Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 161:

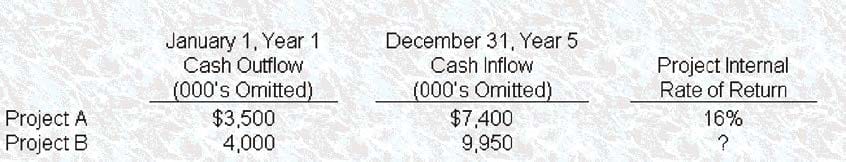

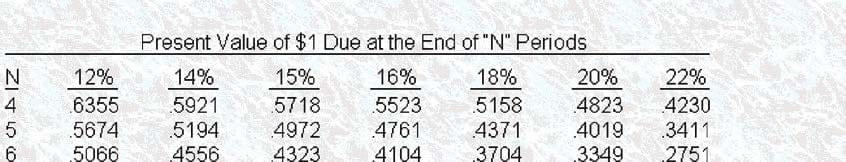

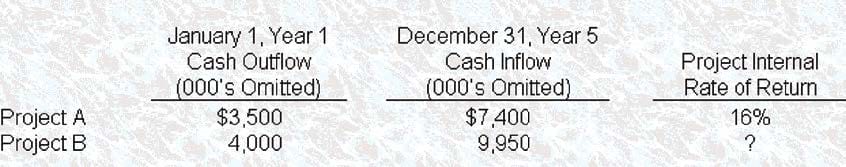

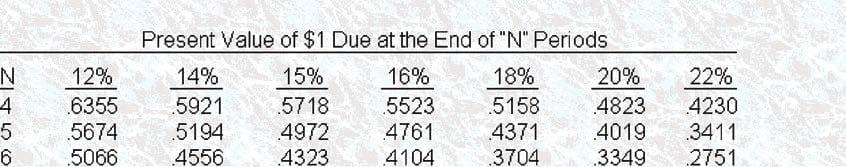

A firm with an 18% desired rate of return is considering the following projects (on January 1, Year 1):

Project B's internal rate of return is closest to

A. 15%

B. 16%

C. 18%

D. 20%

-

Question 162:

A firm with an 18% desired rate of return is considering the following projects (on January 1 1Year 1): Using the net-present-value (NPV) method, Project A's net present value is

A. $316,920

B. $23,140

C. $(265,460)

D. $(316,920)

-

Question 163:

The rankings of mutually exclusive investments determined using the internal rate of return method (IRR) and the net present value method (NPV) may be different when

A. The lives of the multiple projects are equal and the size of the required investments is equal.

B. The required rate of return equals the IRR of each project.

C. The required rate of return is higher than the IRR of each project.

D. Multiple projects have unequal lives and the size of the investment for each project is different.

-

Question 164:

The net present value (NPV) method of investment project analysis assumes that the project's cash flows are reinvested at the

A. Computed internal rate of return.

B. Risk4ree interest rate.

C. Discount rate used in the NPV calculation.

D. Firm's accounting rate of return.

-

Question 165:

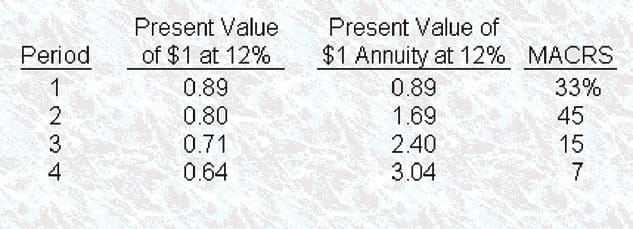

The following data pertain to a 4-year project being considered by Metro Industries:

A depreciable asset that costs $1 .200.000 will be acquired on January 1. The asset, which is expected to

have a $200,000 salvage value at the end of 4 years, qualifies as 3- year property under the Modified

Accelerated Cost Recovery System (MACPS).

The new asset will replace an existing asset that has a tax basis of $150,000 and can be sold on the same

January 1 for $180,000.

