Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Aug 05, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 41:

Clauson Inc. grants credit terms of 1/15, net 30 and projects gross sales for next year of $2,000,000. The credit manager estimates that 40 percent of their customers pay on the discount date, 40 percent on the net due date, and 20 percent pay 15 days after the net due date. Assuming uniform sales and a 360-day year, what is the projected days sales outstanding (rounded to the nearest whole day)?

A. 20 days.

B. 24 days.

C. 27 days.

D. 30 days.

-

Question 42:

Which of the following represents a firm's average gross receivable balance?

I. Days' sales in receivables x accounts receivable turnover.

II. Average daily sales x average collection period.

III.

Net sales ÷ average gross receivables.

A.

I only.

B.

I and II only.

C.

II only.

D.

II and III only.

-

Question 43:

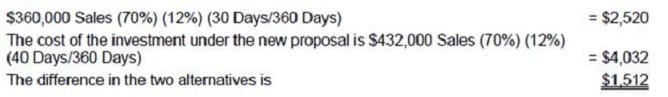

Gartshore Inc. is a mail-order book company. The Company recently changed its credit policy in an attempt to increase sales. Gartshore's variable cost ratio is 70 percent and its required rate of return is 12 percent. The company projects that annual sales will increase from the current level of $360,000 to $432,000, but the average collection period on receivables will go from 30 days to 40 days. Ignoring any tax implications, what is the cost of carrying the additional investment in accounts receivable, using a 360day year?

A. $1,512

B. $2,000

C. $2,160

D. $12,600

-

Question 44:

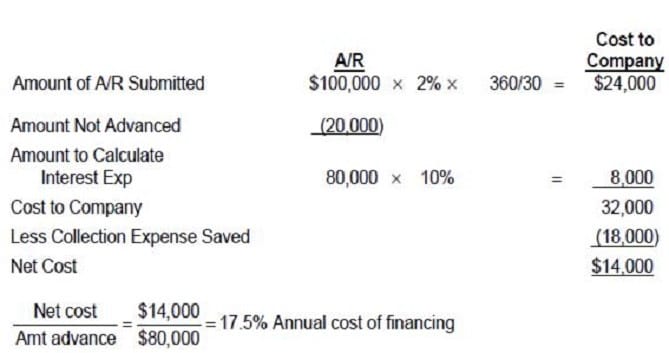

A company enters into an agreement with a firm who will factor the company's accounts receivable. The

factor agrees to buy the company's receivables, which average $100,000 per month and have an average collection period of 30 days. The factor will advance up to 80 percent of the face value of receivables at an annual rate of 10 percent and charge a fee of 2 percent on all receivables purchased. The controller of the company estimates that the company would save $18,000 in collection expenses over the year. Fees and interest are not deducted in advance. Assuming a 360-day year, what is the annual cost of financing?

A. 12.0 percent.

B. 14.0 percent.

C. 16.0 percent.

D. 17.5 percent.

-

Question 45:

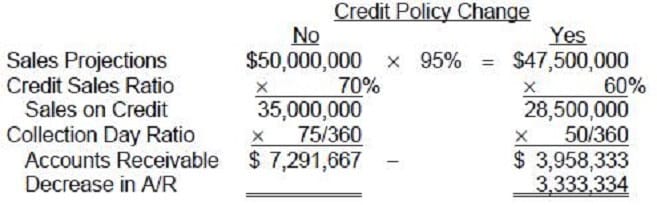

A company plans to tighten its credit policy. The new policy will decrease the average number of days in

collection from 75 to 50 days and will reduce the ratio of credit sales to total revenue from 70 to 60 percent.

The company estimates that projected sales would be five percent less if the proposed new credit policy is

implemented. If projected sales for the coming year are $50 million, calculate the dollar impact on accounts

receivable of this proposed change in credit policy.

Assume a 360-day year.

A. $3,817,445 decrease.

B. $6,500,000 decrease.

C. $3,333,334 decrease.

D. $18,749,778 increase.

-

Question 46:

A firm averages $4,000 in sales per day and is paid, on an average, within 30 days of the sale. After they receive their invoice, 55 percent of the customers pay by check, while the remaining 45 percent pay by credit card. Approximately how much would the company show in accounts receivable on its balance sheet on any given date?

A. $120,000

B. $48,000

C. $54,000

D. $21,600

-

Question 47:

When purchasing temporary investments, which one of the following best describes the risk associated with the ability to sell the investment in a short period of time without significant price concessions?

A. Interest rate risk.

B. Purchasing power risk.

C. Financial risk.

D. Liquidity risk.

-

Question 48:

The marketable securities with the least amount of default risk are:

A. Federal government agency securities.

B. U.S. treasury securities.

C. Repurchase agreements.

D. Bankers' acceptances.

-

Question 49:

All of the following are valid reasons for a business to hold cash and marketable securities, except to:

A. Satisfy compensating balance requirements.

B. Maintain adequate cash needed for transactions.

C. Maintain a precautionary balance.

D. Earn maximum returns on investment assets.

-

Question 50:

Corbin Inc. can issue three-month commercial paper with a face value of $1,000,000 for $980,000. Transaction costs would be $1,200. The effective annualized percentage cost of the financing, based on a 360-day year, would be:

A. 2.16%

B. 8.48%

C. 8.65%

D. 8.00%

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFNS

Commission on Graduates of Foreign Nursing SchoolsCLEP-BUSINESS

CLEP Business: Financial Accounting, Business Law, Information Systems & Computer Applications, Management, Marketing

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.