Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 301:

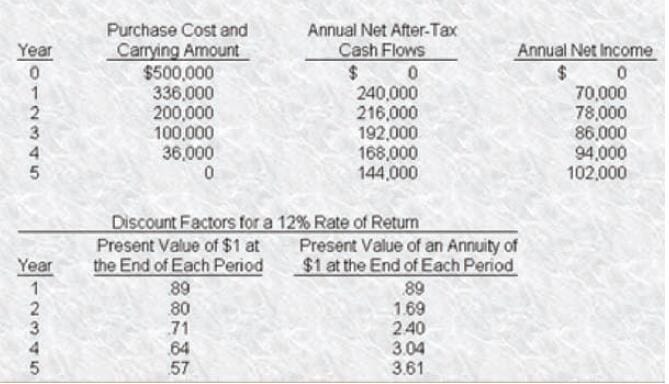

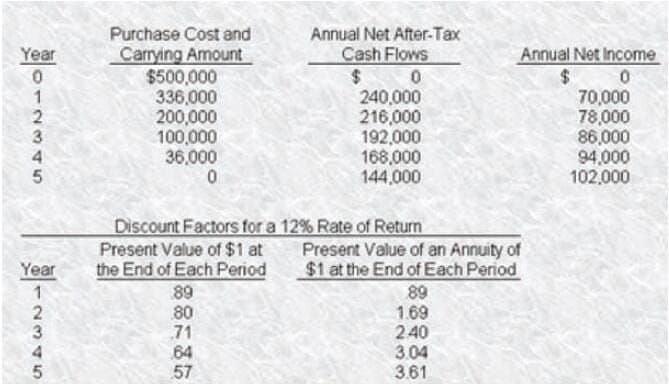

A proposed investment is not expected to have any salvage value at the end of its 5-year life. Because of realistic depreciation practices, the net carrying amount and the salvage value are equal at the end of each year. For present value purposes, cash flows are assumed to occur at the end of each year. The company uses a 12% after-tax target rate of return.

Which statement about the internal rate of return of the investment is true?

A. The IRR is exactly 12%.

B. The IRR is over 12%.

C. The IRR is under 12%.

D. No information about the IRR can be determined.

-

Question 302:

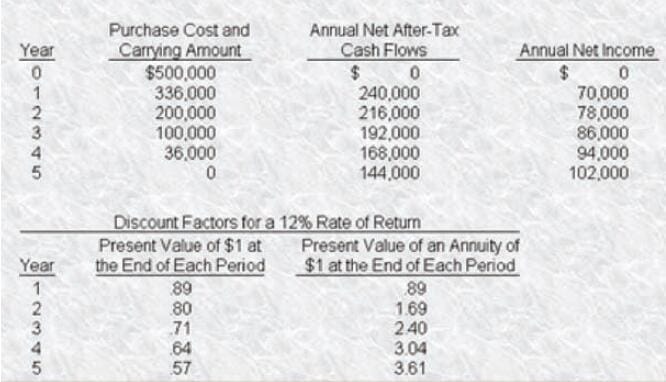

A proposed investment is not expected to have any salvage value at the end of its 5-year life. Because of realistic depreciation practices, the net carrying amount and the salvage value are equal at the end of each year. For present value purposes, cash flows are assumed to occur at the end of each year. The company uses a 12% after-tax target rate of return.

The profitability index is

A. .61

B. .42

C. .86

D. 1425

-

Question 303:

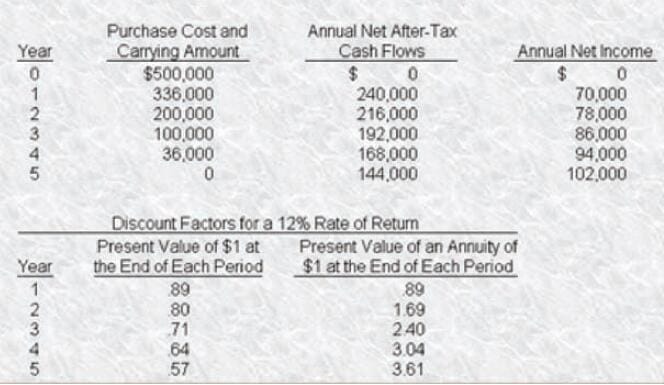

A proposed investment is not expected to have any salvage value at the end of its 5-year life. Because of realistic depreciation practices, the net carrying amount and the salvage value are equal at the end of each year. For present value purposes, cash flows are assumed to occur at the end of each year. The company uses a 12% after-tax target rate of return.

The traditional payback period is

A. Over5years.

B. 2.23years.

C. 1.65years.

D. 2.83 years.

-

Question 304:

A proposed investment is not expected to have any salvage value at the end of its 5-year life. Because of realistic depreciation practices, the net carrying amount and the salvage value are equal at the end of each year. For present value purposes, cash flows are assumed to occur at the end of each year. The company uses a 12% after-tax target rate of return.

