Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 201:

MNO has calculated its return on capital employed ratio for 20X4 and 20X5 as 41% and 56% respectively. Taking each statement in isolation, which would explain the movement in the ratio between the 2 years?

A. In 20X5 the average interest rate on borrowing decreased compared to 20X4.

B. In 20X4 an onerous contract was provided for and this provision did not change in 20X5.

C. In 20X5 the increase in value of MNO's head office was reflected in the financial statements.

D. In 20X4 an unused building was sold at a price in excess of its carrying value.

-

Question 202:

RST sells computer equipment and prepares its financial statements to 31 December.

On 30 September 20X5 RST sold computer software along with a two year maintenance package to a customer. The customer is given the right to return the goods within six months and claim a full refund if they are not satisfied with the

computer software. The risk of return is considered to be insignificant for RST.

How should the revenue from this transaction and the right of return be recognised in the financial statements for the year ended 31 December 20X5?

A. Recognise 100% of the revenue from both the sale of goods and the maintenance contract and create a provision for the anticipated level of returns.

B. Do not recognise any revenue from the sale of goods or the maintenance contract and do not create a provision for the anticipated level of returns.

C. Recognise 12.5% of the revenue from both the sale of goods and the maintenance contract and do not create a provision for the anticipated level of returns.

D. Recognise 100% of the revenue from the sale of goods,12.5% of the revenue from the maintenance contract and create a provision for the anticipated level of returns.

-

Question 203:

When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised in the statement of profit or loss?

A. Finance cost element of the lease payments

B. Depreciation of the leased asset

C. Lease payments paid

D. Lease payments payable

E. Capital repayment element of the lease payments

-

Question 204:

EF acquired a copy machine under a three-year operating lease. EF will pay nothing in year one and then will pay $6,000 in years two and three. The estimated economic useful life of the machine is six years. Which THREE of the following statements are true in respect of how EF will account for its use of the machine and the associated operating lease payments?

A. An asset of $12,000 will be included in EF's property, plant and equipment at the start of the lease.

B. EF will record no expense in year one in respect of the operating lease charges for this machine.

C. EF will record a credit to bank of $6,000 in year two.

D. EF will include an accrual of $4,000 at the end of year one in respect of the lease payments.

E. EF will charge $4,000 to profit or loss in each of the three years in respect of this operating lease.

F. EF will include an accrual of $6,000 at the end of year one in respect of the lease payments.

-

Question 205:

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

A. 15.83

B. 7.92

C. 10.56

D. 9.31

-

Question 206:

FG granted share options to its 500 employees on 1 August 20X0. Each employee will receive 1,000 share options provided they continue to work for FG for the four years following the grant date. The fair value of the options at the grant date was $1.30 each. In the year ended 31 July 20X1, 20 employees left and another 50 were expected to leave in the following three years. In the year ended 31 July 20X2, 18 employees left and a further 30 were expected to leave during the next two years.

The amount recognised in the statement of profit or loss for the year ended 31 July 20X1 in respect of these share options was $139,750.

Calculate the charge to FG's statement of profit or loss for the year ended 31 July 20X2 in respect of the share options.

A. $154,050

B. $141,050

C. $293,800

D. $280,800

-

Question 207:

Which TWO of the following are true in relation to IAS21 The Effects of Changes in Foreign Exchange Rates when consolidating an overseas subsidiary?

A. A current period exchange gain or loss is shown within the consolidated statement of comprehensive income within other comprehensive income.

B. Goodwill is re-translated at the end of each reporting period and reflected at the period end exchange rate in the consolidated statement of financial position.

C. Assets and liabilities of the subsidiary are translated at each reporting date using the average exchange rate for the period.

D. Goodwill is reflected in the consolidated statement of financial position translated at the exchange rate on the date of acquisition.

E. The statement of profit or loss of the subsidiary is translated for the reporting period using the closing exchange rate.

-

Question 208:

ST owns 75% of the equity share capital of GH. GH owns 80% of the equity share capital of RS.

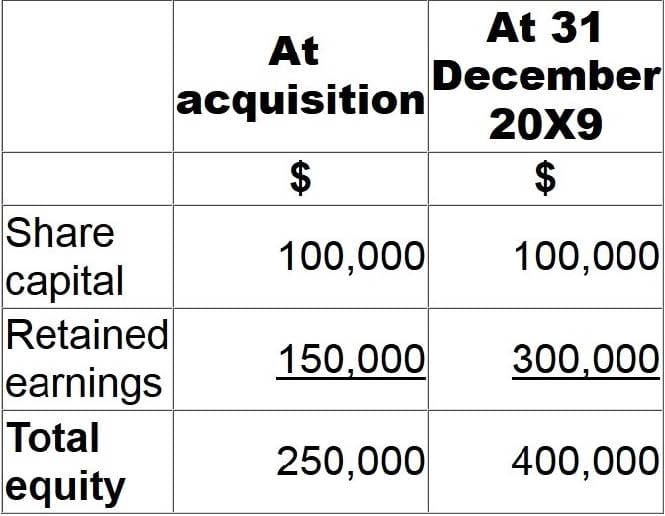

The following balances relate to RS:

The non controlling interest in respect of RS had a fair value of $56,000 at acquisition. There has been no impairment to goodwill since acquisition.

What value should be included in ST's consolidated statement of financial position for the non controlling interest in RS at 31 December 20X9?

A. $116,000

B. $86,000

C. $93,500

D. $146,000

-

Question 209:

Which of the following, in accordance with IFRS 2 Share-based Payments, are only applicable to the accounting treatment of cash settled rather than equity settled share- based payment schemes?

Select ALL that apply.

A. The instruments in the scheme are remeasured at the end of each financial year to fair value.

B. The instruments in the scheme are measured at the fair value at the grant date of the scheme.

C. The credit entry in the financial statements is to liabilities.

D. The credit entry in the financial statements is to equity.

E. The expense of the scheme is spread to profit or loss over the vesting period.

-

Question 210:

Mr D, a CIMA qualified accountant, is working on the preparation of a long term profit forecast required by the local stock market prior to a new share issue of equity shares. At the most recent board meeting the directors requested that the forecast be inflated. In Mr D's view this would grossly overestimate the forecast profit. The board intends to publish the revised inflated forecast.

Which THREE of the following are the ethical options available to Mr D in this situation?

A. Consider resignation of his post as accountant.

B. Adjust the figures in line with the board's request as this is a forecast and not the financial statements.

C. Discuss the situation with his line manager.

D. Consider reporting the situation to the appropriate authorities.

E. Delegate the work to a subordinate.

F. Submit the original forecast without the board's approval.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.