the same volume of sales.

Which of the following, taken individually, would explain why AB's return on capital employed ratio was lower than that of FG?

A. AB revalued its non current assets upwards on 31 December 20X1; FG's non current assets were stated at historic cost.

B. FG issued bonds on 31 December 20X1; AB remains ungeared.

C. AB paid a lower dividend to its shareholders than FG in the year.

D. AB's deferred tax provision at the year end is higher than that of FG.

-

Question 78:

LM acquired 80% of the equity shares of ST when ST's retained earnings were $50 million. The fair value of the net assets of ST included a contingent liability with a fair value of $100 million at the date of acquisition and a fair value of $40 million at 31 December 20X6. No other fair value adjustments were required at the date of acquisition.

LM and ST had retained earnings of $200 million and $80 million respectively at 31 December 20X6.

The consolidated retained earnings of LM at 31 December 20X6 were:

A. $164 million

B. $176 million

C. $272 million

D. $284 million

-

Question 79:

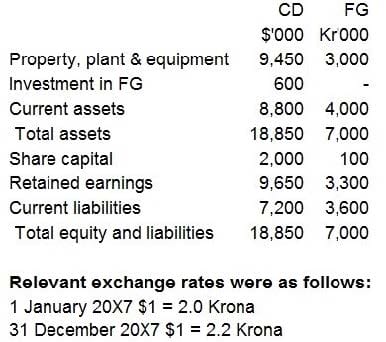

CD acquired 100% of the equity share capital of FG for cash consideration of Kr1,200,000 on 1 January 20X7.

Retained earnings of FG at the date of acquisition was Kr800,000. CD operates from Country A and its functional and presentation currency is $. FG is located and trades throughout Country B and its functional currency is the Krona (Kr).

CD has no other subsidiaries. Goodwill had not suffered any impairment to date.

Summarised data from the statements of financial position for both entities at 31 December 20X7 is presented below:

Which of the following is the correct application of IAS 21 The Effects of Changes in Foreign Exchange Rates in translating FG's statement of financial position into the presentation currency of CD for consolidation purposes at 31 December 20X7?

A. Goodwill at closing rate. Assets and liabilities at closing rate.

B. Monetary assets and liabilities at closing rate. Non monetary assets and liabilities at historic rate.

C. Goodwill at historic rate. Assets and liabilities at closing rate.

D. Monetary assets and liabilities at historic rate. Non monetary assets and liabilities at closing rate.

-

Question 80:

As at 31 October 20X7 TU's financial statements show the entity having profit after tax of $600,000 and 900,000 $1 ordinary shares in issue. There have been no issues of shares during the year. At 31 October 20X7 TU have 300,000 share options in issue, which allow the holders to purchase ordinary shares at $2 a share in 3 years' time. The average price of the ordinary shares throughout the year was $5 a share.

What is the diluted earnings per share for the year ended 31 October 20X7?

A. 66.7 cents

B. 58.8 cents

C. 50.0 cents

D. 55.6 cents

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.