Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 331:

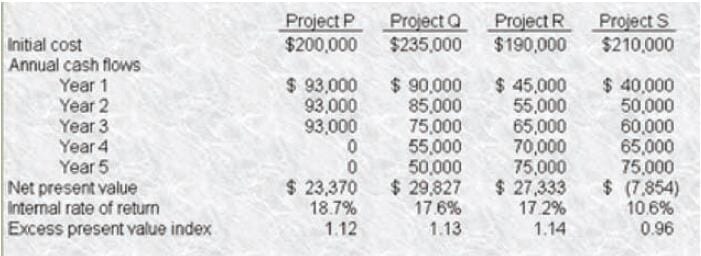

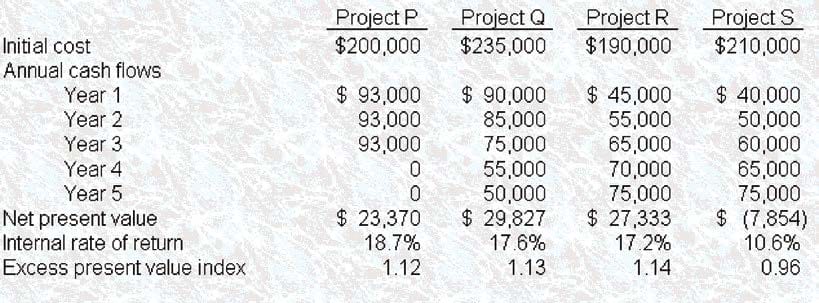

Mercken Industries is contemplating four projects, Project P, Project Q, Project P, and Project S. The capital costs and estimated after-tax net cash flows of each mutually exclusive project are listed below. Mercken's desired after-tax opportunity cost is 12%, and the company has a capital budget for the year of $450,000. Idle funds cannot be reinvested at greater than 12%.

If Mercken is able to accept only one project, the company would choose

A. Project P.

B. Project 0 because it has the highest net present value.

C. Project P because it has the highest internal rate of return.

D. Project P because it has the shortest payback period.

-

Question 332:

Mercken Industries is contemplating four projects, Project P, Project Q, Project P, and Project S. The capital costs and estimated after-tax net cash flows of each mutually exclusive project are listed below. Mercken's desired after-tax opportunity cost is 12%, and the company has a capital budget for the year of $450,000. Idle funds cannot be reinvested at greater than 12%.

During this year, Mercken will choose

A. Projects P, 0, and P.

B. Projects P, Q, R, and S.

C. Projects Q and R.

D. Projects P and Q.

-

Question 333:

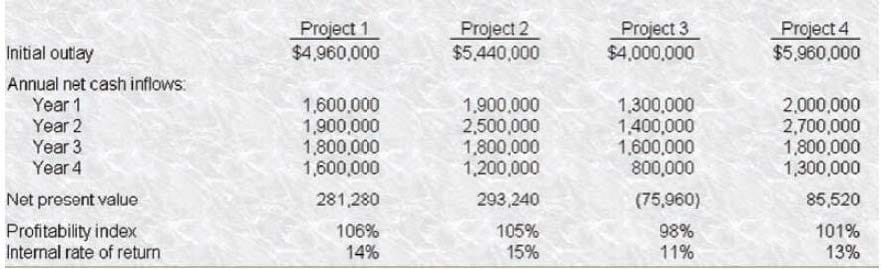

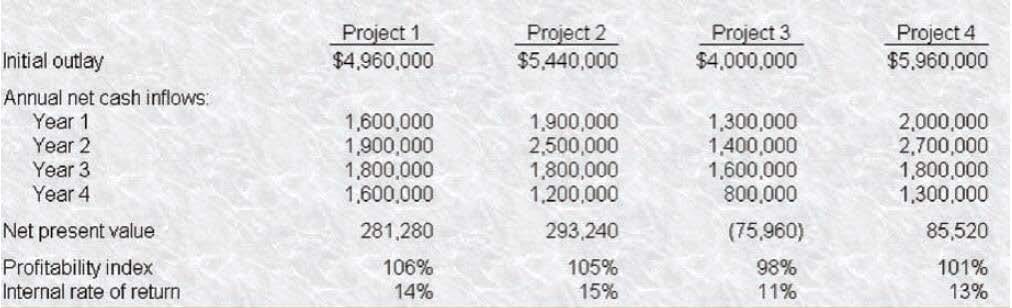

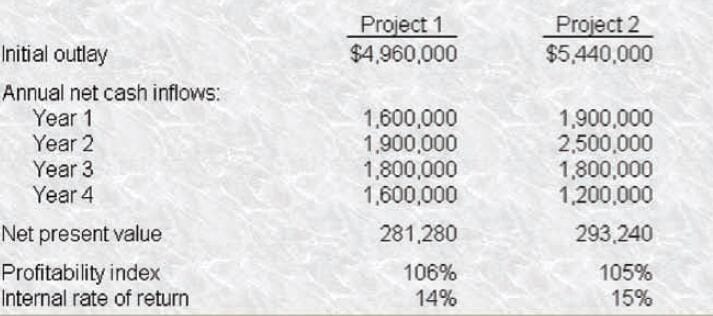

Maloney Company uses a 12% hurdle rate for all capital expenditures and has done the following analysis for four projects for the upcoming year

Which project(s) should Maloney undertake during the upcoming year if it has only $6,000,000 of funds available?

A. Project 3.

B. Projects 1 and 2.

C. Project 1.

D. Project 2.

-

Question 334:

Maloney Company uses a 12% hurdle rate for all capital expenditures and has done the following analysis for four projects for the upcoming year Which projects should Maloney undertake during the upcoming year if it has only $12,000,000 of investment funds available?

A. Projects 1 and 3.

B. Projects 1, 2, and 4.

C. Projects 1 and 4.

D. Projects 1 and 2.

-

Question 335:

Maloney Company uses a 12% hurdle rate for all capital expenditures and has done the following analysis for four projects for the upcoming year

Which project(s) should Maloney undertake during the upcoming year assuming it has no budget restrictions?

A. All of the projects.

B. Projects 1, 2 and 3.

C. Projects 1, 2 and 4.

D. Projects 1 and 2.

-

Question 336:

Which mutually exclusive project would you select if both are priced at $1,000 and your discount rate is 14%: Project A, with three annual cash flows of $1 .000, Project B, with three years of zero cash flow followed by three years of $1,500 annually?

A. Project A.

B. Project B.

C. The IRRs are equal, hence you are indifferent.

D. The NPVs are equal, hence you are indifferent.

-

Question 337:

Which one of the following capital investment evaluation methods does not take the time value of money into consideration?

A. Net present value.

B. Discounted payback.

C. Internal rate of return.

D. Accounting rate of return.

-

Question 338:

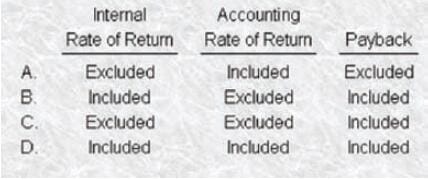

If income tax considerations are ignored, how is depreciation handled by the following capital budgeting techniques?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 339:

The method that divides a project's annual after--tax net income by the average investment cost to measure the estimated performance of a capital investment is the

A. Internal rate of return method.

B. Accounting rate of return method.

C. Payback method.

D. Net present value (NPV) method.

-

Question 340:

The technique used to evaluate all possible capital projects of different dollar amounts and then rank them according to their desirability is the

A. Profitability index method.

B. Net present value method.

C. Payback method.

D. Discounted cash flow method.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.