Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 311:

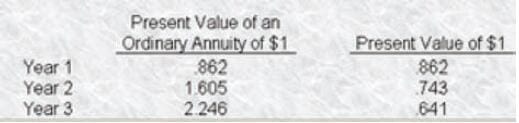

MS Trucking is considering the purchase of a new piece of equipment that has a net initial investment with a present value of $300,000. The equipment has an estimated useful life of3years. For tax purposes1 the equipment will be fully depreciated a rates of 30%, 40%, and 30% in years one, two, and three, respectively. The new machine is expected to have a $20,000 salvage value. The machine is expected to save the company $170,000 per year in operating expenses. MS Trucking has a 40% marginal income tax rate and a 16% cost of capital. Discount rates for a 16% rate are:

What is the net present value of this project?

A. $31684

B. $26,556 C. $94,640

D. $18,864

-

Question 312:

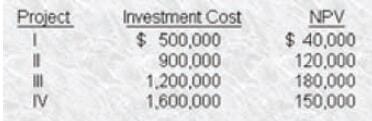

Woods, Inc. is considering four independent investment proposals. Woods has $3 million available for investment during the present period. The investment outlay for each project and its projected net present value (NPV) is presented below.

Which of the following project options should be recommended to Woods' management?

A. Projects I, II, and Ill only.

B. Projects I, II, and IV only.

C. Projects II, Ill, and IV only.

D. Projects Ill and IV only.

-

Question 313:

Capital budgeting methods are often divided into two classifications: project screening and project ranking. Which one of the following is considered a ranking method rather than a screening method?

A. Net present value.

B. Time-adjusted rate of return.

C. Profitability index.

D. Accounting rate of return.

-

Question 314:

The technique that measures the number of years required for the after-tax cash flows to recover the initial investment in a project is called the

A. Net present value method.

B. Payback method.

C. Profitability index method.

D. Accounting rate of return method.

-

Question 315:

The technique that measures the estimated performance of a capital investment by dividing the project's annual after4ax net income by the average investment cost is called the

A. Average rate of return method.

B. Internal rate of return method.

C. Capital asset pricing model.

D. Accounting rate of return method.

-

Question 316:

The technique that incorporates the time value of money by determining the compound interest rate of an investment such that the present value of the after-tax cash inflows over the life of the investment is equal to the initial investment is called the

A. Internal rate of return method.

B. Capital asset pricing model.

C. Profitability index method.

D. Accounting rate of return method.

-

Question 317:

The technique that reflects the time value of money and is calculated by dividing the present value of the future net after- tax cash inflows that have been discounted at the desired cost of capital by the initial cash outlay for the investment is called the

A. Capital rationing method.

B. Average rate of return method.

C. Profitabilityr index method.

D. Accounting rate of return method.

-

Question 318:

The technique that recognizes the time value of money by discounting the after-tax cash flows for a project over its life to time period zero using the company's minimum desired rate of return is called the

A. Net present value method.

B. Payback method.

C. Average rate of return method.

D. Accounting rate of return method.

-

Question 319:

Future1 Inc. is in the enviable situation of having unlimited capital funds. The best decision rule, in an economic sense, for it to follow would be to invest in all projects in which the

A. Accounting rate of return is greater than the earnings as a percent of sales.

B. Payback reciprocal is greater than the internal rate of return.

C. Internal rate of return is greater than zero.

D. Net present value is greater than zero.

-

Question 320:

A company has unlimited capital funds to invest. The decision rule for the company to follow in order to maximize shareholders' wealth is to invest in all projects having a(n)

A. Present value greater than zero.

B. Net present value greater than zero.

C. Internal rate of return greater than zero.

D. Accounting rate of return greater than the hurdle rate used in capital budgeting analyses.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.