Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 1211:

An auditor issued an audit report that was dual dated for a subsequent event occurring after the original date of the auditor's report but before issuance of the related financial statements. The auditor's responsibility for events occurring subsequent to the original report date was:

A. Limited to include only events occurring up to the date of the last subsequent event referenced.

B. Limited to the specific event referenced.

C. Extended to subsequent events occurring through the later date.

D. Extended to include all events occurring since the original report date.

-

Question 1212:

March, CPA, is engaged by ABC Corp., a client, to audit the financial statements of XYZ Corp., a company that is not March's client. ABC expects to present XYZ's audited financial statements with March's auditor's report to 1st Federal Bank to obtain financing in ABC's attempt to purchase XYZ. In these circumstances, March's auditor's report would usually be addressed to:

A. ABC Corp., the client that engaged March.

B. XYZ Corp., the entity audited by March.

C. 1st Federal Bank.

D. Both ABC Corp. and 1st Federal Bank.

-

Question 1213:

Mead, CPA, had substantial doubt about ABC Co.'s ability to continue as a going concern when reporting on ABC's audited financial statements for the year ended June 30, 19X4. That doubt has been removed in 19X5. What is Mead's reporting responsibility if ABC is presenting its financial statements for the year ended June 30, 19X5, on a comparative basis with those of 19X4?

A. The explanatory paragraph included in the 19X4 auditor's report should not be repeated.

B. The explanatory paragraph included in the 19X4 auditor's report should be repeated in its entirety.

C. A different explanatory paragraph describing Mead's reasons for the removal of doubt should be included.

D. A different explanatory paragraph describing Tech's plans for financial recovery should be included.

-

Question 1214:

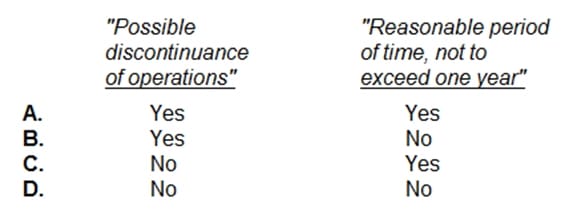

Kane, CPA, concludes that there is substantial doubt about ABC Co.'s ability to continue as a going concern for a reasonable period of time. If ABC's financial statements adequately disclose its financial difficulties, Kane's auditor's report is required to include an explanatory paragraph that specifically uses the phrase(s):

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 1215:

Management of ABC Industries plans to disclose an uncertainty as follows: The Company is a defendant in a lawsuit alleging infringement of certain patent rights and claiming damages. Discovery proceedings are in progress. The ultimate outcome of the litigation cannot presently be determined. Accordingly, no provision for any liability that may result upon adjudication has been made in the accompanying financial statements.

The auditor is satisfied that sufficient audit evidence supports management's assertions about the nature and disclosure of the uncertainty. What type of opinion should the auditor express under these circumstances?

A. Unqualified without an explanatory paragraph.

B. "Subject to" qualified.

C. "Except for" qualified.

D. Disclaimer of opinion.

-

Question 1216:

In which of the following circumstances would an auditor not express an unqualified opinion?

A. There has been a material change between periods in accounting principles.

B. Quarterly financial data required by the SEC has been omitted.

C. The auditor wishes to emphasize an unusually important subsequent event.

D. The auditor is unable to obtain audited financial statements of a consolidated investee.

-

Question 1217:

ABC Co. uses the FIFO method of costing for its international subsidiary's inventory and LIFO for its domestic inventory. Under these circumstances, the auditor's report on ABC's financial statements should express an:

A. Unqualified opinion.

B. Opinion qualified because of a lack of consistency.

C. Opinion qualified because of a departure from GAAP.

D. Adverse opinion.

-

Question 1218:

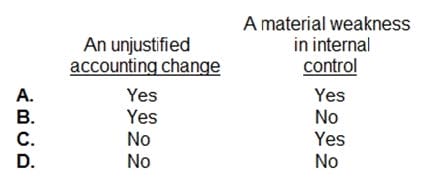

An auditor would express an unqualified opinion with an explanatory paragraph added to the auditor's report for:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 1219:

An auditor most likely would express an unqualified opinion and would not add explanatory language to the report if the auditor:

A. Wishes to emphasize that the entity had significant transactions with related parties.

B. Concurs with the entity's change in its method of computing depreciation.

C. Discovers that supplementary information required by FASB has been omitted.

D. Believes that there is a probable likelihood of a material loss resulting from an uncertainty that is sufficiently supported and disclosed.

-

Question 1220:

An auditor may not issue a qualified opinion when:

A. An accounting principle at variance with GAAP is used.

B. The auditor lacks independence with respect to the audited entity.

C. A scope limitation prevents the auditor from completing an important audit procedure.

D. The auditor's report refers to the work of a specialist.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.