Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Aug 05, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 31:

The level of safety stock in inventory management depends on all of the following, except the:

A. Level of uncertainty of the sales forecast.

B. Level of customer dissatisfaction for back orders.

C. Level of uncertainty in lead-time for stock shipments.

D. Cost to reorder stock.

-

Question 32:

The amount of inventory that a company would tend to hold in safety stock would increase as the:

A. Cost of carrying inventory decreases.

B. Variability of sales decreases.

C. Costs of running out of stock decreases.

D. Length of time that goods are in transit decreases.

-

Question 33:

The sales manager at Ryan Company feels confident that if the credit policy at Ryan's was changed, sales would increase and, consequently, the company would utilize excess capacity. The two credit proposals being considered are as follows:

Currently, payment terms are net 30. The proposal payment terms for Proposal A and Proposal B are net 45 and net 90, respectively. An analysis to compare these two proposals for the change in credit policy would include all of the following factors, except the:

A. Cost of funds for Ryan.

B. Current bad debt experience.

C. Impact on the current customer base of extending terms to only certain customers.

D. Bank loan covenants on days sales outstanding.

-

Question 34:

Which one of the following statements is most correct if a seller extends credit to a purchaser for a period of time longer than the purchaser's operating cycle? The seller:

A. Will have a lower level of accounts receivable than those companies whose credit period is shorter than the purchaser's operating cycle.

B. Is, in effect, financing more than just the purchaser's inventory needs.

C. Is, in effect, financing the purchaser's long-term assets.

D. Has no need for a stated discount rate or credit period.

-

Question 35:

A change in credit policy has caused an increase in sales, an increase in discounts taken, a decrease in the amount of bad debts, and a decrease in the investment in accounts receivable. Based upon this information, the company's:

A. Average collection period has decreased.

B. Percentage discount offered has decreased.

C. Accounts receivable turnover has decreased.

D. Working capital has increased.

-

Question 36:

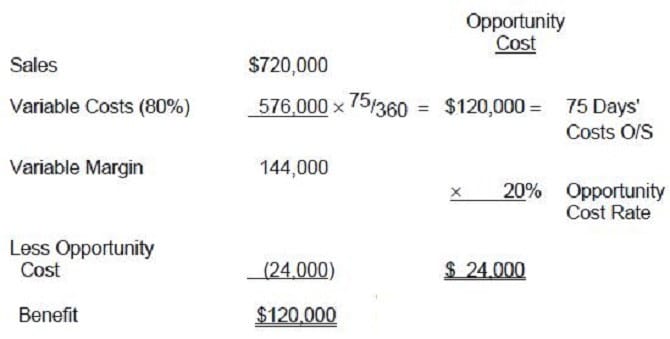

A company with $4.8 million in credit sales per year plans to relax its credit standards, projecting that this will increase credit sales by $720,000. The company's average collection period for new customers is expected to be 75 days; and the payment behavior of the existing customers is not expected to change. Variable costs are 80 percent of sales. The firm's opportunity cost is 20 percent before taxes. Assuming a 360-day year, what is the company's benefit (loss) on the planned change in credit terms?

A. $28,800

B. $144,000

C. $120,000

D. $126,000

-

Question 37:

The average collection period for a firm measures the number of days:

A. After a typical credit sale is made until the firm receives the payment.

B. It takes a typical check to "clear" through the banking system.

C. Before a typical account becomes delinquent.

D. In the inventory cycle.

-

Question 38:

An organization would usually offer credit terms of 2/10, net 30 when:

A. The organization can borrow funds at a rate less than the annual interest cost.

B. The cost of capital approaches the prime rate.

C. Most competitors are not offering discounts, and the organization has a surplus of cash.

D. Most competitors are offering the same terms, and the organization has a shortage of cash.

-

Question 39:

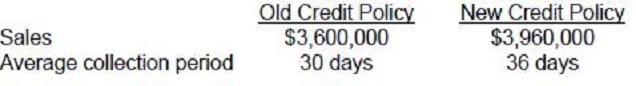

The following information regarding a change in credit policy was assembled by the Wilson Wax Company. The company has a required rate of return of 10 percent and a variable cost ratio of 60 percent.

The pretax cost of carrying the additional investment in receivables, using a 360-day year, would be:

A. $5,760

B. $9,600

C. $8,160

D. $960

-

Question 40:

A change in credit policy has caused an increase in sales, an increase in discounts taken, a reduction in the investment in accounts receivable, and a reduction in the number of doubtful accounts. Based upon this information, we know that:

A. Net profit has increased.

B. The average collection period has decreased.

C. Gross profit has declined.

D. The size of the discount offered has decreased.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFNS

Commission on Graduates of Foreign Nursing SchoolsCLEP-BUSINESS

CLEP Business: Financial Accounting, Business Law, Information Systems & Computer Applications, Management, Marketing

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.