Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 231:

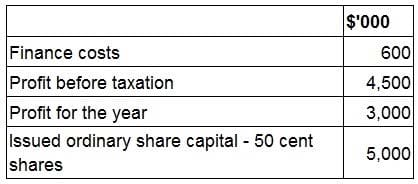

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows: A. 15.83

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

B. 7.92

C. 10.56

D. 9.31

-

Question 232:

Which TWO of the following statements about bonds and their issue are true?

A. Credit rating agencies assign risk categories to bond issues.

B. Bonds are a form of loan capital, traded on stock exchanges.

C. Bonds are a risk-free form of investing because they will always be repaid.

D. All bonds have the same terms and conditions when issued.

E. A bond issue is never underwritten because the return is fixed and guaranteed.

-

Question 233:

When establishing a group structure, which of the following factors need to be considered: Select ALL that apply.

A. Whether control has been established

B. The percentage ownership

C. The date of acquisition

D. Non-controlling interests

E. Goodwill

F. Intra-group investments

G. Whether control is direct or indirect

-

Question 234:

As at 31 October 20X7 TU's financial statements show the entity having profit after tax of $600,000 and 900,000 $1 ordinary shares in issue. There have been no issues of shares during the year. At 31 October 20X7 TU have 300,000 share options in issue, which allow the holders to purchase ordinary shares at $2 a share in 3 years' time. The average price of the ordinary shares throughout the year was $5 a share.

What is the diluted earnings per share for the year ended 31 October 20X7?

A. 66.7 cents

B. 58.8 cents

C. 50.0 cents

D. 55.6 cents

-

Question 235:

AB acquired 10% of the equity share capital of XY on 1 January 20X7 for $180,000 when the fair value of XY's net assets was $190,000. On 1 January 20X9 AB purchased a further 50% of the equity share capital for $550,000 when the fair value of XY's net assets was $820,000.

The original 10% investment had a fair value of $200,000 at the date control of XY was gained. The non controlling interest in XY was measured at its fair value of $300,000 at 1 January 20X9.

Which of the following represents the correct value of goodwill arising on the acquisition of XY that would have been included by AB when it prepared its consolidated financial statements at 31 December 20X9?

A. $230,000

B. $30,000

C. $210,000

D. $40,000

-

Question 236:

What figure will be presented in GHI's consolidated statement of changes in equity for the year ended 31 December 20X4, in respect of dividends paid to non-controlling interest?

A. $25,000

B. $125,000

C. $100,000

D. $0

-

Question 237:

EF have just paid a dividend of 20 cents a share and the current share price is $3.75. EF regularly reinvests 40% of its profit for the year and generates a return on reinvested funds of 12%.

The cost of equity for EF using the dividend valuation model is:

A. 10.4%

B. 12.9%

C. 10.7%

D. 13.2%

-

Question 238:

Company A are approached by a wealthy and internationally famous investor shortly before the launch date of their IPO. He tells them that the company do not need to incur all of the cost and risk of an IPO, as he will give them S55 million for 65% equity in the company.

Which of the following statements are also true of the offer? Select ALL that apply.

A. This offer is from an angel investor

B. The offer may ultimately require the majority stakeholder to sell his shares in the company

C. The investor will probably want to manage the company

D. The investor will want a long term commitment in the company

-

Question 239:

MNO is listed on its local stock exchange. It has a high level of gearing compared to the industry average as a result of rapid expansion funded by debt. The directors of MNO would like to reduce the level of gearing by raising equity to fund the next expansion project. The directors are considering whether to use a placing of new shares or a rights issue.

Which of the following statements is true?

A. A rights issue would not need to be underwritten because the risk of the shares not being taken up is small compared to a placing.

B. The administration costs associated with a placing are usually more expensive than a rights issue because less investors are involved.

C. A placing will increase the proportion of the total number of MNO's shares held by large investors.

D. The directors must use a placing before offering the rights issue to existing shareholders.

-

Question 240:

AB sold the majority of its operating equipment to LM for cash on 30 December 20X9 and then immediately leased it back under an operating lease.

AB used the cash proceeds from the sale to reduce its long term borrowings significantly. No early repayment charge was levied by the lender.

Which of the following statements is true in respect of AB's ratios calculated at 31 December 20X9?

A. AB's return on capital employed would be lower as a result of this sale being recorded.

B. AB's current ratio would be lower as a result of this sale being recorded.

C. AB's non-current asset turnover would be lower as a result of this sale being recorded.

D. AB's gearing ratio would be lower as a result of this sale being recorded.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.