Exam Details

Exam Code

:CIMAPRA19-F02-1Exam Name

:F2 - Advanced Financial ReportingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:256 Q&AsLast Updated

:Jul 17, 2025

CIMA CIMA Certifications CIMAPRA19-F02-1 Questions & Answers

-

Question 131:

Which of the following statements about ST is true?

A. The return on the investment in associate on an annual basis is 14%.

B. The effective tax rate incurred by ST has remained largely the same.

C. The increase in administrative expenses is in line with the increase in revenues.

D. The ratio of distribution costs to revenue has increased significantly.

-

Question 132:

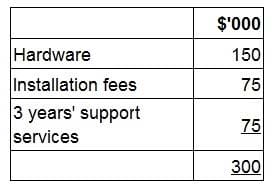

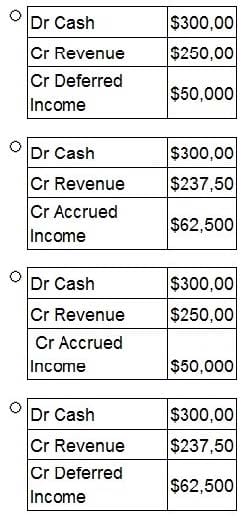

PQ entered into a $300,000 contract on 1 January 20X9 to provide computer hardware to WX with support services for the 3 years from the date of installation. The contract is made up as follows:

The hardware was delivered to WX on 1 January 20X9 and installed immediately. WX paid the full value of the contract on 30 June 20X9. What journal entry records PQ's revenue from this contract for the year ended 31 December 20X9?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 133:

The directors of AB want to reduce the entity's gearing ratio in the year to 31 December 20X9.

Which of the following independent actions could the directors take during 20X9 to achieve this?

A. Recognise the valuation surplus on AB's property, plant and equipment.

B. Issue cumulative preference shares.

C. Issue redeemable preference shares.

D. Switch AB's fixed interest bearing borrowing to a lower variable rate borrowing.

-

Question 134:

XYZ had 600,000 ordinary shares in issue on 1 July 20X4. On 1 January 20X5, the entity made a 1 for 2 bonus issue. The profit attributable to ordinary shareholders for the year ended 30 June 20X5 was $2,925,000. What is the basic earnings per share for the year ended 30 June 20X5?

A. $3.25

B. $4.88

C. $1.63

D. $3.90

-

Question 135:

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?

A. A covenant on the existing bank loan that restricts the level of dividend that can be paid.

B. A projected decrease in interest cover that would breach a covenant on the existing loan.

C. The revaluation of GG's property that shows an increase in its value since the existing bank loan was taken out.

D. A projected lack of profits to be able to claim tax relief on the additional interest arising from the new loan.

-

Question 136:

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

A. Increase in the deferred tax asset.

B. Increase in the deferred tax liability.

C. Decrease in the deferred tax asset.

D. Decrease in the deferred tax liability.

-

Question 137:

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

A. Associate

B. Joint venture

C. Joint arrangement

D. Financial asset

-

Question 138:

Which THREE of the following would typically indicate a finance lease?

A. An asset with a useful life of ten years is being leased for ten years.

B. The lessor is responsible for the annual maintenance of the asset.

C. The lessee has the option to buy the asset at the end of the lease for $1.

D. The lease contract for an asset includes an upgrade to the asset every two years.

E. A leased asset has been specifically modified for the lessee's use.

-

Question 139:

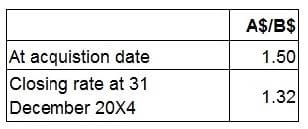

A group presents its financial statements in A$.

The goodwill of its only foreign subsidiary was measured at B$100,000 at acquisition. There have been no impairments to this goodwill.

Exchange rates (where A$/B$ is the number of B$'s to each A$) are as follows:

The value of goodwill to be included in the group's statement of financial position in respect of its foreign subsidiary for the year ended 31 December 20X4 is:

A. A$75,758.

B. A$66,667.

C. A$150,000.

D. A$132,000.

-

Question 140:

AB acquired its one subsidiary, CD, on 1 January 20X1. At this date the fair value of CD's property, plant and equipment was found to be $40 million higher than its carrying value. The relevant items had a remaining estimated useful life of 10 years from the date of acquisition.

At 31 December 20X4 AB and CD presented property, plant and equipment of $100 million and $50 million respectively in their individual financial statements.

The value of property, plant and equipment presented in AB's consolidated statement of financial position at 31 December 20X4 is:

A. $174 million

B. $190 million

C. $150 million

D. $134 million

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRA19-F02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.