Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 181:

Regis Company manufactures plugs used in its manufacturing cycle at a cost of $36 per unit that includes $8 of fixed overhead. Regis needs 30,000 of these plugs annually, and Orlan Company has offered to sell these units to Regis at $33 per unit. If Regis decides to purchase the plugs, $80,000 of the annual fixed overhead applied will be eliminated, and the company may be able to rent the facility previously used for manufacturing the plugs.If the plugs are purchased and the facility rented, Regis Company wishes to realize $100,000 in savings annually. To achieve this goal, the minimum annual rent on the facility must be

A. $10,000

B. $40,000

C. $70,000

D. $190,000

-

Question 182:

Regis needs 30000 of these plugs annually, and Orlan Company has offered to sell these units to Regis at $33 per unit. If Regis decides to purchase the plugs, $60,000 of the annual fixed overhead applied will be eliminated, and the company may be able to rent the facility previously used for manufacturing the plugs.If Regis Company purchases the plugs but does not rent the unused facility, the company would

A. Save $3.00 per unit.

B. Lose $6.00 per unit.

C. Save $2.00 per unit.

D. Lose $3.00 per unit.

-

Question 183:

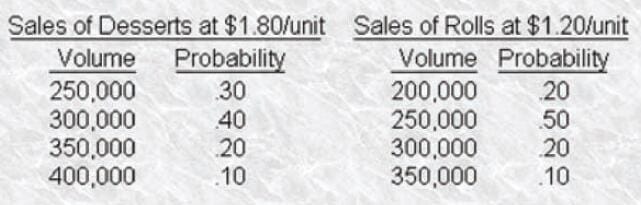

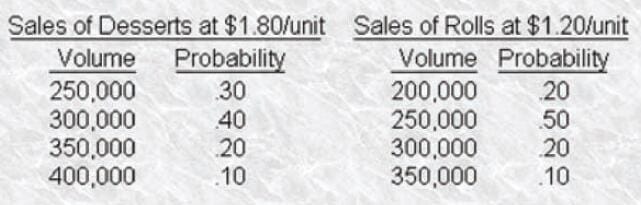

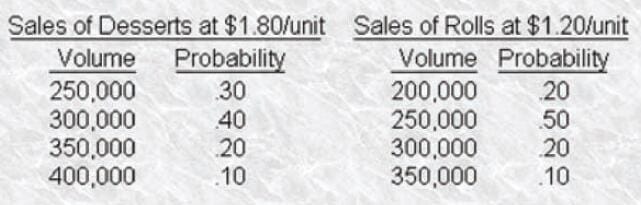

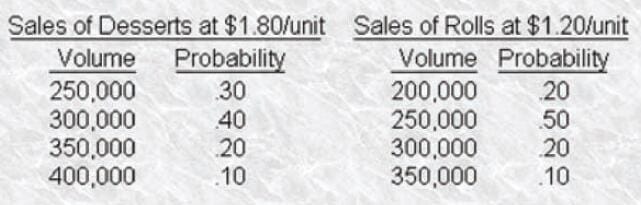

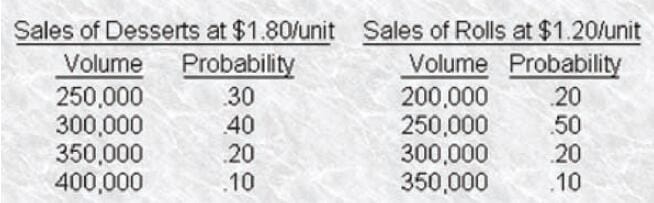

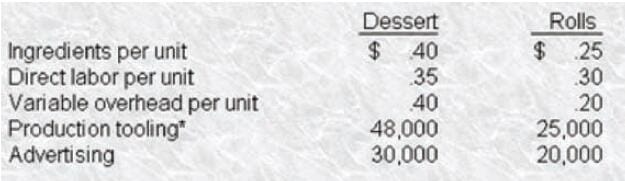

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study, at a cost of $26,000, to determine which product will be more profitable. The results of the study follow.

