Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 171:

Which of the following taken independently would explain the reduction in the profits as highlighted by the Chairman's press release?

A. Amortisation of development expenditure.

B. Staff training costs.

C. Extended credit terms to customers.

D. Installation costs of new equipment.

-

Question 172:

XY owned 80% of the equity share capital of AB at 1 January 20X5. XY disposed of 20% of AB's equity share capital on 31 December 20X5 for $200,000. The non controlling interest was measured at $140,000 immediately prior to the disposal.

What was the amount of the credit to retained earnings that XY will process in respect of this disposal when it prepares its consolidated financial statements at 31 December 20X5?

A. $60,000

B. $140,000

C. $200,000

D. $80,000

-

Question 173:

MNO has calculated its return on capital employed ratio for 20X4 and 20X5 as 41% and 56% respectively.

Taking each statement in isolation, which would explain the movement in the ratio between the 2 years?

A. In 20X5 the average interest rate on borrowing decreased compared to 20X4.

B. In 20X4 an onerous contract was provided for and this provision did not change in 20X5.

C. In 20X5 the increase in value of MNO's head office was reflected in the financial statements.

D. In 20X4 an unused building was sold at a price in excess of its carrying value.

-

Question 174:

ST acquired 75% of the 2 million $1 equity shares of CD on 1 January 20X3, when the retained earnings of CD were S3,550,000. CD has no other reserves.

ST paid $5,600,000 for the shares in CD and the non controlling interest was measured at its fair value of S1,400,000 at acquisition.

At 1 January 20X3, the fair value of CD's net assets were equal to their carrying amount, with the exception of a building. This building had a fair value of $1,000,000 in excess of its carrying amount and a remaining useful life of 25 years on 1 January 20X3.

At 31 December 20X5, the retained earnings of ST and CD were $8,500,000 and $5,250,000 respectively.

What is the value of retained earnings that will be presented in the consolidated statement of financial position of ST as at 31 December 20X5?

A. $9,685,000

B. $9,775,000

C. $9,715,000

D. $10,080,000

-

Question 175:

BC are currently seeking to establish an accounting policy for a particular type of transaction.

There are four alternative ways in which this transaction can be treated. Each treatment will have a different outcome on the financial statements as follows:

1.

Treatment one means that the financial statements will be easier to prepare.

2.

Treatment two will give a fair representation of the transaction in the financial statements.

3.

Treatment three will maximise the profit figure presented in the financial statements.

4.

Treatment four means that the financial statements will be more easily understood by shareholders.

Which accounting treatment should BC adopt?

A. One

B. Two

C. Three

D. Four

-

Question 176:

If you were asked to express the overall performance of an entity as a percentage of its total investment in net assets which of the following ratios would you calculate?

A. Return on capital employed

B. Asset utilisation

C. Dividend yield

D. Non-current asset turnover

-

Question 177:

GH issued a 6% debenture for $1,000,000 on 1 January 20X4. A broker fee of $50,000 was payable in respect of this issue. The effective interest rate associated with this debt instrument is 7.2%.

The carrying value of the debenture at 31 December 20X4 is:

A. $958,400

B. $1,065,600

C. $1,012,000

D. $961,400

-

Question 178:

Which THREE of the following actions should improve the cash position of an entity?

A. Substituting a bonus issue for the final dividend.

B. Selling non current assets and leasing them back under operating leases.

C. Implementing an efficient inventory ordering system.

D. Revaluing all non-current assets.

E. Revising the depreciation policy of non-current assets.

F. Offering extended credit terms to existing customers.

-

Question 179:

On 1 September 20X3, GH purchased 200,000 $1 equity shares in QR for $1.20 each and classified this investment as held for trading.

GH paid a 1% transaction fee to its broker on this transaction. QR's equity shares had a fair value of $1.35 each on 31 December 20X3.

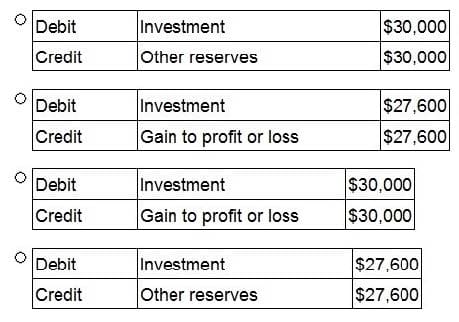

Which of the following journals records the subsequent measurement of this financial instrument at 31 December 20X3?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 180:

Which TWO of the following would be the primary disadvantages of producing the disclosures required in IFRS12 Disclosure of Interests in Other Entities?

A. The users of the financial statements may feel overburdened with information.

B. The disclosures take time and therefore incur costs which erodes shareholder value.

C. The disclosures will give competitors commercially sensitive information.

D. The disclosures will highlight the risks associated with interests in other entities.

E. The auditors will have to audit these disclosures.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.