The project is expected to provide added annual sales of 30,000 units at $20. Additional cash operating

costs are: variable, $12 per unit fixed, $90,000 per year.

A $50,000 working capital investment that is fully recoverable at the end of the fourth year is required.

Metro is subject to a 40% income tax rate and rounds all computations to the nearest dollar. Assume that

any gain or loss affects the taxes paid at the end of the year in which it occurred. The company uses the

net present value method to analyze investments and will employ the following factors and rates.

4. The overall discounted-cash-flow impact of the working capital investment on Metro's project is

A. $(2,800)

B. $(18,000)

C. $(50,000)

D. $(59,200)

-

Question 166:

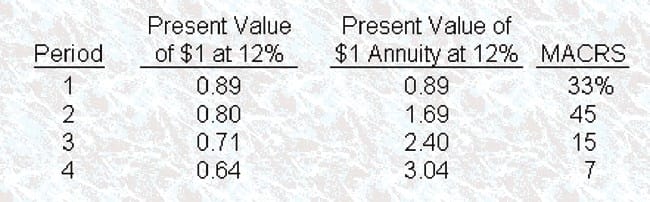

The following data pertain to a 4-year project being considered by Metro Industries:

A depreciable asset that costs $1,200,000 will be acquired on January 1 . The asset, which is expected to

have a $200,000 salvage value at the end of 4 years, qualifies as 3- year property under the Modified

Accelerated Cost Recovery System (MACPS).

The new asset will replace an existing asset that has a tax basis of $150,000 and can be sold on the same

January 1 for $180,000.

The project is expected to provide added annual sales of 30,000 units at $20. Additional cash operating

costs are: variable, $12 per unit fixed, $90,000 per year.

A $50,000 working capital investment that is fully recoverable at the end of the fourth year is required.

Metro is subject to a 40% income tax rate and rounds all computations to the nearest dollar. Assume that

any gain or loss affects the taxes paid at the end of the year in which it occurred. The company uses the

net present value method to analyze investments and will employ the following factors and rates.

The expected incremental sales will provide a discounted, net-of-tax contribution margin over 4 years of

A. $57,600

B. $92,160

C. $273,600

D. $437,760

-

Question 167:

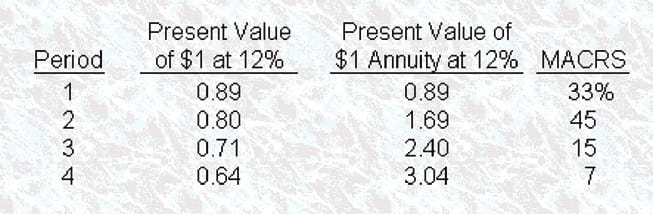

The following data pertain to a 4-year project being considered by Metro Industries:

A depreciable asset that costs $1 .200.000 will be acquired on January 1. The asset, which is expected to

have a $200,000 salvage value at the end of 4 years, qualifies as 3- year property under the Modified

Accelerated Cost Recovery System (MACPS).

The new asset will replace an existing asset that has a tax basis of $150,000 and can be sold on the same

January 1 for $180,000.

The project is expected to provide added annual sales of 30,000 units at $20. Additional cash operating

costs are: variable, $12 per unit fixed, $90,000 per year.

A $50,000 working capital investment that is fully recoverable at the end of the fourth year is required.

Metro is subject to a 40% income tax rate and rounds all computations to the nearest dollar. Assume that

any gain or loss affects the taxes paid at the end of the year in which it occurred. The company uses the

net present value method to analwe investments and will employ the following factors and rates.

