Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 151:

The yield to maturity of a redeemable bond is calculated as the internal rate of return of the relevant cash flows associated with the bond.

Which TWO of the following are considered relevant cash flows in this calculation?

A. The annual interest payments net of tax relief.

B. The redemption value of the bond at the date of redemption.

C. The market value of the bond now.

D. The nominal value of the bond now.

E. The value of the conversion premium on conversion to equity shares.

-

Question 152:

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year. Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

A. The dividend paid in the year was reduced in order to pay for new assets.

B. Surplus cash was used to pay a special dividend in addition to the normal dividend in the year.

C. The profit for the year fell significantly and the dividend per share stayed the same.

D. To compensate investors for the reduction in share price a higher dividend per share was paid.

-

Question 153:

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating

policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

A. Associate

B. Joint venture

C. Joint arrangement

D. Financial asset

-

Question 154:

Which TWO of the following are true in relation to IAS21 The Effects of Changes in Foreign Exchange Rates when consolidating an overseas subsidiary?

A. A current period exchange gain or loss is shown within the consolidated statement of comprehensive income within other comprehensive income.

B. Goodwill is re-translated at the end of each reporting period and reflected at the period end exchange rate in the consolidated statement of financial position.

C. Assets and liabilities of the subsidiary are translated at each reporting date using the average exchange rate for the period.

D. Goodwill is reflected in the consolidated statement of financial position translated at the exchange rate on the date of acquisition.

E. The statement of profit or loss of the subsidiary is translated for the reporting period using the closing exchange rate.

-

Question 155:

AB, a listed entity, prepared its financial statements to 31 December 20X7, in accordance with international accounting standards.

Which THREE of the following were disclosed as related parties of AB in its financial statements?

A. AB's defined benefit pension plan.

B. The wife of the Managing Director of AB, to whom AB sold a motor vehicle in the year to 31 December 20X7.

C. ST, an entity that was jointly established by AB and CD, and that is accounted for as a joint venture in AB's financial statements to 31 December 20X7.

D. AB's bank that provides more than 60% of the entity's loan finance.

E. AB's main supplier, GH, who supplies more than 70% of AB's goods for manufacture.

-

Question 156:

Which THREE of the following statements are true in relation to financial assets designated as fair value through profit or loss under IAS 39 Financial Instruments: Recognition and Measurement?

A. Shares in another entity held for short term trading purposes fall within this category.

B. Transaction costs in relation to these assets are expensed to profit or loss on acquisition.

C. Transaction costs in relation to these assets are added to the initial cost of the asset on acquisition.

D. The gain or loss on the subsequent measurement of these assets is recorded within other comprehensive income.

E. The gain or loss on the subsequent measurement of these assets is recorded within profit for the year.

F. Once the asset has been subsequently measured to fair value an impairment review is undertaken.

-

Question 157:

Which of the following is NOT an example of an unconsolidated structured entity as defined in IFRS12 Disclosure of Interests in Other Entities?

A. A post-employment benefit plan

B. A securitisation vehicle

C. An asset-backed financing scheme

D. An investment fund

-

Question 158:

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?

A. A covenant on the existing bank loan that restricts the level of dividend that can be paid.

B. A projected decrease in interest cover that would breach a covenant on the existing loan.

C. The revaluation of GG's property that shows an increase in its value since the existing bank loan was taken out.

D. A projected lack of profits to be able to claim tax relief on the additional interest arising from the new loan.

-

Question 159:

On 1 January 20X4 EF grants each of its 125 employees 500 share options on the condition that they remain in employment for 3 years. During the year to 31 December 20X4 10 employees left and It is expected that a further 25 will leave before the end of the vesting period.

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

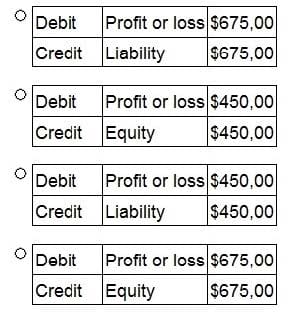

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 160:

As at 31 October 20X7 TU's financial statements show the entity having profit after tax of $600,000 and 900,000 $1 ordinary shares in issue. There have been no issues of shares during the year. At 31 October 20X7 TU have 300,000 share options in issue, which allow the holders to purchase ordinary shares at $2 a share in 3 years' time. The average price of the ordinary shares throughout the year was $5 a share.

What is the diluted earnings per share for the year ended 31 October 20X7?

A. 66.7 cents

B. 58.8 cents

C. 50.0 cents

D. 55.6 cents

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.