The net present value is

A. $304,060

B. $212,320

C. $(70,000)

D. $712,320

-

Question 305:

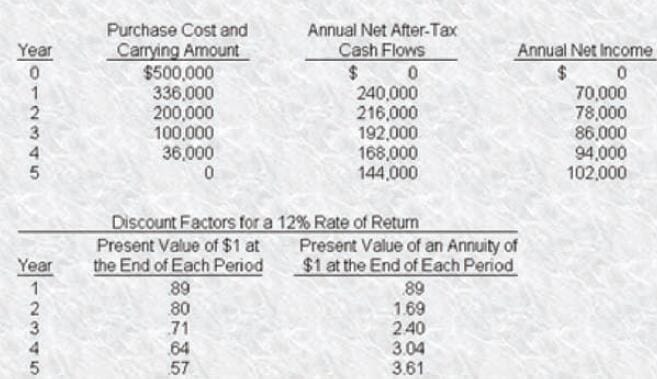

A proposed investment is not expected to have any salvage value at the end of its 5-year life. Because of realistic depreciation practices, the net carrying amount and the salvage value are equal at the end of each year. For present value purposes, cash flows are assumed to occur at the end of each year. The company uses a 12% after-tax target rate of return.

The accounting rate of return based on the average investment is

A. 84.9%

B. 344%

C. 40.8%

D. 12%

-

Question 306:

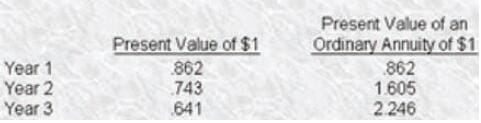

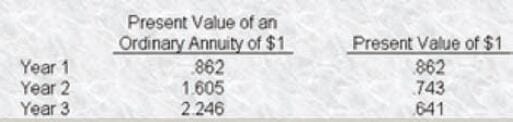

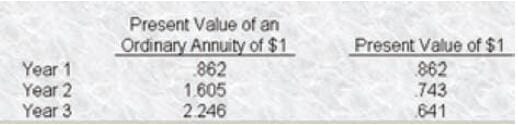

McLean, Inc. is considering the purchase of a new machine that will cost $160,000. The machine has an estimated useful life of 3 years. Assume that 30% of the depreciable base will be depreciated in the first year1 40% in the second year, and 30% in the third year. The new machine will have a $10000 resale value at the end of its estimated useful life. The machine is expected to save the company $85000 per year in operating expenses. McLean uses a 40% estimated income tax rate and a 16% hurdle rate to evaluate capital projects. Discount rates for a 16% rate are as follows:

The payback period for this investment would be

A. 1.88years.

B. 3.00 years.

C. 2.23years.

D. 1.62 years.

-

Question 307:

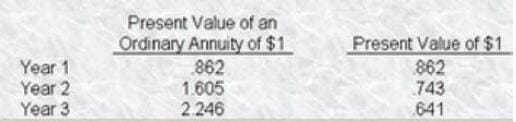

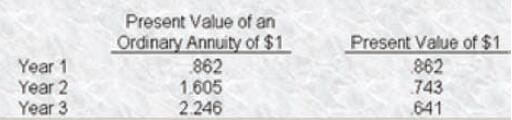

MS Trucking is considering the purchase of a new piece of equipment that has a net initial investment with a present value of $300,000. The equipment has an estimated useful life of3years. For tax purposes1 the equipment will be fully depreciated a rates of 30%, 40%, and 30% in years one, two, and three, respectively. The new machine is expected to have a $20,000 salvage value. The machine is expected to save the company $170,000 per year in operating expenses. MS Trucking has a 40% marginal income tax rate and a 16% cost of capital. Discount rates for a 16% rate are:

What is the net present value of this project?

A. $3,278

B. $5,842

C. $(568)

D. $30,910

-

Question 308:

MS Trucking is considering the purchase of a new piece of equipment that has a net initial investment with a present value of $300,000. The equipment has an estimated useful life of3years. For tax purposes1 the equipment will be fully depreciated a rates of 30%, 40%, and 30% in years one, two, and three, respectively. The new machine is expected to have a $20,000 salvage value. The machine is expected to save the company $170,000 per year in operating expenses. MS Trucking has a 40% marginal income tax rate and a 16% cost of capital. Discount rates for a 16% rate are:

Assume that the salvage value at the end of the investment's useful life is zero. What is the new payback period?

A. 2.84years.

B. 1.76years.

C. 2.08 years.

D. 2.09 years.

-

Question 309:

MS Trucking is considering the purchase of a new piece of equipment that has a net initial investment with a present value of $300,000. The equipment has an estimated useful life of3years. For tax purposes1 the equipment will be fully depreciated a rates of 30%, 40%, and 30% in years one, two, and three, respectively. The new machine is expected to have a $20,000 salvage value. The machine is expected to save the company $170,000 per year in operating expenses. MS Trucking has a 40% marginal income tax rate and a 16% cost of capital. Discount rates for a 16% rate are:

The payback period for this investment is

A. 2.84years.

B. 1.76years.

C. 2.O8years.

D. 3.00 years.

-

Question 310:

MS Trucking is considering the purchase of a new piece of equipment that has a net initial investment with a present value of $300,000. The equipment has an estimated useful life of3years. For tax purposes1 the equipment will be fully depreciated a rates of 30%, 40%, and 30% in years one, two, and three, respectively. The new machine is expected to have a $20,000 salvage value. The machine is expected to save the company $170,000 per year in operating expenses. MS Trucking has a 40% marginal income tax rate and a 16% cost of capital. Discount rates for a 16% rate are:

What is the profitability index for the project?

A. 1.089

B. 1.106

C. 1.315

D. 1.063

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.