Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 291:

Don Adams Breweries is considering an expansion project with an investment of $1,500,000. The equipment will be depreciated to zero salvage value on a straight-line basis over 5 years. The expansion will produce incremental operating revenue of $400,000 annually for 5 years. The company's opportunity cost of capital is 12%. Ignore taxes. What is the book (accounting) rate of return of the investment using the average investment method?

A. 6.67%

B. 13.33%

C. 16.67%

D. 26.67%

-

Question 292:

Don Adams Breweries is considering an expansion project with an investment of $1 .500000. The equipment will be depreciated to zero salvage value on a straight-line basis over 5 years. The expansion will produce incremental operating revenue of $400,000 annually for 5 years. The company's opportunity cost of capital is 12%. Ignore taxes.What is the NPV of the investment?

A. $0

B. $(58,000)

C. $(116,000)

D. $1,442,000

-

Question 293:

Don Adams Breweries is considering an expansion project with an investment of $1 .500000. The equipment will be depreciated to zero salvage value on a straight-line basis over 5 years. The expansion will produce incremental operating revenue of $400,000 annually for 5 years. The company's opportunity cost of capital is 12%. Ignore taxes.What is the SR of the investment?

A. 1043%

B. 12.68%

C. 16.32%

D. 19.17%

-

Question 294:

Rex Company is considering an investment in a new plant which will entail an immediate capital expenditure of $4,000,000. The plant is to be depreciated on a straight-line basis over 10 years to zero salvage value. Operating income (before depreciation and taxes) is expected to be $800,000 per year over the 10-year life of the plant. The opportunity cost of capital is 14%. Assume that there are no taxes.What is the NPV for the investment?

A. $172,800

B. $(1,913,600)

C. $520,000

D. $362,400

-

Question 295:

Rex Company is considering an investment in a new plant which will entail an immediate capital expenditure of $4,000,000. The plant is to be depreciated on a straight-line basis over 10 years to zero salvage value. Operating income (before depreciation and taxes) is expected to be $800,000 per year over the 10-year life of the plant. The opportunity cost of capital is 14%. Assume that there are no taxes.What is the discounted payback period for the investment?

A. 5.5years.

B. 7.1 years.

C. 9.2 years.

D. 11.7years.

-

Question 296:

Rex Company is considering an investment in a new plant which will entail an immediate capital expenditure of $4,000,000. The plant is to be depreciated on a straight-line basis over 10 years to zero salvage value. Operating income (before depreciation and taxes) is expected to be $800,000 per year over the 10-year life of the plant. The opportunity cost of capital is 14%. Assume that there are no taxes.What is the book (or accounting) rate of return for the investment using the average investment method?

A. 10%

B. 20%

C. 28%

D. 35%

-

Question 297:

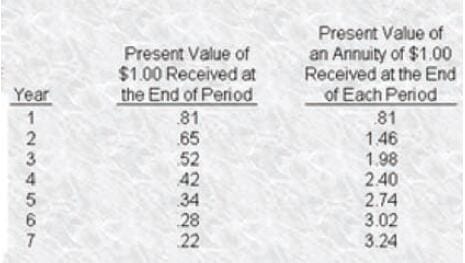

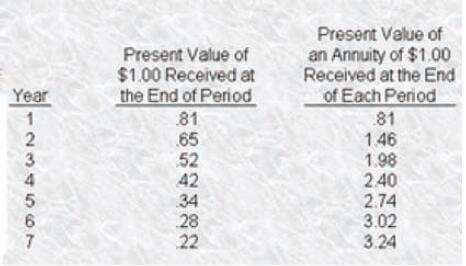

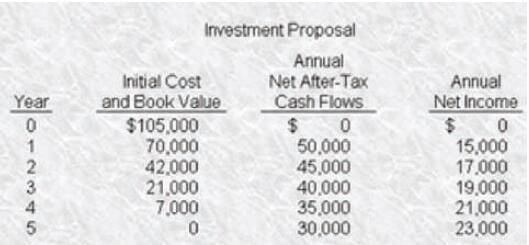

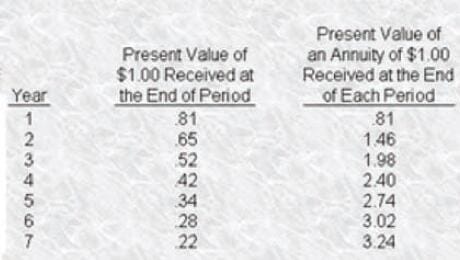

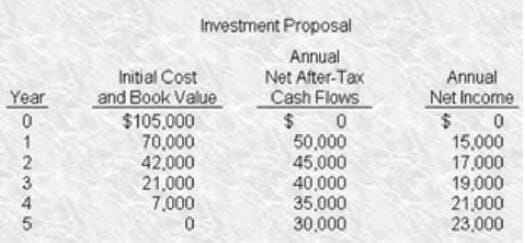

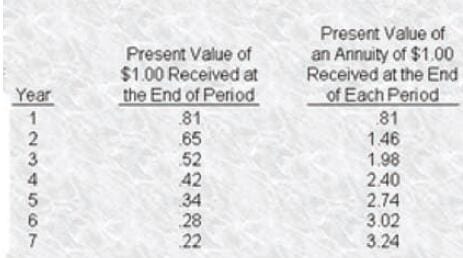

Yipann Corporation is reviewing an investment proposal. The initial cost, as well as other related data for each year. are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value of the investment at the Yipann uses a 24% after4axtargetrate of return for new investment proposals. The discount figures for a 24% rate of return are given.

The traditional payback period for the investment proposal is

A. .875 years.

B. 1.833 years.

C. 2.250 years.

D. Over5years.

-

Question 298:

Yipann Corporation is reviewing an investment proposal. The initial cost, as well as other related data for each year. are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value of the investment at the Yipann uses a 24% after4axtargetrate of return for new investment proposals. The discount figures for a 24% rate of return are given.

The net present value of the investment proposal is

A. $4,600

B. $10,450

C. $(55,280)

D. $115,450

-

Question 299:

Yipann Corporation is reviewing an investment proposal. The initial cost, as well as other related data for each year. are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value of the investment at the end of each year is equal to its net book value, and there will be no salvage value at the end of the investments life.

Yipann uses a 24% after4axtargetrate of return for new investment proposals. The discount figures for a 24% rate of return are given.

The accounting rate of return for the investment proposal over its life using the initial value of the investment is

A. 36.2%

B. 18.1%

C. 28.1%

D. 38.1%

-

Question 300:

Yipann Corporation is reviewing an investment proposal. The initial cost, as well as other related data for each year. are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value of the investment at the end of each year is equal to its net book value, and there will be no salvage value at the end of the investments life.

Yipann uses a 24% after4axtargetrate of return for new investment proposals. The discount figures for a 24% rate of return are given.

The average annual cash inflow at which Yipann would be indifferent to the investment (rounded to the nearest dollar) is

A. $21,000

B. $40,000

C. $38,321

D. $46,667

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.