Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 81:

GH is seeking to finance a substantial new project that is guaranteed to enhance the profitability of the entity. Its key determinants in deciding upon the best source of finance are to balance the following requirements:

1) to minimise the costs of issue of the finance;

2) to avoid the need to find cash to repay the source of finance;

3) to ensure that the long-term gearing level does not increase.

Which of the following financing options best meets these requirements?

A. Convertible loan stocks

B. Initial public offering of ordinary shares

C. Redeemable preference shares

D. A term loan

-

Question 82:

Mr. Rodgers is an accountant for JK Pic. He is asked to record a particular share-based payment in the company's accounts and obliges by debiting as an expense the first relevant account and crediting the corresponding double-entry as a liability.

Which type of share-based payment has Mr. Rodgers recorded?

A. Cash-settled in the future

B. Cash-settled immediately

C. Equity-settled immediately

D. Equity-settled in the future

E. Neither cash nor equity-settled

-

Question 83:

RS has issued an instrument with a nominal value of $1 million, at a discount of 2.5%, and a coupon rate of 6%. The terms of the issue are that the instrument must either be redeemed at par, at the option of the holder, in three years' time, or alternatively converted into equity shares in RS.

The characteristics of this instrument taken as a whole indicates that it would be classifed as which of the following?

A. Compound instrument

B. Debt instrument

C. Equity instrument

D. Discounted instrument

-

Question 84:

A group presents its financial statements in A$.

The goodwill of its only foreign subsidiary was measured at B$100,000 at acquisition. There have been no impairments to this goodwill.

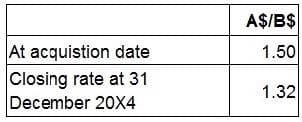

Exchange rates (where A$/B$ is the number of B$'s to each A$) are as follows:

The value of goodwill to be included in the group's statement of financial position in respect of its foreign subsidiary for the year ended 31 December 20X4 is:

A. A$75,758.

B. A$66,667.

C. A$150,000.

D. A$132,000.

-

Question 85:

AB acquired a financial investment on 1 January 20X9, incurring $5,000 related agency fees. AB initially classified the investment as held for trading, in accordance with IAS 32 Financial Instruments: Presentation. Which of the following statements reflects the accounting treatment that AB adopted in respect of this investment when it prepared its financial statements to 31 December 20X9?

A. Agency fees were recorded as an expense and the gain/loss on the remeasurement of the investment at the year end was recorded in profit or loss for the year.

B. Agency fees were recorded as an expense and the gain/loss on the remeasurement of the investment at the year end was recorded in other comprehensive income.

C. Agency fees were added to the cost of the investment and the gain/loss on the remeasurement of the investment at the year end was recorded in profit or loss for the year.

D. Agency fees were added to the cost of the investment and the gain/loss on the remeasurement of the investment at the year end was recorded in other comprehensive income.

-

Question 86:

An investor owns 75 shares values at $1.50 each. If the shares increase in value to $1.75, how much money will the investor have made through this capital gain?

A. $18.75

B. $131.25

C. $187.50

D. $112.50

E. $26.25

F. $15

-

Question 87:

Operating segments are separately reportable where they exceed 15% of revenue / profits / assets. These must in total cover 80% of total revenue. Is this statement true or false?

A. True

B. False

-

Question 88:

FG acquired 75% of the equity share capital of HI on 1 September 20X3.

On the date of acquisition, the fair value of the net assets was the same as the carrying amount, with the exception of a contingent liability disclosed by HI and relating to a pending legal case. At 1 September 20X3, the contingent liability was

independently valued at $1.2 million.

At the current year end, 31 March 20X5, the legal case is still outstanding. The fair value of the liability has now been estimated at $1.4 million, and the case is expected to be resolved in the forthcoming financial year.

How should this contingent liability be recorded in the consolidated financial statements for the year ended 31 March 20X5?

A. A current liability of $1.4 million.

B. A non-current liability of $1.4 million.

C. A current liability of $1.2 million.

D. A non-current liability $1.2 million.

-

Question 89:

An entity has declared a dividend of $0.12 a share. The cum dividend market price of one equity share is $1.40. Assuming a dividend growth rate of 7% a year, what is the entity's cost of equity?

A. 17.0%

B. 8.6%

C. 16.2%

D. 9.4%

-

Question 90:

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?

A. A covenant on the existing bank loan that restricts the level of dividend that can be paid.

B. A projected decrease in interest cover that would breach a covenant on the existing loan.

C. The revaluation of GG's property that shows an increase in its value since the existing bank loan was taken out.

D. A projected lack of profits to be able to claim tax relief on the additional interest arising from the new loan.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.