Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 141:

On 30 November 20X9 OPQ acquires a financial asset that is classified as Available for Sale.

Which of the following describes the value of the financial asset on the date of acquisition?

A. Fair value excluding transaction costs.

B. Fair value including transaction costs.

C. Present value including transaction costs.

D. Present value excluding transaction costs.

-

Question 142:

Which of the following statements is true in respect of ST's gross profit margin based on the information given?

A. Gross profit margin has increased as a result of management negotiating a premium price for the contract with the new customer.

B. Economies of scale have been achieved from increased revenues resulting in a reduction in the gross profit margin.

C. The associate's gross profit margin is greater than ST's leading to an overall increase in ST's margin.

D. Gross profit margin has reduced due to the increased cost of the new contract.

-

Question 143:

JK is seeking to raise new finance through a rights issue of equity shares. Which THREE of the following statements are correct?

A. The administration costs associated with a rights issue are higher than those for an initial public offering.

B. Shareholders must pay the full market price for shares offered in a rights issue.

C. An alternative name for a rights issue is a scrip issue of shares.

D. A rights issue will dilute an existing shareholder's control of the entity if they do not take up their rights.

E. Entities have the opportunity to underwrite a rights issue.

F. Shareholders' entitlement to rights may be sold on their behalf.

-

Question 144:

Which of the following actions would be most likely to improve an entity's gross profit margin?

A. Negotiating with trade suppliers for a bulk purchase discount

B. Offering increased credit to customers

C. Reducing administrative expenses by 10%

D. Writing down the value of obsolete inventories

-

Question 145:

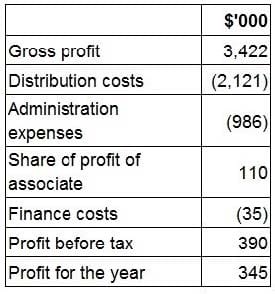

Extracts from its statement of profit or loss for the year ending 31 October 20X7 are as follows:

At 31 October 20X1 RS has in issue 10% debentures 20X8 with a carrying value of $350,000.

What is the interest cover for RS for the ended 31 October 20X7?

A. 9.0 times

B. 11.1 times

C. 10.0 times

D. 8.0 times

-

Question 146:

An entity undertakes an issue of new debt which has the effect of reducing the entity's weighted average cost of capital (WACC). Which of the following would best explain why the WACC will have fallen?

A. The entity was 100% equity financed prior to the issue of the debt.

B. The risk to the shareholders has reduced leading to a fall in the cost of equity.

C. The new debt is being used to replace existing debt that had a lower cost.

D. The new debt is being used to replace existing debt that had the same cost.

-

Question 147:

Which of the following is a related party according to the definition of a related party in IAS24 Related Party Disclosures?

A. Major customer

B. Provider of finance

C. Managing Director

D. Major supplier

-

Question 148:

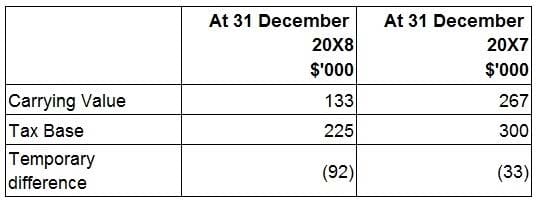

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

A. Increase in the deferred tax asset.

B. Increase in the deferred tax liability.

C. Decrease in the deferred tax asset.

D. Decrease in the deferred tax liability.

-

Question 149:

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

A. ST will benefit from the tax relief on the interest payment.

B. The debentures will be redeemed at a discount to their par value.

C. The debentures will be redeemed at their par value.

D. The market value of the debentures must be higher than their par value.

-

Question 150:

XY has a weighted average cost of capital (WACC) of 10% based on its gearing level (measured as debt/debt+equity) of 40%. It is considering a signficant new project.

In which of the following situations would it be appropriate to appraise this project using XY's existing WACC of 10%?

A. The project is in a different industry to XY's current operations and funded entirely by equity.

B. The project is an extension of XY's current operations and is funded 40% by debt and 60% by equity.

C. The project is an extension of XY's current operations and is funded by equal amounts of debt and equity.

D. The project is in a different industry to XY's current operations and is funded by equal amounts of debt and equity.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.