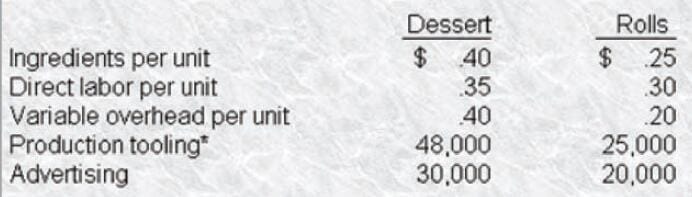

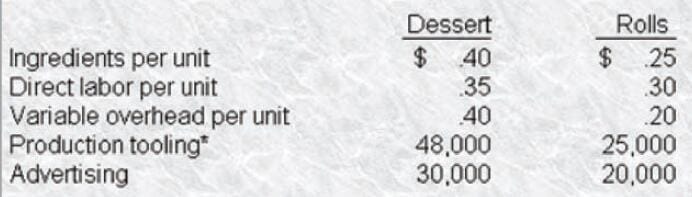

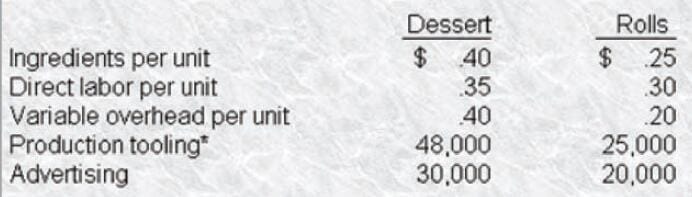

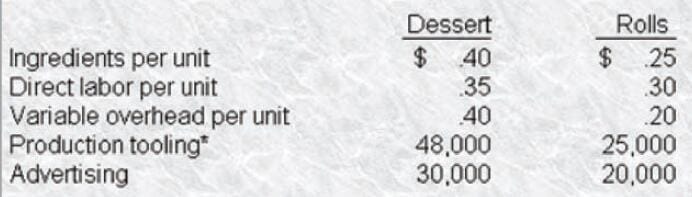

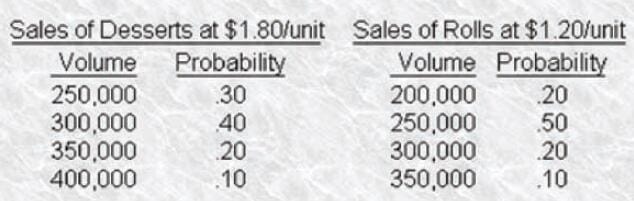

The costs associated with the two products have been estimated by Gleason's cost accounting department and are shown as follows:

Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed asset.Assuming that Gleason elects to produce the frozen dessert, the profit that would have been earned on the breakfast rolls is a(n)

A. Deferrable cost.

B. Sunk cost.

C. Avoidable cost.

D. Opportunity cost.

-

Question 184:

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study, at a cost of $26,000, to determine which product will be more profitable. The results of the study follow.

The costs associated with the two products have been estimated by Gleason's cost accounting department and are shown as follows:

Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed asset.The advertising expense estimated by Gleason for the introduction of the new products is an example of a(n)

A. Conversion cost.

B. Discretionary cost.

C. Committed cost.

D. Opportunity cost.

-

Question 185:

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study, at a cost of $26,000, to determine which product will be more profitable. The results of the study follow.

The costs associated with the two products have been estimated by Gleason's cost accounting department and are shown as follows:

*Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed

asset.

The cost incurred by Gleason for the market study is a(n)

A. Incremental cost.

B. Prime cost.

C. Opportunity cost.

D. Sunk cost.

-

Question 186:

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study, at a cost of $26,000, to determine which product will be more profitable. The results of the study follow.

The costs associated with the two products have been estimated by Gleason's cost accounting department and are shown as follows:

Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed asset.In order to recover the costs of production tooling and advertising for the breakfast rolls, Gleason's sales of the breakfast rolls would have to be

A. 37500 units.

B. 100,000 units.

C. 60,000 units.

D. Some amount other than those given.

-

Question 187:

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study, at a cost of $26,000, to determine which product will be more profitable. The results of the study follow.

*Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed asset. The expected value of Gleason's operating profit directly traceable to the sale of frozen desserts is

A. $198,250

B. $150,250

C. $120,250

D. Some amount other than those given.

-

Question 188:

Gleason Co. has two products, a frozen dessert and ready4o-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study, at a cost of $26000, to determine which product will be more profitable. The results of the study follow.

The costs associated with the two products have been estimated by Gleason's cost accounting department and are shown as follows:

*Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed asset. Applying a deterministic approach, Gleason's revenue from sales of frozen desserts would be

A. $549,000

B. $540,000

C. $216,000

D. Some amount other than those given.

-

Question 189:

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study, at a cost of $26000, to determine which product will be more profitable. The results of the study follow.

The costs associated with the two products have been estimated by Gleason's cost accounting department and are shown as follows:

*Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed asset. According to Gleason's market study, the expected value of the sales volume of the breakfast rolls is

A. 125,000 units.

B. 260,000 units.

C. 275,000 units.

D. Some amount other than those given.

-

Question 190:

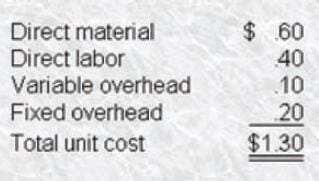

Cohasset Company currently manufactures all component parts used in the manufacture of various hand tools. A handle is used in three different tools. The unit cost budget for 201000 handles is

RandM Steel has offered to supply 20,000 handles to Cohasset for $1.25 each, delivered. If Cohasset

currently has idle capacity that cannot be used, accepting the offer will

A. Decrease the handle unit cost by $05.

B. Increase the handle unit cost by $ .15.

C. Decrease the handle unit cost by $15.

D. Increase the handle unit cost by $.05.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.