Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 161:

AB sold the majority of its operating equipment to LM for cash on 30 December 20X9 and then immediately leased it back under an operating lease.

AB used the cash proceeds from the sale to reduce its long term borrowings significantly. No early repayment charge was levied by the lender.

Which of the following statements is true in respect of AB's ratios calculated at 31 December 20X9?

A. AB's return on capital employed would be lower as a result of this sale being recorded.

B. AB's current ratio would be lower as a result of this sale being recorded.

C. AB's non-current asset turnover would be lower as a result of this sale being recorded.

D. AB's gearing ratio would be lower as a result of this sale being recorded.

-

Question 162:

Which of the following examples would be classed as related parties ofJH Ltd due to the power they possess to directly influence the company?

1: JH Ltd's managing director

2: The son of JH Ltd's managing director, who is an intern in the company's office

3: The brother of JH Ltd's managing director, whose business supplies a large amount of production material for the company

4: JH Ltd's subsidiary company, AL Ltd

5:

BR PLC, one of JH Ltd's regular customers

A.

1and4

B.

1

C.

1, 2, 3 and 4

D.

2, 3 and 4

E.

1, 2 and 3

F.

All of the above

-

Question 163:

Which of the following statements are true regarding consolidated cash flows after the acquisition of a subsidiary?

Select ALL that apply.

A. The subsidiary's cash inflows and outflows become part of the group after purchase

B. Cash acquired from the subsidiary upon purchase is represented as a cash inflow

C. Adjustments need to be made to group working capital in light of the working capital acquired from the subsidiary

D. Net cash paid to acquire a subsidiary is shown as a cash inflow within the cash flow from investing activities

E. Disclosure notes are required to show cash and cash equivalents paid or received, but not details of goodwill, assets and liabilities acquired

F. Further adjustments are required to cash inflows and outflows after profit has been consolidated

-

Question 164:

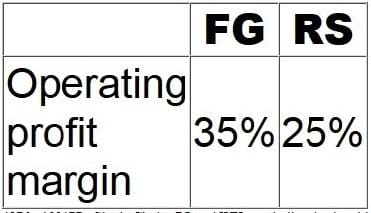

FG and RS operate in the same retail sector within the same country and are of a similar size. The following ratios have been calculated based on the financial statements for the year ended 30 September 20X4:

Which of the following factors would limit the usefulness of these ratios as a basis for assessing the comparative performances of FG and RS?

A. RS has a higher level of borrowings and associated finance costs.

B. RS sold a piece of land for a sum much greater than its carrying value.

C. RS operates at the low margin end of the market whilst FG operates at the high margin end.

D. FG has a higher level of deferred tax liabilities than RS.

-

Question 165:

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year.

Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

A. The dividend paid in the year was reduced in order to pay for new assets.

B. Surplus cash was used to pay a special dividend in addition to the normal dividend in the year.

C. The profit for the year fell significantly and the dividend per share stayed the same.

D. To compensate investors for the reduction in share price a higher dividend per share was paid.

-

Question 166:

What is meant by the term "a placing of ordinary shares"?

A. Selling new ordinary shares to a financial institution on a pre-arranged basis.

B. Selling new ordinary shares directly to the public.

C. Selling existing ordinary shares to new investors through a stock exchange.

D. Selling new ordinary shares to existing shareholders.

-

Question 167:

GH granted 100 share options to each of its 1,000 employees on 1 January 20X8. The fair value of each option was $7 on 1 January 20X8 and had risen to $8 at 31 December 20X8.

Which of the following statements represents the treatment that GH adopted to account for the related expense of these share options in its financial statements for the year ended 31 December 20X8, in accordance with IFRS 2 Share-based Payments?

A. The expense was measured using the fair value of $7 and the credit entry was to equity.

B. The expense was measured using the fair value of $7 and the credit entry was to liabilities.

C. The expense was measured using the fair value of $8 and the credit entry was to equity.

D. The expense was measured using the fair value of $8 and the credit entry was to liabilities.

-

Question 168:

GH owned 70% of the equity share capital of XY at 1 January 20X6. GH acquired a further 20% of XY's equity share capital on 31 December 20X6 for $430,000. Non controlling interest was measured at $600,000 immediately prior to the 20% acquisition.

Which of the following amounts will GH debit to non controlling interest when the 20% acquisition is adjusted for in its consolidated financial statements at 31 December 20X6?

A. $400,000

B. $120,000

C. $200,000

D. $430,000

-

Question 169:

Which THREE of the following would determine the functional currency of an overseas subsidiary in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates?

A. The currency which principally influences selling prices for goods and services.

B. The currency in which operating receipts are retained.

C. The currency that mainly influences labour, material and other costs.

D. The currency which the parent company uses to present its financial statements.

E. The currency in which all non-current assets are purchased and recognised.

F. The currency which principally influences the choice of functional currency of the parent.

-

Question 170:

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?

A. Provide for the $400,000 potential outflow and disclose the $250,000 potential inflow.

B. Provide for the $400,000 potential outflow and recognise the $250,000 potential inflow.

C. Disclose the $400,000 potential outflow and disclose the $250,000 potential inflow.

D. Disclose the $400,000 potential outflow and recognise the $250,000 potential inflow.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.