Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 251:

The tax benefit on a company's asset is £80,000 and the useful life on that asset is five years. The company creates a deferred tax provision to spread this benefit over the asset's useful life.

What entry is needed to reduce this deferred tax provision in the company's year two accounts?

A. DR Deferred tax liability (SOFP) £6,000

B. CR Deferred tax liability (SOFP) £6,000

C. DR Corporation tax (income statement) £6,000

D. CR Corporation tax (income statement) £6,00

E. DR Deferred tax liability (SOFP) £44,000

F. CR Deferred tax liability (SOFP) £44,000

G. DR Corporation tax (income statement) £44,000

H. CR Corporation tax (income statement) £44,000

-

Question 252:

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

A. ST will benefit from the tax relief on the interest payment.

B. The debentures will be redeemed at a discount to their par value.

C. The debentures will be redeemed at their par value.

D. The market value of the debentures must be higher than their par value.

-

Question 253:

Which of the following should be eliminated when using the equity method to account for associates in a parent's financial statements?

Select ALL that apply.

A. Unrealised profits

B. Dividends from associates

C. Intra-group balances and transactions

D. Goodwill payments

-

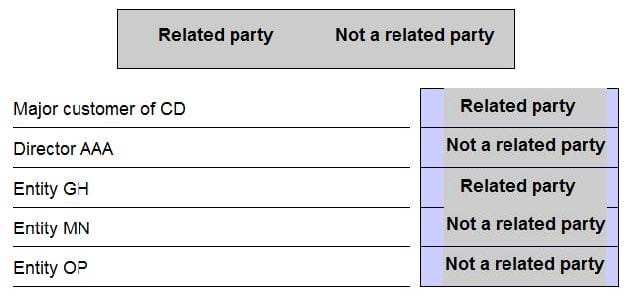

Question 254:

DRAG DROP

AAA is the only director of entity CD. AAA is also a director of entity GH. CD owns 30% of the equity of MN and 60% of the equity of OP.

Identify which of the following are related parties of CD by placing the appropriate response against one.

Select and Place:

-

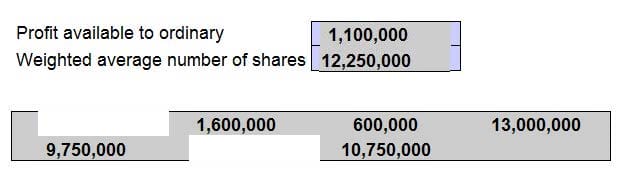

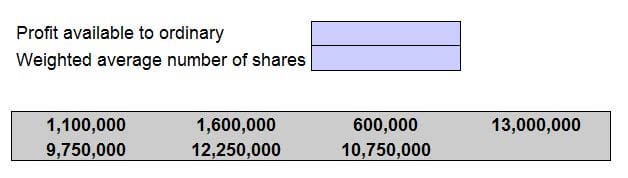

Question 255:

DRAG DROP

On 1 January 20X6 AB, a listed entity, had 10,000,000 $1 ordinary shares in issue. On 1 April 20X6 AB issued 3,000,000 $1 ordinary shares at their full market price. AB's profit was reported as $1,100,000 after charging corporate income tax

of $500,000.

Place the correct values for profit and weighted average number of shares in the boxes below that will be used to calculate AB's earnings per share for the year to 31 December 20X6.

Select and Place:

-

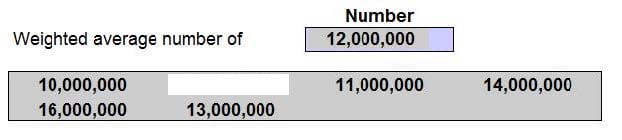

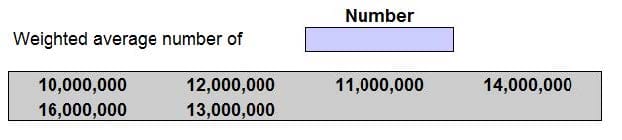

Question 256:

DRAG DROP

On 1 January 20X8 XY, a listed entity, had 10,000,000 ordinary shares in issue each with a par value of 50 cents. On 1 July 20X8 XY raised $6,000,000 by issuing ordinary shares at a price of ?.50 each which was the full market price.

Place the correct figure into the box below to show the number that XY will use as its weighted average number of ordinary shares in the calculation of earnings per share for the year to 31 December 20X8.

Select and Place:

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.