Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 151:

Jackson Corporation uses net present value techniques in evaluating its capital investment projects. The company is considering a new equipment acquisition that will cost $100,000, fully installed, and have a zero salvage value at the end of its five-year productive life. Jackson will depreciate the equipment on a straight-line basis for both financial and tax purposes. Jackson estimates $70,000 in annual recurring operating cash income and $20,000 in annual recurring operating cash expenses. Jackson's desired rate of return is 12% and its effective income tax rate is 40%. What is the net present value of this investment on an after-tax basis?

A. $28,840

B. $8,150

C. $36,990

D. $80,250

-

Question 152:

In order to increase production capacity, Gunning Industries is considering replacing an existing production

machine with a new technologically improved machine effective January 1. The following information is

being considered by Gunning Industries:

The new machine would be purchased for $160,000 in cash. Shipping, installation, and testing would cost

an additional $30,000.

The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit.

Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

The investment in the new machine will require an immediate increase in working capital of $35,000. This

cash outflow will be recovered after 5 years.

Gunning uses straight-line depreciation for financial reporting and tax reporting purposes. The new

machine has an estimated useful life of 5 years and zero salvage value.

Gunning is subject to a 40% corporate income tax rate. Gunning uses the net present value method to

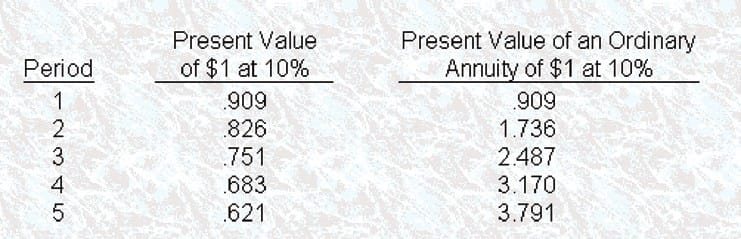

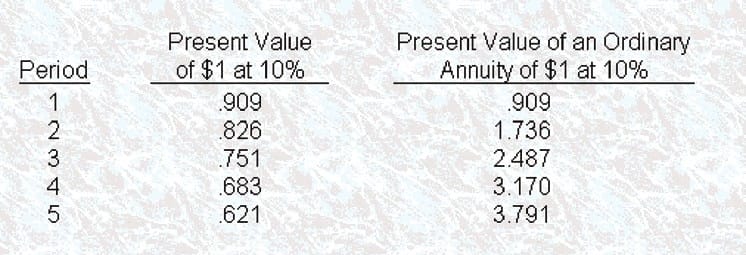

analyze investments and will employ the following factors and rates:

The overall discounted cash flow impact of Gunning Industries' working capital investment for the new production machine would be

A. $(7,959)

B. $(10,080)

C. $(13,265)

D. $(35,000)

-

Question 153:

In order to increase production capacity, Gunning Industries is considering replacing an existing production

machine with a new technologically improved machine effective January 1. The following information is

being considered by Gunning Industries:

The new machine would be purchased for $160,000 in cash. Shipping, installation, and testing would cost

an additional $30,000.

The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit.

Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

The investment in the new machine will require an immediate increase in working capital of $35,000. This

cash outflow will be recovered after 5 years.

Gunning uses straight-line depreciation for financial reporting and tax reporting purposes. The new

machine has an estimated useful life of 5 years and zero salvage value.

Gunning is subject to a 40% corporate income tax rate. Gunning uses the net present value method to

analyze investments and will employ the following factors and rates:

The acquisition of the new production machine by Gunning Industries will contribute a discounted net-oftax contribution margin of

A. $242,624

B. $303,280

C. $363,936

D. $454,920

-

Question 154:

In order to increase production capacity, Gunning Industries is considering replacing an existing production

machine with a new technologically improved machine effective January 1.The following information is

being considered by Gunning Industries:

The new machine would be purchased for $160,000 in cash. Shipping, installation, and testing would cost

an additional $30,000.

The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit.

Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

The investment in the new machine will require an immediate increase in working capital of $35,000. This

cash outflow will be recovered after 5 years.

Gunning uses straight-line depreciation for financial reporting and tax reporting purposes. The new

machine has an estimated useful life of 5 years and zero salvage value.

Gunning is subject to a 40% corporate income tax rate. Gunning uses the net present value method to

analyze investments and will employ the following factors and rates:

Gunning Industries' discounted annual depreciation tax shield for the year of replacement is

A. $13,817

B. $16,762

C. $20,725

D. $22,800

-

Question 155:

In order to increase production capacity, Gunning Industries is considering replacing an existing production

machine with a new technologically improved machine effective January 1. The following information is

being considered by Gunning Industries:

The new machine would be purchased for $160,000 in cash. Shipping, installation, and testing would cost

an additional $30,000.

The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit.

Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

The investment in the new machine will require an immediate increase in working capital of $35,000. This

cash outflow will be recovered after 5 years.

Gunning uses straight-line depreciation for financial reporting and tax reporting purposes. The new

machine has an estimated useful life of 5 years and zero salvage value.

Gunning is subject to a 40% corporate income tax rate. Gunning uses the net present value method to

analyze investments and will employ the following factors and rates:

Gunning Industries' net cash outflow in a capital budgeting decision is

A. $190,000

B. $195,000

C. $204,525

D. $225,000

-

Question 156:

A disadvantage of the net present value method of capital expenditure evaluation is that it

A. Is calculated using sensitively analysis.

B. Computes the true interest rate.

C. Does not provide the true rate of return on investment.

D. Is difficult to apply because it uses a trial-and-error approach.

-

Question 157:

The NPV of a project has been calculated to be $215000. Which one of the following changes in assumptions would decrease the NPV?

A. Decrease the estimated effective income tax rate.

B. Decrease the initial investment amount.

C. Extend the project life and associated cash inflows.

D. Increase the discount rate.

-

Question 158:

The use of an accelerated method instead of the straight-line method of depreciation in computing the net present value of a project has the effect of

A. Raising the hurdle rate necessary to justify the project.

B. Lowering the net present value of the project.

C. Increasing the present value of the depreciation tax shield.

D. Increasing the cash outflows at the initial point of the project.

-

Question 159:

All of the following items are included in discounted cash flow analysis except

A. Future operating cash savings.

B. The current asset disposal price.

C. The future asset depreciation expense.

D. The tax effects of future asset depreciation.

-

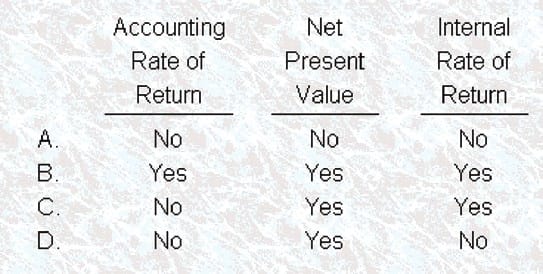

Question 160:

Amstar Corporation has not yet decided on its hurdle rate for use in the evaluation of capital budgeting projects. This lack of information will prohibit Amstar from calculating a project's

A. Option

B. Option

C. Option

D. Option

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.