Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 181:

When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised in the statement of profit or loss?

A. Finance cost element of the lease payments

B. Depreciation of the leased asset

C. Lease payments paid

D. Lease payments payable

E. Capital repayment element of the lease payments

-

Question 182:

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

A. Increase in the deferred tax asset.

B. Increase in the deferred tax liability.

C. Decrease in the deferred tax asset.

D. Decrease in the deferred tax liability.

-

Question 183:

LM granted 100 share options to each of its 400 employees on 1 January 20X7. The options will only vest if employees remain with LM for 3 years from the grant date. The fair value of each share option was $5 on 1 January 20X7.

20 employees left in the year to 31 December 20X7 and at that date it was estimated that a further 35 would leave over the following two years.

Which of the following journal entries did LM process to account for the share options in the year to 31 December 20X7, in accordance with IFRS2 Share-based Payments?

A. Dr Profit or loss $57,500 ; Cr Other reserves within equity $57,500

B. Dr Profit or loss $57,500 ; Cr Liabilities $57,500

C. Dr Profit or loss $172,500 ; Cr Other reserves within equity $172,500

D. Dr Profit or loss $172,500 ; Cr Liabilities $172,500

-

Question 184:

Which THREE of the following statements about preference shares are true?

A. For an investor, preference shares carry more risk than ordinary shares.

B. Unlike ordinary shares, preference shares may be cumulative.

C. The characteristics of preference shares are closer to debt than equity.

D. Preference shares cannot be issued as redeemable shares.

E. Preference shareholders receive their dividend entitlement before the equity shareholders.

F. Preference shareholders rank below the equity shareholders in a winding up.

-

Question 185:

W and Y are very similar entities with the same level of profit before interest and tax. However, W has gearing of 95% and Y has gearing of 30%.

Which of the following statements is true?

A. Investing in W carries a higher level of risk than investing in Y.

B. A greater proportion of profit will be available out of which to declare a dividend in W.

C. Investors in Y will expect a higher return than investors in W.

D. Y has a greater commitment to meet interest payments than W.

-

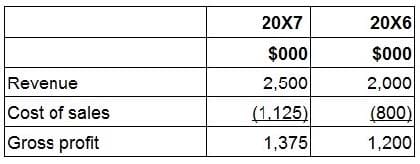

Question 186:

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal which is proving to be successful.

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

A. A worldwide shortage of leather resulting in increased prices from suppliers.

B. The opportunity to sell handbags in the airport store at a premium price.

C. KL locating a new supplier prepared to supply handbags at a cheaper price.

D. KL locating a new supplier closer to the warehouse, reducing distribution costs.

-

Question 187:

Which of the following statements are INCORRECT with regards to impairment of financial instruments; Select ALL that apply.

A. Held to maturity instruments and available for sale assets are both measured at amortised cost and are therefore impacted by impairment.

B. If a loss is suspected following an impairment review, a financial asset is written down to its fair value.

C. If a contract relating to a financial instrument is breached then this might be an indication of impairment.

D. In the result of an impairment loss, the carrying amount of the asset is directly reduced, or reduced through an allowance account.

E. The impairment loss on held to maturity instruments is the difference between the assets carrying amount and the present value of its future cashflows.

-

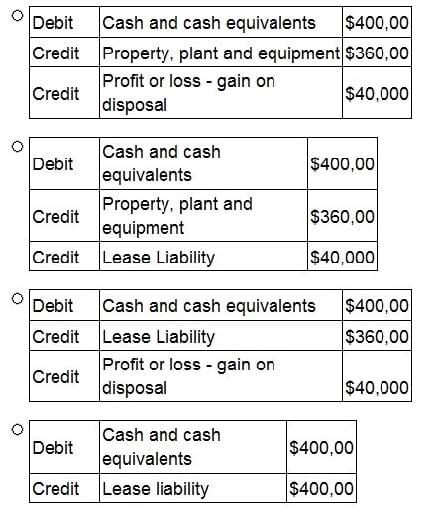

Question 188:

ST has sold its main office property, which had a carrying value of $360,000, to AB, a property management entity.

The property was sold for $400,000 which is equal to its fair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 189:

LM has made the following share purchases during the year:

Purchased 55% of the equity share capital of OP.

Purchased 45% of the equity share capital of QR. LM have the power to appoint the majority of board members on the QR board. Purchased 30% of the equity share capital of ST. LM is represented by one director on the main board of ST

which has five members in total. The other 70% of ST's equity share capital is owned by a single company, UV.

The Managing Director has told you that OP has performed well, but both QR and ST have not performed as expected. He is therefore pleased that OP will be included as a subsidiary and that QR and ST will only be included as investments in the group financial statements.

In accordance with the ethical principle of professional competence and due care how should the investments in OP, QR and ST be treated in the group financial statements?

A. OP and QR should be consolidated and ST should be equity accounted.

B. OP should be consolidated and QR and ST should be equity accounted.

C. OP should be consolidated, QR should be equity accounted and ST should be valued at cost.

D. OP and QR should be equity accounted and ST should be valued at cost.

-

Question 190:

In the year ended 31 December 20X7, FG leased a piece of machinery. The accountant of FG had prepared the financial statements for the year to 31 December 20X7 on the basis of the lease being an operating lease.

However, following the end of year audit it has been agreed that the machinery is in fact held under a finance lease and therefore the financial statements need to be corrected.

The correction will have which THREE of the following affects on the financial statements?

A. Non-current assets will increase.

B. Finance costs will increase.

C. Current liabilities will increase.

D. Non-current liabilities will decrease.

E. Depreciation costs will decrease.

F. Non-current assets will decrease.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.