Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 351:

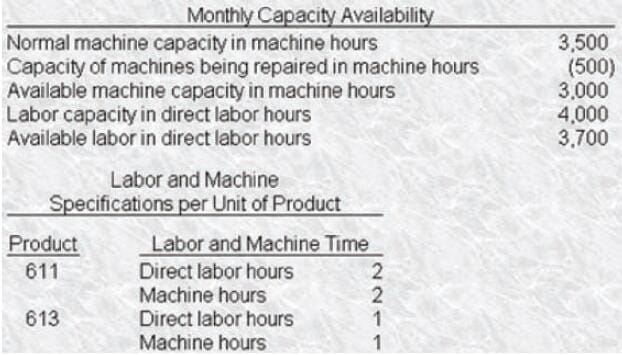

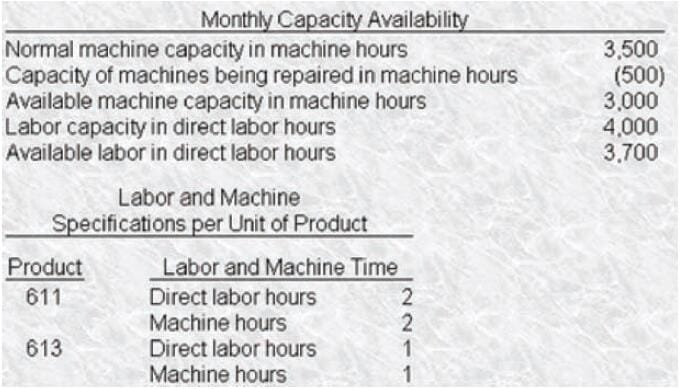

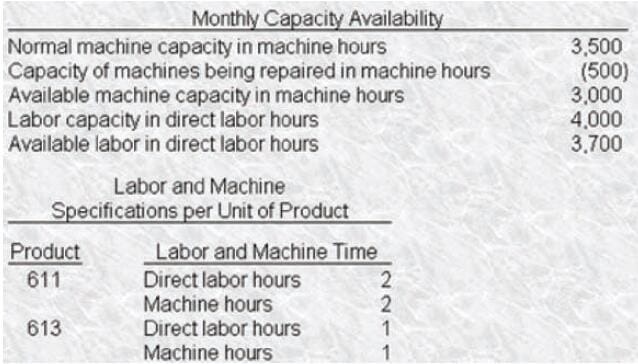

Bakker Industries sells three products (Products 611, 613. and 615) that it manufactures in a factory consisting of one department Both labor and machine time are applied to the products. Bakker's management is planning its production schedule for the next several months. There are labor shortages in the community. Some of the machines will be out of service for extensive overhauling. Available machine and labor time for each of the next 6 months is listed below What is product 615's contribution per machine hour?

A. $54.50

B. $58

C. $109

D. $167

-

Question 352:

Bakker Industries sells three products (Products 611.613. and 615) that it manufactures in a factory consisting of one department Both labor and machine time are applied to the products. Bakker's management is planning its production schedule for the next several months. There are labor shortages in the community. Some of the machines will be out of service for extensive overhauling Available machine and labor time for each of the next 6 months is listed below. Monthly Capacity Availability What is the excess (deficiency) for labor hours?

A. (100) hours

B. 300 hours.

C. 700 hours

D. 1.800 hours.

-

Question 353:

Bakker Industries sells three products (Products 611. 613. and 615) that it manufactures in a factory consisting of one department Both labor and machine time are applied to me products. Bakker's management is planning its production schedule for the next several months. There are labor shortages in the community. Some of the machines will be out of service for extensive overhauling. Available machine and labor time for each of the next 6 months is listed below.

What is the excess (deficiency) for machine hours?

A. (700) hours

B. (400) hours

C. 0 hours,

D. 1,100 hours.

-

Question 354:

A company sells two products, X and Y. The sales mix consists of a composite unit of 2 units of X for even 5 units of Y (2:5). Fixed costs are $49,500 The unit contribution margins for X and Y are $2.50 and $1.20. respectively. If the company had a profit of $22,000. the unit sales must have been?

A. 5.000 12,500

B. 13.000 32,500

C. 23.800 59,500

D. 32.500 13,000

-

Question 355:

A company sells two products, X and Y. The sales mix consists of a composite unit of 2 units of X for every 5 units of V (2.5). Fixed costs are $49.500. The unit contribution margins for X arid V are $2.50 and $1.20. respectively. Considering the company as a whole, the number of composite units to break even is?

A. 1.650

B. 4.500

C. 8,250

D. 22,500

-

Question 356:

The ratio of fixed costs to the unit contribution margin is the?

A. Breakeven point

B. Profit margin.

C. Operating profit

D. Contribution margin ratio.

-

Question 357:

Donne Corporation manufactures and sells T-shirts imprinted with collage names and slogans. Last year. the shirts sold for $750 each, and the variable cost to manufacture them was $2.25 per unit. The company needed to sell 20.000 shirts to break even. The net income last year was $5,040. Donnelly's expectations for the coming year include the following: The sales price of the T-shirts will be $9 Variable cost to manufacture will increase by one-third Fixed costs will increase by 10% The income tax rate of 40% will be unchanged

121. If Donnelly Corporation wishes to earn $22,500 in net income for the coming year, the company's sales volume in dollars must be?

A. $213.750

B. $257.625

C. $207.000

D. $229.500

-

Question 358:

Donnelly Corporation manufactures and sells T-shirts imprinted with collage names and slogans. Last year, the shirts sold for $7.50 each, and the variable cost to manufacture them was $2.25 per unit, The company needed to sell 20.000 shirts to break even. The net income last year was $5,040. Donnelly's expectations for the coming year include the following: The sales price of the T-shirts will be $9 Variable cost to manufacture will increase by one-third Fixed costs will increase by 10% The income tax rate of 40% will be unchanged

Sales for the coming year are expected to exceed last year's by 1000 units. If this occurs. Donnelly's sales volume in the coming year will be?

A. 22,600 units.

B. 21,960units.

C. 23.400 units.

D. 21,000 units.

-

Question 359:

Donnelly Corporation manufactures and sells T-shirts imprinted with college names and slogans. Last year. the shirts sold for $750 each, and the variable cost to manufacture them was $2.25 per unit. The company needed to sell 20.000 shirts to break even. The net income last year was $5,040. Donnelly's expectations for the coming year include the following: The sales price of the T-shirts will be $9 Variable cost to manufacture will increase by one-third Fixed costs Will increase by 10% The income tax rate of 40% will be unchanged

The number of T-shirts Donnelly Corporation must sell to break even in the coming year is?

A. 17.500

B. 19.250

C. 20,000

D. 22.000

-

Question 360:

Donnelly Corporation manufactures and sells T-shirts imprinted with college names and slogans. Last year. the shirts sold for $7.50 each, and the variable cost to manufacture them was $2.25 per unit. The company needed to sell 20.000 shirts to break even. The net income last year was $5,040 Donnelly expectations for me coming year include the following: The sales price of the T-shirts will be $9 Variable cost to manufacture Will increase by one-third Fixed costs will increase by 10% The income tax rate of 40% will be unchanged

The selling price that would maintain the same contribution margin rate as last year is?

A. $9.00

B. $8.25

C. $10.00

D. $9.75

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.