Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 241:

LM is preparing its consolidated financial statements for the year ended 30 April 20X5. During the year LM acquired 30% of the equity shares of AB giving it significant influence over AB.

LM conducted ratio analysis comparing the financial performance of the group for 30 April 20X4 and 20X5.

Which of the following ratios would not be comparable as a result of the acquisition of AB?

A. Operating profit margin.

B. Return on capital employed.

C. Earnings per share.

D. Interest cover.

-

Question 242:

Which of the following options provides a representation of how the non controlling interest in FG is measured in CD's consolidated statement of financial position at 31 December 20X8?

A. FV of NCI at acquisition; plus NCI's share of post acquisition reserves of FG; plus NCI's share of accumulated exchange differences arising on goodwill of FG.

B. FV of NCI at acquisition; plus NCI's share of post acquisition reserves of FG; plus NCI's share of exchange difference arising on goodwill of FG for the year.

C. FV of NCI at reporting date; plus NCI's share of post acquisition reserves of FG; plus NCI's share of exchange difference arising on goodwill of FG for the year.

D. FV of NCI at reporting date; plus NCI's share of group reserves; plus NCI's share of accumulated exchange differences arising on goodwill of FG.

-

Question 243:

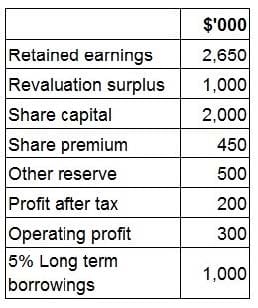

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

A. gearing of 15% and interest cover of 6.

B. gearing of 16% and interest cover of 6.

C. gearing of 15% and interest cover of 4.

D. gearing of 16% and interest cover of 4.

-

Question 244:

AB acquired a financial investment on 1 January 20X9, incurring $5,000 related agency fees. AB initially classified the investment as held for trading, in accordance with IAS 32 Financial Instruments: Presentation. Which of the following statements reflects the accounting treatment that AB adopted in respect of this investment when it prepared its financial statements to 31 December 20X9?

A. Agency fees were recorded as an expense and the gain/loss on the remeasurement of the investment at the year end was recorded in profit or loss for the year.

B. Agency fees were recorded as an expense and the gain/loss on the remeasurement of the investment at the year end was recorded in other comprehensive income.

C. Agency fees were added to the cost of the investment and the gain/loss on the remeasurement of the investment at the year end was recorded in profit or loss for the year.

D. Agency fees were added to the cost of the investment and the gain/loss on the remeasurement of the investment at the year end was recorded in other comprehensive income.

-

Question 245:

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

A. 15.83

B. 7.92

C. 10.56

D. 9.31

-

Question 246:

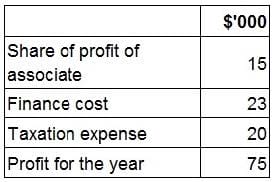

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following:

What is VW's interest cover for the year ended 30 September 20X7?

A. 4.5

B. 3.3

C. 4.1

D. 5.1

-

Question 247:

What is the total comprehensive income attributable to the non-controlling interest that will be presented in GHI's consolidated statement of changes in equity for the year ended 31 December 20X4?

A. $95,000

B. $595,000

C. $575,000

D. $190,000

-

Question 248:

Taking each statement individually, which of the following explains the movement in the gross profit margin from 20X4 to 20X5 as calculated by the analysts?

A. Increase in the levels of closing inventory of raw materials.

B. Reduction in the cost of raw materials NOT passed onto customers.

C. Prompt payment discounts no longer offered to customers.

D. Increase in the volume of sales over the year.

-

Question 249:

Which of the following are limitations of financial statement figures for ratio analysis? Select the ALL that apply.

A. Only provides historic data

B. Only provides financial information

C. Limited information to identify trends over time

D. Provide only summarised information

E. Contains complicated information that needs to be summarised

F. Only provides forecast data

-

Question 250:

When preparing a consolidated statement of cash flows, which of the following describes the correct presentation of an associate's dividends?

A. Dividends received from the associate in cash flows from investing activities

B. Dividends received from the associate in cash flows from operating activities

C. Dividends paid by the associate in cash flows from financing activities

D. Dividends paid by the associate in cash flows from investing activities

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.