Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 191:

Which of the following examples of contracts will use cost of sales as the balancing figure when calculating profit or loss?

Select ALL that apply.

A. Contract A has a total value of£50m, costs to date of£42m and expected costs to completion of£15m. The project's % stage of completion is 74% using the cost method.

B. Contract A has a total value of£55m, costs to date of£33m and expected costs to completion of£18m.

C. Contract A has a total value of£75m, costs to date of£61m and expected costs to completion of£20m. The contracts % stage of completion was calculated by dividing its value to date of£45m by£75m.

D. Contract A has a total value of£60m, costs to date of£42m and expected costs to completion of£15m. The project's % stage of completion is 80% using the value method.

E. Contract A has a total value of£85m, costs to date of£69m and expected costs to completion of£22m. The contracts % stage of completion was calculated by dividing its costs incurred to date of£69m by £75m.

-

Question 192:

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

A. gearing of 15% and interest cover of 6.

B. gearing of 16% and interest cover of 6.

C. gearing of 15% and interest cover of 4.

D. gearing of 16% and interest cover of 4.

-

Question 193:

Which of the following reduce the usefulness of ratio analysis when comparing entities that operate in the same industry? Select ALL that apply.

A. The revenue figure being aggregated from many different activities and sources.

B. Accounting estimates in respect of depreciation being different between entities.

C. The effect of a material and unusual item being disclosed separately in the notes.

D. An entity adopting a policy of revaluing its non current assets.

E. Ratio calculations being based on historical information.

F. Ratios being quick and easy to calculate.

-

Question 194:

XY purchased $100,000 of quoted 8% bonds in the current year which it intends to hold until redemption.

Which of the following identifies the correct classification and subsequent measurement basis for this financial instrument?

A. A loans and receivables financial asset subsequently measured at fair value with gains and losses in reserves.

B. A held to maturity financial asset subsequently measured at amortised cost.

C. A loans and receivables financial asset subsequently measured at amortised cost.

D. A held to maturity financial asset subsequently measured at fair value with gains and losses in reserves.

-

Question 195:

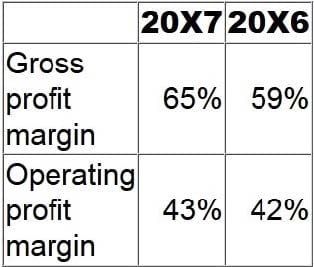

Ratios calculated from the financial statements of ST Group for the years ended 31 August 20X7 and 20X6 are as follows:

Which of the following would have contributed to the movements in these ratios?

A. During 20X7 ST Group acquired an associate which made a relatively small profit for the year.

B. ST Group extended its customer base which resulted in an increase in the volume of sales during 20X7.

C. During 20X7 ST Group increased the useful life of its vehicles to five years from four and adjusted the depreciation charge accordingly.

D. The fair value of an investment acquired in 20X7 and classified as fair value through profit or loss has increased in value by the year end.

-

Question 196:

Which of the following reduce the usefulness of ratio analysis when comparing entities that operate in the same industry?

Select ALL that apply.

A. The revenue figure being aggregated from many different activities and sources.

B. Accounting estimates in respect of depreciation being different between entities.

C. The effect of a material and unusual item being disclosed separately in the notes.

D. An entity adopting a policy of revaluing its non current assets.

E. Ratio calculations being based on historical information.

F. Ratios being quick and easy to calculate.

-

Question 197:

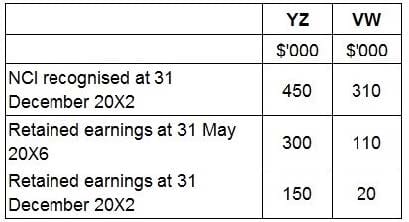

AB acquired 90% of the equity of YZ on 31 December 20X2. On the same date YZ acquired 60% of the equity shares of VW for $750,000. AB has no other subsidiaries. The following information regarding YZ and VW was available:

What amount will AB include in its consolidated statement of financial position in respect of non controlling interest at 31 May 20X6?

A. $816,400

B. $741,400

C. $840,600

D. $811,000

-

Question 198:

LM acquired 80% of the equity shares of ST when ST's retained earnings were $50 million. The fair value of the net assets of ST included a contingent liability with a fair value of $100 million at the date of acquisition and a fair value of $40 million at 31 December 20X6. No other fair value adjustments were required at the date of acquisition. LM and ST had retained earnings of $200 million and $80 million respectively at 31 December 20X6.

The consolidated retained earnings of LM at 31 December 20X6 were:

A. $164 million

B. $176 million

C. $272 million

D. $284 million

-

Question 199:

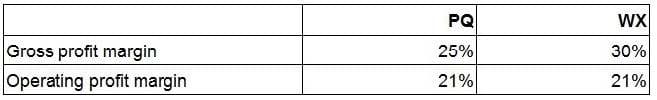

PQ and WX are similar sized entities and operate in the same industry within Country X . Both operate from a single warehouse and have similar levels of non current asset resources. The following ratios have been calculated at 31 October 20X8: If considered individually, which of the following would limit the usefulness of these ratios in assessing the comparative financial performances of PQ and WX?

A. Depreciation of warehouses being charged to cost of sales by PQ and distribution costs by WX.

B. Operating lease rentals for plant and equipment being charged to administration expenses by PQ and distribution costs by WX.

C. Year end review of equipment resulting in WX charging an impairment loss while PQ's equipment is not impaired.

D. Increased prices for raw materials, which was passed on to customers by both entities.

-

Question 200:

CD granted 1,000 share options to its 100 employees on 1 January 20X8.To be eligible, employees must remain employed for 3 years from the grant date. In the year to 31 December 20X8, 15 staff left and a further 25 were expected to leave

over the following two years.

The fair value of each option at 1 January 20X8 was $10 and at 31 December 20X8 was $15.

Which THREE of the following are true in respect of recording these share options in the year ended 31 December 20X8?

A. The credit entry will be to equity.

B. The credit entry will be to non-current liabilities.

C. Fair value at 1 January 20X8 will be used to value the options.

D. Fair value at 31 December 20X8 will be used to value the options.

E. The calculation of the charge for the year will be adjusted for actual leavers only.

F. The calculation of the charge for the year will be adjusted for actual and estimated leavers.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.