Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 211:

AB acquired a financial investment on 1 January 20X9, incurring $5,000 related agency fees. AB initially classified the investment as held for trading, in accordance with IAS 32 Financial Instruments: Presentation.

Which of the following statements reflects the accounting treatment that AB adopted in respect of this investment when it prepared its financial statements to 31 December 20X9?

A. Agency fees were recorded as an expense and the gain/loss on the remeasurement of the investment at the year end was recorded in profit or loss for the year.

B. Agency fees were recorded as an expense and the gain/loss on the remeasurement of the investment at the year end was recorded in other comprehensive income.

C. Agency fees were added to the cost of the investment and the gain/loss on the remeasurement of the investment at the year end was recorded in profit or loss for the year.

D. Agency fees were added to the cost of the investment and the gain/loss on the remeasurement of the investment at the year end was recorded in other comprehensive income.

-

Question 212:

Which TWO of the following are TRUE in respect of preparing a consolidated statement of cash flows where there has been an acquisition of a subsidiary part way through the year?

A. Investing activities will include a total cash outflow for the acquisition comprising the cash paid for the subsidiary less the cash held by the subsidiary at the acquisition date.

B. The working capital held by the subsidiary at acquisition will be excluded from the year end figures based on the percentage shareholding in the subsidiary.

C. Non-controlling interest will arise in relation to the subsidiary and any dividends paid to the non-controlling interest will be shown within financing activities as a cash outflow.

D. Any shares that were issued on acquisition of the subsidiary will be shown separately on the statement of cash flows within financing activities.

E. The year end cash and cash equivalents balance will be reduced by the cash and cash equivalents that were held by the subsidiary at the acquisition date.

-

Question 213:

Which TWO of the following are relevant ethical considerations when selecting an accounting policy?

A. It shows faithful representation of the financial statements.

B. It shows a favourable view of performance.

C. It is in accordance with International Financial Reporting Standards.

D. It is straightforward to implement.

E. It maximises shareholder wealth.

-

Question 214:

ST acquired 75% of the 2 million $1 equity shares of CD on 1 January 20X3, when the retained earnings of CD were S3,550,000. CD has no other reserves.

ST paid $5,600,000 for the shares in CD and the non controlling interest was measured at its fair value of S1,400,000 at acquisition. At 1 January 20X3, the fair value of CD's net assets were equal to their carrying amount, with the exception of a building. This building had a fair value of $1,000,000 in excess of its carrying amount and a remaining useful life of 25 years on 1 January 20X3.

At 31 December 20X5, the retained earnings of ST and CD were $8,500,000 and $5,250,000 respectively.

What is the figure for non-controlling interest to be shown in the consolidated statement of financial position of ST as at 31 December 20X5?

A. $1,795,000

B. $1,607,500

C. $1,825,000

D. $1,805,000

-

Question 215:

How would KL account for its investment in MN in its consolidated financial statements for the year to 31 December 20X9?

A. Joint venture

B. Joint arrangement

C. Financial asset

D. Subsidiary

-

Question 216:

JJ's current share price is $1.80, with a dividend of $0.20 a share just about to be paid.

Dividends have increased at an average annual growth rate of 4.5% and this is expected to continue into the future.

What is JJ's cost of equity?

A. 17.6%

B. 16.1%

C. 12.5%

D. 11.1%

-

Question 217:

AB and CD are competitors supplying components to the car manufacturing industry. AB operates in Country X and CD operates in Country Y. Both entities were incorporated on the same day, are the same size and prepare financial

statements to 31 March each year using international accounting standards.

Which of the following statements taken individually would limit the usefulness of the comparison of the return on capital employed ratio between the two entities?

A. The corporate tax rate is 25% in Country X and 40% in Country Y.

B. The average rate of inflation is 3% in Country X and 10% in Country Y.

C. The average rate of borrowing is 2% in Country X and 7% in Country Y.

D. The currency is Dollar in Country X and Krona in Country Y.

-

Question 218:

Which of the following principles are the basic principles followed by the consolidated income statement?

Select ALL that apply.

A. Include all of the parent's income and expenses plus all of the subsidiaries' income and expenses

B. Ignore investment income from subsidiary to parent (e.g. dividend payments or loan interest)

C. After profit for the period, show the profit split between amounts attributable to the parent's shareholders and other shareholders

D. Include all of the parent's income and expenses minus all of the subsidiaries' income and expenses

E. Include investment income from subsidiary to parent (e.g. dividend payments or loan interest)

-

Question 219:

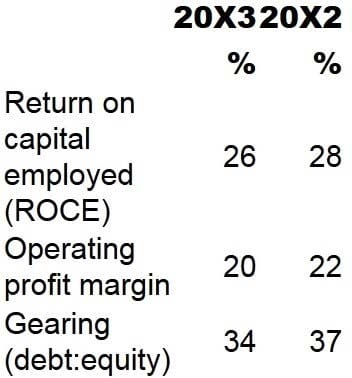

Ratios have been produced below for EF for the year to 31 March:

Which TWO of the following could explain the movement in both gearing and ROCE?

A. A rights issue on 31 March 20X3.

B. A debt issue on 31 March 20X3.

C. A revaluation upwards on the head office property on 1 April 20X2.

D. A bonus issue of shares on 1 April 20X2.

E. A bank loan to purchase new machinery on 31 March 20X3.

-

Question 220:

Following the impairment review of the investment in BC, what would be the carrying value of this associate in KL's consolidated statement of financial position at 31 December 20X9?

A. $1,050,000

B. $1,240,000

C. $1,800,000

D. $1,960,000

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.