Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 221:

Which of the following would limit the effectiveness of analysis performed on the operating profit margins of two separate entities with the same total revenue over a12 month period?

A. Different accounting estimates in respect of depreciation of property, plant and equipment.

B. Different approaches to allocating expenses to cost of sales, administration expenses and distribution costs.

C. Different interest rates on loan finance available to the entities.

D. Different pattern of monthly revenues caused by seasonality.

-

Question 222:

XY has a weighted average cost of capital (WACC) of 12%. The debt:equity ratio is 1:3 and this is considered low for the industry. XY needs to raise finance to purchase new machinery in the coming year. Which of the following forms of finance is most likely to increase the WACC?

A. Rights issue of equity shares

B. 6% bank loan

C. 8% preference shares

D. Finance lease

-

Question 223:

AB owned 80% of the equity share capital of FG at 1 January 20X6. AB disposed of 10% of FG's equity share capital on 31 December 20X6 for $400,000. The non controlling interest was measured at $700,000 immediately prior to the disposal.

Which of the following represents the adjustment that AB made to non controlling interest in respect of the disposal when it prepared its consolidated financial statements at 31 December 20X6?

A. Credit of $350,000

B. Debit of $400,000

C. Debit of $350,000

D. Credit of $50,000

-

Question 224:

RST sells computer equipment and prepares its financial statements to 31 December.

On 30 September 20X5 RST sold computer software along with a two year maintenance package to a customer. The customer is given the right to return the goods within six months and claim a full refund if they are not satisfied with the

computer software. The risk of return is considered to be insignificant for RST.

How should the revenue from this transaction and the right of return be recognised in the financial statements for the year ended 31 December 20X5?

A. Recognise 100% of the revenue from both the sale of goods and the maintenance contract and create a provision for the anticipated level of returns.

B. Do not recognise any revenue from the sale of goods or the maintenance contract and do not create a provision for the anticipated level of returns.

C. Recognise 12.5% of the revenue from both the sale of goods and the maintenance contract and do not create a provision for the anticipated level of returns.

D. Recognise 100% of the revenue from the sale of goods,12.5% of the revenue from the maintenance contract and create a provision for the anticipated level of returns.

-

Question 225:

LM are just about to pay a dividend of 20 cents a share. Historically, dividends have grown at a rate of 5% each year.

The current share price is $3.05.

The cost of equity using the dividend valuation model is:

A. 12.4%

B. 11.9%

C. 7.4%

D. 6.9%

-

Question 226:

JK is seeking to raise finance for a project and the directors would prefer to take out a fixed rate bank loan repayable over the next 5 years. The project will increase the profit of JK even after taking into account the additional interest costs. Which of the following statements about the use of a bank loan in this situation is true?

A. In the long term servicing a bank loan is more expensive than servicing equity shares due to the higher risk for the lender.

B. The interest on a bank loan is deducted from profit before dividends can be declared to equity shareholders each year.

C. Because the assets of a business belong to the equity shareholders, a bank loan should NOT be secured on the assets of the business.

D. A bank loan has high issue costs compared to an issue of equity shares because it takes longer to arrange.

-

Question 227:

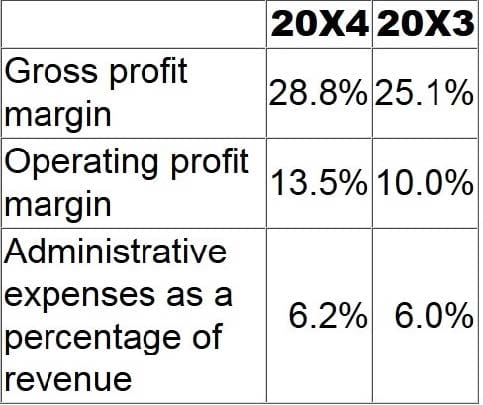

PQ is a retail business. In recent years they have improved their financial performance and increased their revenue. The following ratios have been calculated for the years ended 31 December 20X4 and 20X3: Which of the following explanations of PQ's financial performance is consistent with these ratios?

A. In 20X4 PQ reduced the unit selling price resulting in an increase in volumes sold and an increase in overall revenue.

B. PQ changed suppliers early in 20X4 because the new supplier agreed to supply the same goods at a cheaper price.

C. In 20X4 taxation legislation was amended which reduced the rate of corporate income tax by 3.5%.

D. In 20X4 PQ sold a retail outlet resulting in a significant gain on disposal which has been deducted from administrative expenses.

-

Question 228:

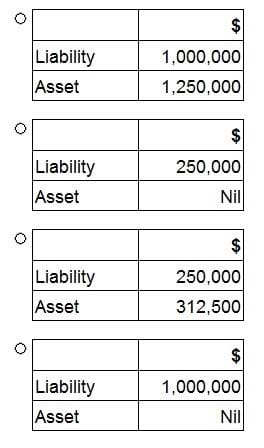

The following information relates to DEF for the year ended 31 December 20X7:

Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of $2,500,000.

There are unused tax losses to carry forward of $1,250,000.

These tax losses have arisen due to poor trading conditions which are not expected to improve in the foreseeable future.

The corporate income tax rate is 25%.

In accordance with IAS 12 Income Taxes, the financial statements of DEF for the year ended 31 December 20X7 would recognise deferred tax balances of:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 229:

EF obtained a government licence, free of charge, to operate a silver mine in 20X7 and $5 million was spent on preparing the site. The mine commenced operation on 1 January 20X8. The licence requires that at the end of the mine's useful

life of 20 years, the site above ground must be reinstated to its original position.

EF estimated that the cost in 20 years' time of this reinstatement will be $3 million, which has a present value of $1 million at 1 January 20X8.

Which THREE of the following describe how the cost of the reinstatement of the site should be treated in the financial statements of EF in the year ended 31 December 20X8?

A. The cost of the mine will be increased by $1 million on 1 January 20X8.

B. The cost of the mine will be increased by $3 million on 1 January 20X8.

C. There will be a credit to finance costs for the unwinding of the discount on the reinstatement provision.

D. There will be a debit to finance costs for the unwinding of the discount on the reinstatement provision.

E. Only the cost of the site preparation will be depreciated over the mine's useful economic life.

F. Depreciation will be charged over 20 years on the full cost of the mine including the reinstatement cost.

-

Question 230:

You are a Financial Controller at BCD and are in the process of preparing the year-end financial statements. A member of your finance team has come to see you about her provisions balance at year-end.

She says that the Managing Director has asked her to increase the provisions balance by $1 million overall. She thinks this is because BCD has had a very good year in terms of profit, and the Managing Director wants to put some profit aside

to protect against any future reductions in profit. $1 million is material to BCD.

You believe that the provisions balance was fairly stated without the additional $1 million.

Which TWO of the following would be appropriate actions in this scenario?

A. Discuss the matter with the Finance Director as he is your immediate line manager.

B. Speak to the Managing Director to explain that the level of provisions is governed by financial reporting standards.

C. Tell the member of your finance team to ignore the Managing Director and to leave the provisions balance as it was.

D. Contact the external auditors of BCD and tell them that the Managing Director wants to change the provisions balance.

E. Speak to the shareholders at the upcoming annual general meeting about this issue.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.