Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 51:

AB's financial information shows that the non current assets' carrying value is greater than the tax base at the year end.

What is the journal entry to record the movement in the provision for deferred tax resulting from this difference?

A. Dr Deferred tax provisionCr Tax expense

B. Dr Deferred tax provisionCr Other comprehensive income

C. Dr Tax expenseCr Deferred tax provision

D. Dr Other comprehensive incomeCr Deferred tax provision

-

Question 52:

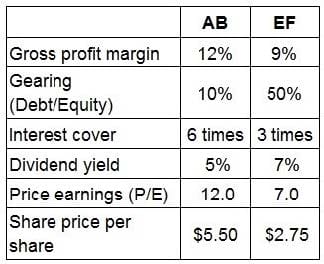

AB and EF are located in the same country and prepare their financial statements to 31 October in accordance with International Accounting Standards. EF supplies AB with a component that is vital to AB's product range. AB is considering acquiring a controlling interest in EF by 31 December 20X4 in order to guarantee future supply. The Board of EF has indicated that such an approach would be postively considered. AB would use its control to make AB the sole customer of EF.

The Finance Director of AB has been granted access to EF's management accounts and has conducted some initial analysis from the financial press. The results togther with comparisons for AB for the year to 31 October 20X4 are presented below:

AB and EF are forecasting revenues of S1,500,000 and $700,000 respectively for the year ended 31 October 20X5.

Which of the following independent options would explain the difference between the gearing ratios of AB and EF at 31 October 20X4?

A. EF's average cost of borrowing is significantly lower than that of AB and EF has taken advantage of that.

B. EF has a policy of revaluing non current assets whereas AB does not.

C. EF made a bonus issue of shares from retained earnings during the year whereas AB did not.

D. EF's market value of shares at 31 October 20X4 is lower than that of AB.

-

Question 53:

Which of the following defines the calculation of interest cover?

A. Profit before interest and tax divided by finance costs

B. Finance costs divided by profit before interest and tax

C. Profit after tax divided by finance costs

D. Finance costs divided by profit after tax

-

Question 54:

ST granted 1,000 share appreciation rights (SARs) to its 100 employees on 1 December 20X7. To be eligible, employees must remain employed for 3 years from the grant date. In the year to 30 November 20X8, 10 staff left and a further 20

were expected to leave over the following two years. The fair value of each SAR was $12 at 1 December 20X7 and $15 at 30 November 20X8.

What is the accounting entry to record this transaction for the year to 30 November 20X8?

A. Dr Staff costs $350,000, Cr Non-current liabilities $350,000

B. Dr Staff costs $350,000, Cr Equity $350,000

C. Dr Staff costs $280,000, Cr Non-current liabilities $280,000

D. Dr Staff costs $280,000, Cr Equity $280,000

-

Question 55:

When producing the consolidated statement of profit or loss and other comprehensive income, which TWO of the following will be disclosed as attributable to the equity holders of the parent company and the non-controlling interests?

A. Profit before tax

B. Profit after tax

C. Other comprehensive income

D. Total comprehensive income

E. Operating profit

-

Question 56:

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

A. Associate

B. Joint venture

C. Joint arrangement

D. Financial asset

-

Question 57:

If you were asked to express the overall performance of an entity as a percentage of its total investment in net assets which of the following ratios would you calculate?

A. Return on capital employed

B. Asset utilisation

C. Dividend yield

D. Non-current asset turnover

-

Question 58:

Which of the following statements are incorrect regarding identifiable assets? Select ALL that apply.

A. Deferred tax assets and liabilities are not classed as identifiable assets

B. Contingent assets and liabilities are examples of exceptions to the rules governing identifiable assets

C. To be identifiable assets must be separable from the subsidiary

D. Assets can also be identifiable if they arise from contractual or legal rights

E. Net assets must be identifiable at acquisition

-

Question 59:

GH is a listed entity which holds equity shares in one subsidiary and one associate.

Information extracted from the most recent financial statements is as follows: What is the interest cover for the year?

A. 9.6 times

B. 10.7 times

C. 11.7 times

D. 8.5 times

-

Question 60:

RST sells computer equipment and prepares its financial statements to 31 December.

On 30 September 20X5 RST sold computer software along with a two year maintenance package to a customer. The customer is given the right to return the goods within six months and claim a full refund if they are not satisfied with the computer software. The risk of return is considered to be insignificant for RST.

How should the revenue from this transaction and the right of return be recognised in the financial statements for the year ended 31 December 20X5?

A. Recognise 100% of the revenue from both the sale of goods and the maintenance contract and create a provision for the anticipated level of returns.

B. Do not recognise any revenue from the sale of goods or the maintenance contract and do not create a provision for the anticipated level of returns.

C. Recognise 12.5% of the revenue from both the sale of goods and the maintenance contract and do not create a provision for the anticipated level of returns.

D. Recognise 100% of the revenue from the sale of goods,12.5% of the revenue from the maintenance contract and create a provision for the anticipated level of returns.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.