Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 1181:

If information accompanying the basic financial statements in an auditor-submitted document has been subjected to auditing procedures, the auditor may include in the auditor's report on the financial statements an opinion that the accompanying information is fairly stated in:

A. Accordance with generally accepted auditing standards.

B. Conformity with generally accepted accounting principles.

C. All material respects in relation to the basic financial statements taken as a whole.

D. Accordance with attestation standards expressing a conclusion about management's assertions.

-

Question 1182:

An auditor is engaged to report on selected financial data that are included in a client-prepared document containing audited financial statements. Under these circumstances, the report on the selected data should:

A. Be limited to data derived from the audited financial statements.

B. Be distributed only to senior management and the board of directors.

C. State that the presentation is a comprehensive basis of accounting other than GAAP.

D. Indicate that the data are not fairly stated in all material respects.

-

Question 1183:

An auditor may report on condensed financial statements that are derived from complete financial statements if the:

A. Condensed financial statements are distributed to stockholders along with the complete financial statements.

B. Auditor describes the additional procedures performed on the condensed financial statements.

C. Auditor indicates whether the information in the condensed financial statements is fairly stated in all material respects in relation to the complete financial statements from which it has been derived.

D. Condensed financial statements are presented in comparative form with the prior year's condensed financial statements.

-

Question 1184:

When an auditor submits a document containing audited financial statements to a client, and those financial statements include supplementary information required by GAAP, the auditor may choose any of the following options, except:

A. Express an opinion on the information, if he or she has been engaged to examine such information.

B. Express negative assurance on the information, if review procedures have been appropriately performed.

C. Report on whether the information is fairly stated in relation to the financial statements taken as a whole, if appropriate auditing procedures have been applied.

D. Disclaim an opinion on the information.

-

Question 1185:

Which of the following reporting options is least likely with regard to supplementary information that is required by GAAP?

A. The auditor's report on the financial statements makes no reference to the supplementary information.

B. A disclaimer of opinion is issued on supplementary information that is not clearly distinguished from the financial statements and is not marked "unaudited."

C. The auditor's report on the financial statements includes both an opinion on the supplementary information and a statement restricting the use of the report.

D. The auditor's report on the financial statements includes an opinion regarding whether the supplementary information is fairly stated in all material respects in relation to the financial statements taken as a whole.

-

Question 1186:

Which of the following is true regarding the auditor's responsibility to report on information accompanying the basic financial statements in a client-prepared document?

A. The auditor may report on information accompanying the basic financial statements in a clientprepared document only if he or she has been specifically engaged to do so.

B. The auditor is required to express an opinion on whether information accompanying the basic financial statements in a client-prepared document is fairly stated in all material respects in relation to the financial statements taken as a whole.

C. If an auditor chooses to report on information accompanying the basic financial statements in a clientprepared document, the report should include a description of the character of the audit work performed.

D. If an auditor chooses to report on information accompanying the basic financial statements in a clientprepared document, the report should include an opinion on the information but should not describe the character of the audit work performed.

-

Question 1187:

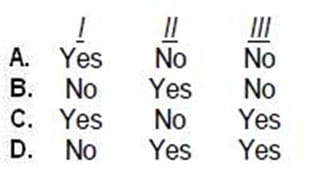

The financial statements of ABC company, a U.S. entity, are prepared for inclusion in the consolidated financial statements of its non-U.S. parent. These financial statements are prepared in conformity with the accounting principles generally accepted in the parent's country and are for use only in that country. How may ABC company's auditor report on these financial statements?

I. A U.S.-style report (unmodified).

II. A U.S.-style report modified to report on the accounting principles of the parent's country.

III.

The report form of the parent's country.

A.

Option A

B.

Option B

C.

Option C

D.

Option D

-

Question 1188:

Blue, CPA, has been asked to render an opinion on the application of accounting principles to a specific transaction by an entity that is audited by another CPA. Blue may accept this engagement, but should:

A. Consult with the continuing CPA to obtain information relevant to the transaction.

B. Report the engagement's findings to the entity's audit committee, the continuing CPA, and management.

C. Disclaim any opinion that the hypothetical application of accounting principles conforms with generally accepted accounting principles.

D. Notify the entity that the report is for the general use of all interested parties.

-

Question 1189:

In connection with a proposal to obtain a new client, an accountant in public practice is asked to prepare a written report on the application of accounting principles to a specific transaction. The accountant's report should include a statement that:

A. Any difference in the facts, circumstances, or assumptions presented may change the report.

B. The engagement was performed in accordance with Statements on Standards for Consulting Services.

C. The guidance provided is for management use only and may not be communicated to the prior or continuing auditors.

D. Nothing came to the accountant's attention that caused the accountant to believe that the accounting principles violated GAAP.

-

Question 1190:

Before reporting on the financial statements of a U.S. entity that have been prepared in conformity with another country's accounting principles, an auditor practicing in the U.S. should:

A. Understand the accounting principles generally accepted in the other country.

B. Be certified by the appropriate auditing or accountancy board of the other country.

C. Notify management that the auditor is required to disclaim an opinion on the financial statements.

D. Receive a waiver from the auditor's state board of accountancy to perform the engagement.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.