Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 341:

The profitability index (present value index)

A. Represents the ratio of the discounted net cash outflows to cash inflows.

B. Is the relationship between the net discounted cash inflows less the discounted cash outflows divided by the discounted cash outflows.

C. Is calculated by dividing the discounted profits by the cash outflows.

D. Is the ratio of the discounted net cash inflows to discounted cash outflows.

-

Question 342:

If an investment project has a profitability index of 1.15,the

A. Project's internal rate of return is 15%.

B. Project's cost of capital is greater than its internal rate of return.

C. Project's internal rate of return exceeds its net present value.

D. Net present value of the project is positive.

-

Question 343:

The profitability index approach to investment analysis

A. Fails to consider the timing of project cash flows.

B. Considers only the project's contribution to net income and does not consider cash flow effects.

C. Always yields the same accept/reject decisions for independent projects as the net present value method.

D. Always yields the same accept/reject decisions for mutually exclusive projects as the net present value method.

-

Question 344:

Barker, Inc. has no capital rationing constraint and is analyzing many independent investment alternatives. Barker should accept all investment proposals

A. If debt financing is available for them.

B. That have positive cash flows.

C. That provide returns greater than the before-tax cost of debt.

D. That have a positive net present value.

-

Question 345:

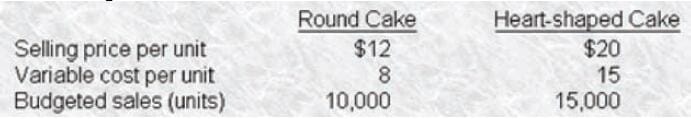

Specialty Cakes, Inc. produces two types of cakes, a round cake and a heart-shaped cake. Total fixed costs for the firm are $92,000 Variable costs and sales data for these cakes are presented below How many cakes will be required to reach the breakeven point?

A. 8.000 round cakes and 12.000 heart-shaped cakes

B. 9.000 round cakes and 11.000 heart-shaped cakes

C. 10.000 round cakes and 10,000 heart-shaped cakes

D. 23,000 round cakes and 18.400 heart-shaped cakes

-

Question 346:

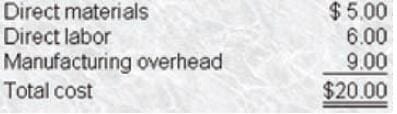

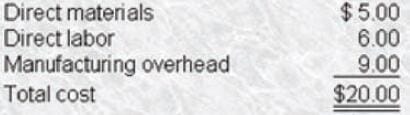

The Sommers Company manufactures a vanity of industrial valves. Current', the company is operating at about 70% capacity and is earning a satisfactory return on investment. Management has been approached by Glascow Industries Ltd. of Scotland with an offer to buy 120.000 units of a pressure valve. Glascow manufactures a valve that is almost identical to Sommers' pressure valve; however, a fire in Glascow Industries' valve plant has shut down its manufacturing operations. Glascow needs the 120,000 valves over the next 4 months to meet commitments to its regular customers; the company is prepared to pay $19 each for the valves, FOB shipping point. Sommers' product cost, based on current attainable standards, foi the pressure valve is

Manufacturing overhead is applied to production at the rate of $18 per standard direct labor hour. This overhead rate is made up of the following components

What is the minimum unit price that Sommers could accept without reducing net income?

A. $14

B. $14.40

C. $20

D. $20.40

-

Question 347:

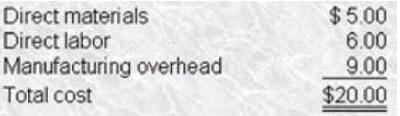

The Sommers Company manufactures a van ely of industrial valves. Currently, the company is operating at about 70% capacity and is earning a satisfactory return on investment, Management has been approached by Glascow Industries Ltd of Scotland with an offer to buy 120.000 units of a pressure valve. Glascow manufactures a valve that is almost identical to Sommers' pressure valve however, a fire in Glascow industries valve plant has shut down its manufacturing operations. Glascow needs the 120.000 valves over the next 4 months to meet commitments to its regular customers, the company is prepared to pay $19 each for the valves, FOB shipping point. Sommers' product cost, based on current attainable standards, for the pressure valve is

Manufacturing overhead is applied to production at the rate of $18 per standard direct labor hour This overhead rate is made up of the following components

What is the incremental profit (loss) before tax associated with the Glascow order?

