Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:May 11, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 91:

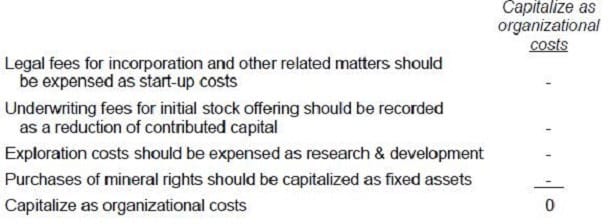

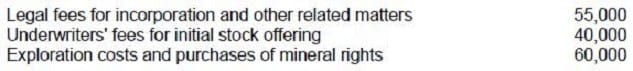

Tanker Oil Co., a development stage enterprise, incurred the following costs during its first year of operations:

Tanker had no revenue during its first year of operation. What amount may Tanker capitalize as organizational costs?

A. $115,000

B. $95,000

C. $55,000

D. $0

-

Question 92:

Which of the following statements regarding fair value is/are correct?

I. The fair value of an asset or liability is specific to the entity making the fair value measurement.

II. Fair value is the price to acquire an asset or assume a liability.

III. Fair value includes transportation costs, but not transaction costs.

IV.

The price in the principal market for an asset or liability will be the fair value measurement.

A.

I and II

B.

I and IV

C.

II and III

D.

III and IV

-

Question 93:

Which of the following qualifies as an operating segment?

A. Corporate headquarters, which oversees $1 billion in sales for the entire company.

B. North American segment, whose assets are 12% of the company's assets of all segments, and management reports to the chief operating officer.

C. South American segment, whose results of operations are reported directly to the chief operating officer, and has 5% of the company's assets, 9% of revenues, and 8% of the profits.

D. Eastern Europe segment, which reports its results directly to the manager of the European division, and has 20% of the company's assets, 12% of revenues, and 11% of profits.

-

Question 94:

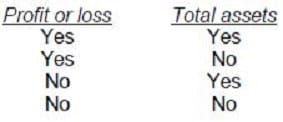

Which of the following should be disclosed for each reportable operating segment of an enterprise?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 95:

Opto Co. is a publicly-traded, consolidated enterprise reporting segment information. Which of the

following items is a required enterprise-wide disclosure regarding external customers?

A. The fact that transactions with a particular external customer constitute more than 10% of the total enterprise revenues.

B. The identity of any external customer providing 10% or more of a particular operating segment's revenue.

C. The identity of any external customer considered to be "major" by management.

D. Information on major customers is not required in segment reporting.

-

Question 96:

In financial reporting of segment data, which of the following items is always used in determining a segment's operating income?

A. Income tax expense.

B. Sales to other segments.

C. General corporate expense.

D. Gain or loss on discontinued operations.

-

Question 97:

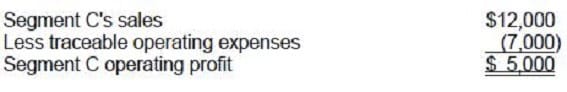

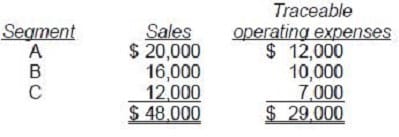

Taft Corp. discloses supplemental industry segment information. The following information is available for 1992: Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200 General corporate expenses 4,800

Segment C's 1992 operating profit was:

A. $5,000

B. $3,200

C. $2,600

D. $2,000

-

Question 98:

What information should a public company present about revenues from its reporting segments?

A. Disclose separately the amount of sales to unaffiliated customers and the amount of intracompany sales.

B. Disclose as a combined amount sales to unaffiliated customers and intracompany sales between geographic areas.

C. Disclose separately the amount of sales to unaffiliated customers but not the amount of intracompany sales between geographic areas.

D. No disclosure of revenues from foreign operations need be reported.

-

Question 99:

APB Opinion No. 28, Interim Financial Reporting, concluded that interim financial reporting should be viewed primarily in which of the following ways?

A. As useful only if activity is spread evenly throughout the year.

B. As if the interim period were an annual accounting period.

C. As reporting for an integral part of an annual period.

D. As reporting under a comprehensive basis of accounting other than GAAP.

-

Question 100:

During the first quarter of 1993, Tech Co. had income before taxes of $200,000, and its effective income tax rate was 15%. Tech's 1992 effective annual income tax rate was 30%, but Tech expects its 1993 effective annual income tax rate to be 25%. In its first quarter interim income statement, what amount of income tax expense should Tech report?

A. $0

B. $30,000

C. $50,000

D. $60,000

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFM

Certified Government Financial ManagerCGFNS

Commission on Graduates of Foreign Nursing Schools

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.