Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 1201:

Which paragraphs of an auditor's standard report on financial statements should refer to generally accepted auditing standards (GAAS) and generally accepted accounting principles (GAAP)?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 1202:

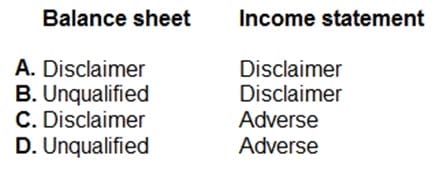

Park, CPA, was engaged to audit the financial statements of ABC Co., a new client, for the year ended December 31, 20X3. Park obtained sufficient audit evidence for all of ABC's financial statement items except ABC's opening inventory. Due to inadequate financial records, Park could not verify ABC's January 1, 20X3, inventory balances. Park's opinion on ABC's 20X3 financial statements most likely will be:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 1203:

When single-year financial statements are presented, an auditor ordinarily would express an unqualified opinion in an unmodified report if the:

A. Auditor is unable to obtain audited financial statements supporting the entity's investment in a foreign affiliate.

B. Entity declines to present a statement of cash flows with its balance sheet and related statements of income and retained earnings.

C. Auditor wishes to emphasize an accounting matter affecting the comparability of the financial statements with those of the prior year.

D. Prior year's financial statements were audited by another CPA whose report, which expressed an unqualified opinion, is not presented.

-

Question 1204:

When there has been a change in accounting principles, but the effect of the change on the comparability of the financial statements is not material, the auditor should:

A. Refer to the change in an explanatory paragraph.

B. Explicitly concur that the change is preferred.

C. Not refer to consistency in the auditor's report.

D. Refer to the change in the opinion paragraph.

-

Question 1205:

An auditor includes a separate paragraph in an otherwise unmodified report to emphasize that the entity being reported on had significant transactions with related parties. The inclusion of this separate paragraph:

A. Is considered an "except for" qualification of the opinion.

B. Violates generally accepted auditing standards if this information is already disclosed in footnotes to the financial statements.

C. Necessitates a revision of the opinion paragraph to include the phrase "with the foregoing Explanation: ."

D. Is appropriate and would not negate the unqualified opinion.

-

Question 1206:

Reference in a principal auditor's report to the fact that part of the audit was performed by another auditor

most likely would be an indication of the:

A. Divided responsibility between the auditors who conducted the audits of the components of the overall financial statements.

B. Lack of materiality of the portion of the financial statements audited by the other auditor.

C. Principal auditor's recognition of the other auditor's competence, reputation, and professional certification.

D. Different opinions the auditors are expressing on the components of the financial statements that each audited.

-

Question 1207:

When an auditor concludes there is substantial doubt about a continuing audit client's ability to continue as a going concern for a reasonable period of time, the auditor's responsibility is to:

A. Issue a qualified or adverse opinion, depending upon materiality, due to the possible effects on the financial statements.

B. Consider the adequacy of disclosure about the client's possible inability to continue as a going concern.

C. Report to the client's audit committee that management's accounting estimates may need to be adjusted.

D. Reissue the prior year's auditor's report and add an explanatory paragraph that specifically refers to "substantial doubt" and "going concern."

-

Question 1208:

When an independent CPA assists in preparing the financial statements of a publicly held entity, but has not audited or reviewed them, the CPA should issue a disclaimer of opinion. In such situations, the CPA has no responsibility to apply any procedures beyond:

A. Documenting that internal control is not being relied on.

B. Reading the financial statements for obvious material misstatements.

C. Ascertaining whether the financial statements are in conformity with GAAP.

D. Determining whether management has elected to omit substantially all required disclosures.

-

Question 1209:

Which of the following auditing procedures most likely would assist an auditor in identifying conditions and events that may indicate substantial doubt about an entity's ability to continue as a going concern?

A. Inspecting title documents to verify whether any assets are pledged as collateral.

B. Confirming with third parties the details of arrangements to maintain financial support.

C. Reconciling the cash balance per books with the cut-off bank statement and the bank confirmation.

D. Comparing the entity's depreciation and asset capitalization policies to other entities in the industry.

-

Question 1210:

When an independent CPA is associated with the financial statements of a publicly held entity but has not audited or reviewed such statements, the appropriate form of report to be issued must include a(an):

A. Regulation S-X exemption.

B. Report on pro forma financial statements.

C. Unaudited association report.

D. Disclaimer of opinion.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.