A. ($168,000)

B. ($120,000)

C. $552,000

D. $600000

-

Question 348:

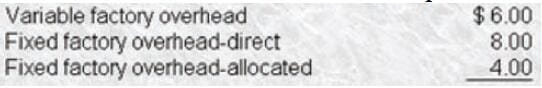

The Summers Company manufactures a vanity of industrial valves. Current', the company is operating at about 70% capacity and is earning a satisfactory return on investment. Management has been approached by Glasgow Industries Ltd. of Scotland

with an offer to buy 120.000 units of a pressure valve. Glascow manufactures a valve that is almost identical to Summers' pressure valve; however, a fire in Glascow Industries' valve plant has shut down its manufacturing operations. Glascow needs the 120,000 valves over the next 4 months to meet commitments to its regular customers; the company is prepared to pay $19 each for the valves. FOB shipping point. Summers' product cost, based on current attainable standards. for the pressure valve is

Manufacturing overhead is applied to production at the rate of $18 per standard direct labor hour This overhead rate is made up of the following components

How many additional direct Labor hours would be required each month to fill the Glascow order?

A. 10,000

B. 15,000

C. 30,000

D. 120,000

-

Question 349:

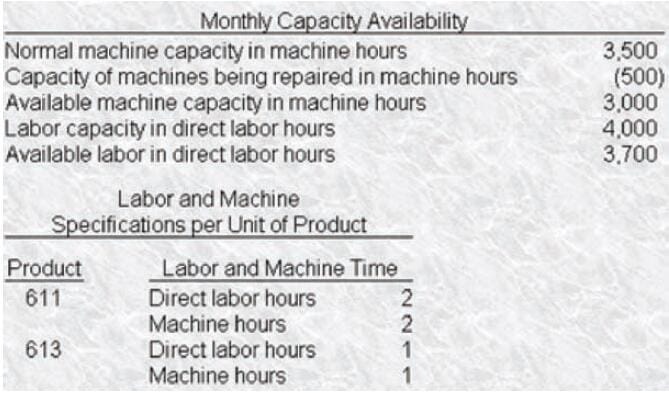

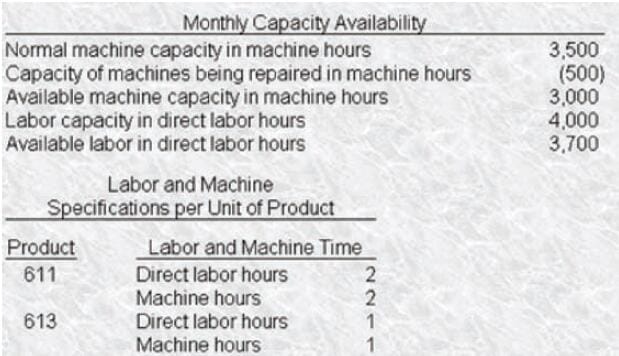

Bakker Industries sells three products (Products 611 613. and 615) that it manufactures in a factory consisting of one department Both labor and machine time are applied to the products Bakker's management is planning its production schedule for the next several months. There are labor shortages in the community. Some of the machines will be out of service for extensive overtraining. Available machine and labor time for each of the next 6 months is listed below It Bakker's strategy is to maximize total profits, what is the total contribution?

A. $113.150

B. $193,500

C. $215,300

D. $280.800

-

Question 350:

Bakker Industries seals three products (Products 611, 613, and 615) that it manufactures in a factory consisting of one department Both labor and machine time are applied to the products. Bakker's management is planning its production schedule for the next several months There are labor shortages in the community. Some of the machines will be out of service for extensive overhauling Available machine and labor time for each of me next 6 months is listed below If Bakker's strategy is to maximize dollar profits, how many units of product 615 will be produced?

A. 400 units

B. 500 units.

C. 800 units

D. 1.000 units.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.