Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 321:

The technique that measures the estimated performance of a capital investment by dividing the project's annual after-tax net income by the average investment cost is called the

A. Bail-out payback method.

B. Internal rate of return method.

C. Profitability index method.

D. Accounting rate of return method.

-

Question 322:

The recommended technique for evaluating projects when capital is rationed and there are no mutually exclusive projects from which to choose is to rank the projects by

A. Accounting rate of return.

B. Payback.

C. Internal rate of return.

D. Profitability index.

-

Question 323:

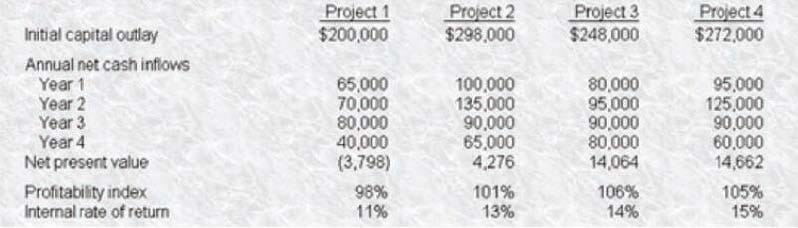

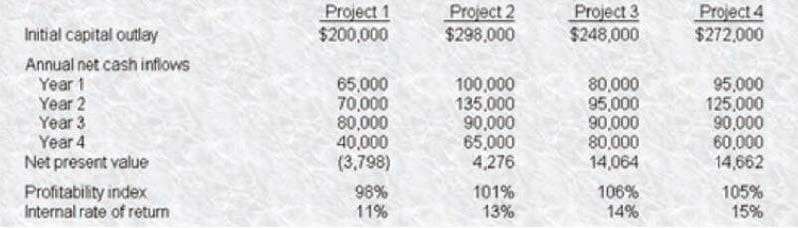

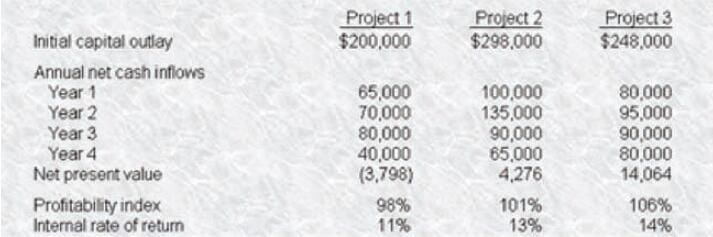

Capital Invest, Inc. uses a 12% hurdle rate for all capital expenditures and has done the following analysis for four projects for the upcoming year:

Which project(s) should Capital Invest, Inc. undertake during the upcoming year if it has only $300,000 of capital funds available?

A. Project 1.

B. Projects 2, 3, and 4.

C. Projects 3 and 4.

D. Project 3.

-

Question 324:

Capital Invest, Inc. uses a 12% hurdle rate for all capital expenditures and has done the following analysis for four projects for the upcoming year:

Which project(s) should Capital Invest, Inc. undertake during the upcoming year if it has only $600,000 of funds available?

A. Projects 1 and 3.

B. Projects 2, 3, and 4.

C. Projects 2 and 3.

D. Projects 3 and 4.

-

Question 325:

Capital Invest, Inc. uses a 12% hurdle rate for all capital expenditures and has done the following analysis for four projects for the upcoming year:

Which project(s) should Capital Invest, Inc. undertake during the upcoming year assuming it has no budget restrictions?

A. All of the projects.

B. Projects 1, 2, and 3.

C. Projects 2, 3,and 4.

D. Projects 1, 3, and 4.

-

Question 326:

Flex Corporation is studying a capital acquisition proposal in which newly acquired assets will be depreciated using the straight-line method. Which one of the following statements about the proposal would be incorrect if a switch is made to the Modified Accelerated Cost Recovery System (MACRS)?

A. The net present value will increase.

B. The internal rate of return will increase.

C. The payback period will be shortened.

D. The profitability index will decrease.

-

Question 327:

Mesa Company is considering an investment to open a new banana processing division. The project in question would entail an initial investment of $45000, and as a result of the project cash inflows of $20000 can be expected in each of the next 3 years. The hurdle rate is 10%. What is the profitability index for the project?

A. 1.0784

B. 1.1053

C. 1.1379

D. 1.1771

-

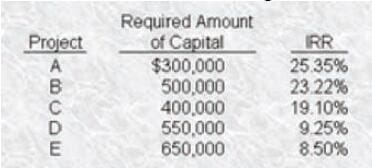

Question 328:

Mulva Inc. is considering the following five independent projects: The company has a target capital structure which is 40 percent debt and 60 percent equity. The company can issue bonds with a yield to maturity of 10 percent. The company has $900000 in retained earnings, and the current stock price is $40 per share. The flotation costs associated with issuing new equity are $2 per share. Mulva's earnings are expected to continue to grow at 5 percent per year. Next year's dividend (D1) is forecasted to be $2.50. The firm faces a 40 percent tax rate. What is the size of Mulva's capital budget?

A. $1,200,000

B. $1,750,000

C. $2,400,000

D. $800,000

-

Question 329:

Rohan Transport is considering two alternative busses to transport people between cities that are in the Southeastern U.S., such as Baton Rouge and Gainesville. A gas-powered bus has a cost of $55,000, and will produce end-of-year net cash flows of $22,000 per year for 4 years. A new electric bus will cost $90,000, and will produce cash flows of $28000 per year for 8 years. The company must provide bus service for 8 years, after which it plans to give up its franchise and to cease operating the route. Inflation is not expected to affect either costs or revenues during the next 8 years. If Rohan Transports cost of capital is 16%, by what amount will the better project increase the company's value?

A. $6,556

B. $(14,432)

C. $13,112

D. $31,632

-

Question 330:

The method that recognizes the time value of money by discounting the after-tax cash flows over the life of a project, using the company's minimum desired rate of return is the

A. Accounting rate of return method.

B. Net present value method.

C. Internal rate of return method.

D. Payback method.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.