Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Aug 05, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 11:

Limitations of the information provided by total asset turnover include:

A. A good measure for trend analysis of a particular company, but variable ways of calculating cost of goods sold limit its usefulness for comparative analysis.

B. The calculation can be affected by varying accounting assumptions, which affect the calculation of net income.

C. Because of differing costs of capital, the measure cannot be effectively used for comparative analysis.

D. When making the calculation, total assets may need to be refined by the elimination of assets that do not relate to sales as the inclusion of these items could distort the measure.

-

Question 12:

Return on assets:

A. Is a measure of profitability and indicates how much is left of each sales dollar to cover operating expenses and profit.

B. Is a profitability measure and can be used to evaluate the efficiency of asset usage and management,

and the effectiveness of business strategies to create profits.

C. Measures the amount of operating income earned above the imputed cost of capital for the operating unit. If the measure is positive, returns exceed the cost of financing the operating unit.

D. Measures asset activity and the ability of the firm to generate sales through the use of assets. Generally, the more sales dollars generated per dollar of assets used, the better the net income of an entity.

-

Question 13:

In planning and controlling capital expenditures, the most logical sequence is to begin with:

A. Analyzing capital addition proposals.

B. Analyzing and evaluating all promising alternatives.

C. Identifying capital addition projects and other capital needs.

D. Developing capital budgets.

-

Question 14:

A company has total costs of $100,000, of which 40% is variable costs. What is the operating leverage?

A. .40

B. .60

C. 1.5

D. 2.5

-

Question 15:

The Frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified four alternative sources of funds, which are given below.

A. Pay a factor to buy the company's receivables, which average $125,000 per month and have an average collection period of 30 days. The factor will advance up to 80 percent of the face value of receivables at 10 percent and charge a fee of 2 percent of all receivables purchased. The controller estimates that the firm would save $24,000 in collection expenses over the year. Assume the fee and interest are not deductible in advance.

B. Borrow $110,000 from a bank at 12 percent interest. A 9 percent compensating balance would be required.

C. Issue $110,000 of six-month commercial paper to net $100,000. (New paper would be issued every 6 months.)

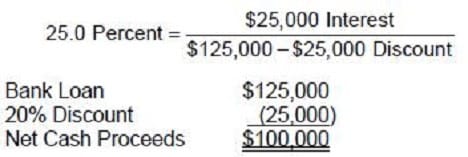

D. Borrow $125,000 from a bank on a discount basis at 20 percent. No compensating balance would be required. Assume a 360-day year in all of your calculations.

The cost of Alternative D is:

A. 10.0 percent.

B. 20.0 percent.

C. 25.0 percent.

D. 40.0 percent.

-

Question 16:

The Frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified four alternative sources of funds, which are given below.

A. Pay a factor to buy the company's receivables, which average $125,000 per month and have an average collection period of 30 days. The factor will advance up to 80 percent of the face value of receivables at 10 percent and charge a fee of 2 percent of all receivables purchased. The controller estimates that the firm would save $24,000 in collection expenses over the year. Assume the fee and interest are not deductible in advance.

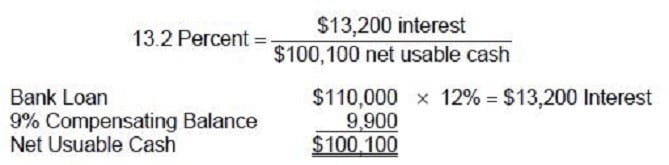

B. Borrow $110,000 from a bank at 12 percent interest. A 9 percent compensating balance would be required.

C. Issue $110,000 of six-month commercial paper to net $100,000. (New paper would be issued every 6 months.)

D. Borrow $125,000 from a bank on a discount basis at 20 percent. No compensating balance would be required. Assume a 360-day year in all of your calculations.

The cost of Alternative B is: A. 10.5 percent.

B. 12.0 percent.

C. 13.2 percent.

D. 21.0 percent.

-

Question 17:

CyberAge outlet, a relatively new store, is a cafe that offers customers the opportunity to browse the Internet or play computer games at their tables while they drink coffee. The customer pays a fee based on the amount of time spent signed on to the computer. The store also sells books, tee shirts, and computer accessories. CyberAge has been paying all of its bills on the last day of the payment period, thus forfeiting all supplier discounts. Shown below are data on CyberAge's two major vendors, including average monthly purchases and credit terms.

Should CyberAge use trade credit and continue paying at the end of the credit period?

A. No, if the cost of alternative short-term financing is more.

B. Yes, if the firm's weighted average cost of capital is equal to its weighted average trade credit.

C. No, if the cost of alternative long-term financing is more.

D. Yes, if the cost of alternative short-term financing is more.

-

Question 18:

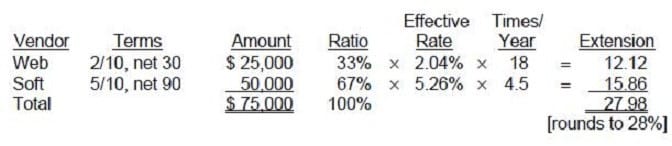

CyberAge outlet, a relatively new store, is a cafe that offers customers the opportunity to browse the Internet or play computer games at their tables while they drink coffee. The customer pays a fee based on the amount of time spent signed on to the computer. The store also sells books, tee shirts, and computer accessories. CyberAge has been paying all of its bills on the last day of the payment period, thus forfeiting all supplier discounts. Shown below are data on CyberAge's two major vendors, including average monthly purchases and credit terms.

Assuming a 360-day year and that CyberAge continues paying on the last day of the credit period, the company's weighted annual interest rate for trade credit (ignoring the effects of compounding) for these two vendors is:

A. 27.0 percent.

B. 28.0 percent.

C. 29.3 percent.

D. 30.2 percent.

-

Question 19:

Which one of the following statements about trade credit is correct? Trade credit is:

A. Not an important source of financing for small firms.

B. A source of long-term financing to the seller.

C. Subject to risk of buyer default.

D. Usually an inexpensive source of external financing.

-

Question 20:

Which one of the following provides a spontaneous source of financing for a firm?

A. Accounts payable.

B. Accounts receivable.

C. Debentures.

D. Preferred stock.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFNS

Commission on Graduates of Foreign Nursing SchoolsCLEP-BUSINESS

CLEP Business: Financial Accounting, Business Law, Information Systems & Computer Applications, Management, Marketing

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.