The discounted, net-of-tax amount that relates to disposal of the existing asset is

A. $168,000

B. $169,320

C. $180,000

D. $190,680

-

Question 168:

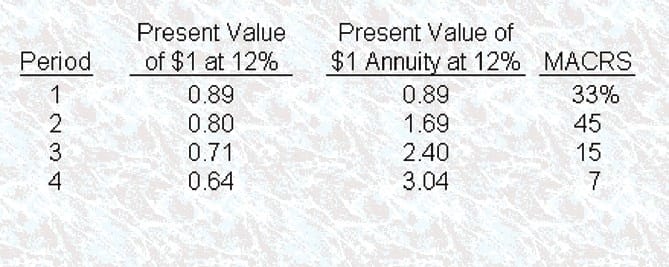

The following data pertain to a 4-year project being considered by Metro Industries: ?A depreciable as set that costs $1, 200,000 will be acquired on January 1 . The asset, which is expected to have a $200,000 salvage value at the end of 4 years, qualifies as 3- year property' under the Modified Accelerated Cost Recovery System (MACPS). The new asset will replace an existing asset that has a tax basis of $150,000 and can be sold on the same January 1 for $180,000. The project is expected to provide added annual sales of 30,000 units at $20. Additional cash operating costs are: variable, $12 per unit fixed, $90,000 per year. A $50,000 working capital investment that is fully recoverable at the end of the fourth year is required. Metro is subject to a 40% income tax rate and rounds all computations to the nearest dollar. Assume that any gain or loss affects the taxes paid at the end of the year in which it occurred. The company uses the net present value method to analyze investments and will employ the following factors and rates.

The discounted cash flow for the fourth year MACPS depreciation on the new asset is

A. $0

B. $17,920

C. $21,504

D. $26,880

-

Question 169:

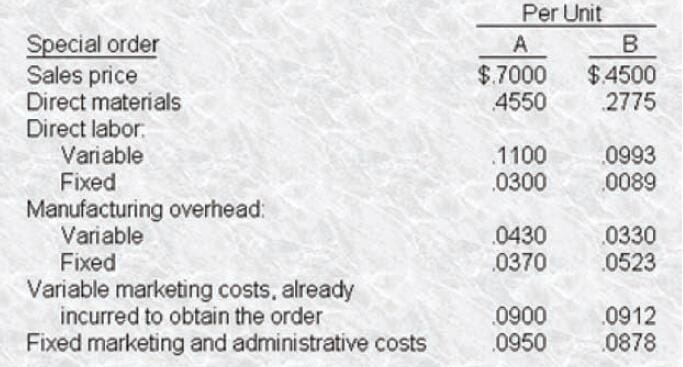

McCann Company can manufacture one of two special orders with their existing capacity. Special Order A

is for 100,000 units and Special Order B is for 200,000 units.

Cost and revenue data per unit are as follows:

Based on the above information, which one of the following statements correctly identifies the effect on pretax profit if the optimal decision is made?

A. $200 increase if Special Order A is taken.

B. $9,200 increase if Special Order A is taken.

C. $13,430 increase if Special Order A is taken.

D. $8,040 increase if Special Order B is taken.

-

Question 170:

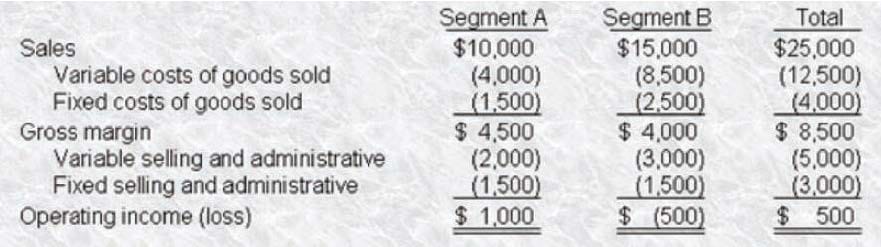

Following are the operating results of the two segments of Parklin Corporation.

Fixed costs of goods sold are allocated to each segment based on the number of employees. Fixed selling and administrative expenses are allocated equally. If Segment B is eliminated, $1 .500 of fixed costs of goods sold would be eliminated. Assuming Segment B is closed, the effect on operating income would be a(n)

A. Increase of $500.

B. Increase of $2,000.

C. Decrease of $2,000.

D. Decrease of $2500.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.