Exam Details

Exam Code

:BUSINESS-ENVIRONMENT-AND-CONCEPTSExam Name

:Certified Public Accountant (Business Environment amd Concepts)Certification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:530 Q&AsLast Updated

:Jul 11, 2025

Test Prep Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Questions & Answers

-

Question 511:

Rivers and Lee want to form a partnership. For the partnership agreement to be enforceable, it must be in writing if:

A. Rivers and Lee reside in different states.

B. The agreement cannot be completed within one year from the date on which it will be entered into.

C. Either Rivers or Lee is to contribute more than $500 in capital.

D. The partnership intends to buy and sell real estate.

-

Question 512:

Heather, Erika, and Shelby are members in HES LLC. Heather works 40 hours per week and Erika and Shelby work 20 hours per week. Heather contributed $30,000 to the LLC and Erika and Shelby contributed $60,000 each. Erika and Shelby have each originated 45% of the LLC's business and Heather has originated the other 10%. If HES were a general partnership, who controls management?

A. Heather, because she works the most.

B. Erika and Shelby equally because they contributed the most.

C. Heather, Erika, and Shelby equally because of state law.

D. Erika and Shelby, because they originate most of the work.

-

Question 513:

Eller, Fort, and Owens do business as Venture Associates, a general partnership. Trent Corp. brought a

breach of contract suit against Venture and Eller individually. Trent won the suit and filed a judgment

against both Venture and Eller.

Trent will generally be able to collect the judgment from:

A. Partnership assets only.

B. The personal assets of Eller, Fort, and Owens only.

C. Eller's personal assets only after partnership assets are exhausted.

D. Eller's personal assets only.

-

Question 514:

On dissolution of a general partnership, distributions will be made on account of:

I. Partners' capital accounts.

II. Amounts owed partners with respect to profits.

III. Amounts owed partners for loans to the partnership.

In the following order:

A. III, I, and II.

B. I, II, and III.

C. II, III, and I.

D. III, II, and I.

-

Question 515:

Which of the following is not necessary to create an express partnership?

A. Execution of a written partnership agreement.

B. Agreement to share ownership of the partnership.

C. Intention to conduct a business for profit.

D. Intention to create a relationship recognized as a partnership.

-

Question 516:

In a general partnership, the authorization of all partners is required for an individual partner to bind the partnership in a business transaction to:

A. Purchase inventory.

B. Hire employees.

C. Sell goodwill.

D. Sign advertising contracts.

-

Question 517:

Locke and Vorst were general partners in a kitchen equipment business. On behalf of the partnership, Locke contracted to purchase 15 stoves from Gage. Unknown to Gage, Locke was not authorized by the partnership agreement to make such contracts. Vorst refused to allow the partnership to accept delivery of the stoves and Gage sought to enforce the contract. Gage will:

A. Lose, because Locke's action was not authorized by the partnership agreement.

B. Lose, because Locke was not an agent of the partnership.

C. Win, because Locke had express authority to bind the partnership.

D. Win, because Locke had apparent authority to bind the partnership.

-

Question 518:

Which of the following requirements must be met to have a valid partnership exist?

I. Co-ownership of all property used in a business.

II.

Co-ownership of a business for profit.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

-

Question 519:

The partners of College Assoc., a general partnership, decided to dissolve the partnership and agreed that none of the partners would continue to use the partnership name. Under the Revised Uniform Partnership Act, which of the following events will occur on dissolution of the partnership?

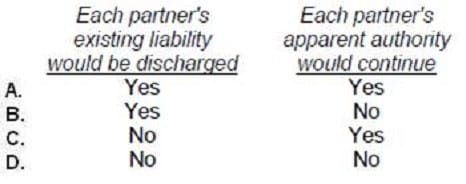

A. Option A

B. Option B

C. Option C D. Option D

-

Question 520:

Park and Graham entered into a written partnership agreement to operate a retail store. Their agreement was silent as to the duration of the partnership. Park wishes to dissociate from the partnership. Which of the following statements is correct?

A. Park may dissociate from the partnership at any time.

B. Unless Graham consents to the dissociation, Park must apply to a court and obtain a decree ordering the dissociation.

C. Park may not dissociate from the partnership unless Graham consents.

D. Park may dissociate from the partnership only after notice of the proposed dissolution is given to all partnership creditors.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFNS

Commission on Graduates of Foreign Nursing SchoolsCLEP-BUSINESS

CLEP Business: Financial Accounting, Business Law, Information Systems & Computer Applications, Management, Marketing

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your BUSINESS-ENVIRONMENT-AND-CONCEPTS exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.