Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 281:

A company uses portfolio theory to develop its investment portfolio. If the company wishes to obtain optimal risk reduction through the portfolio effect, it should make its next investment in an investment that

A. Correlates negatively to the current portfolio holdings.

B. Is uncorrelated to the current portfolio holdings.

C. Is highly correlated to the current portfolio holdings.

D. Is perfectly correlated to the current portfolio holdings.

-

Question 282:

For capital budgeting purposes, management would select a high hurdle rate of return for certain projects because management

A. Wants to use equity funding exclusively.

B. Believes too many proposals are being rejected.

C. Believes bank loans are riskier than capital investments.

D. Wants to factor risk into its consideration of projects.

-

Question 283:

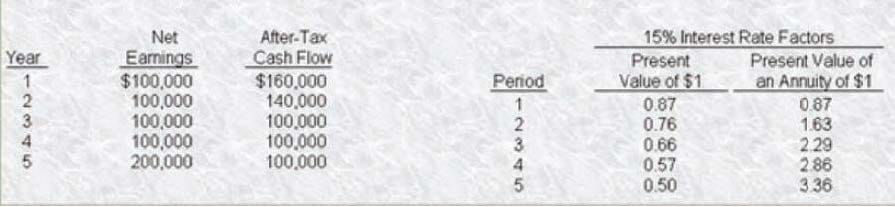

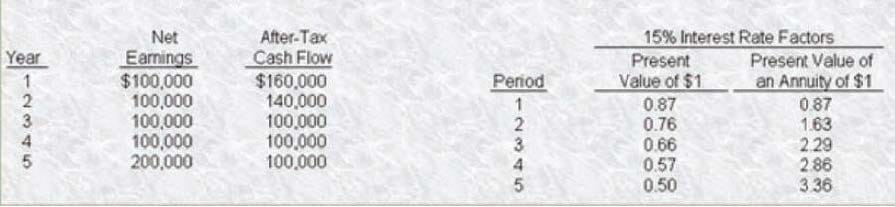

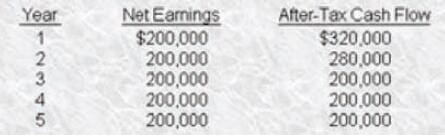

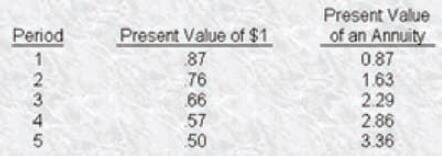

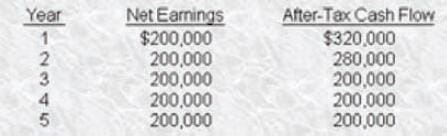

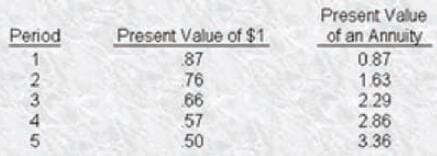

Willis, Inc. has a desired rate of return of 15% and is considering the acquisition of a new machine which costs $400,000 and has a useful life of 5 years. Willis projects that earnings and cash flow will increase as follows:

The net present value of Willis' investment is

A. Negative, $64,000.

B. Negative, $14,000.

C. Positive, $18,600.

D. Positive, $200,000.

-

Question 284:

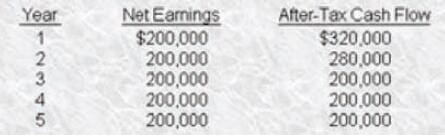

Willis, Inc. has a desired rate of return of 15% and is considering the acquisition of a new machine which costs $400,000 and has a useful life of 5 years. Willis projects that earnings and cash flow will increase as follows:

What is the payback period of Willis' investment?

A. 1.5 years.

B. 3.0 years.

C. 3.3 years.

D. 4.0 years.

-

Question 285:

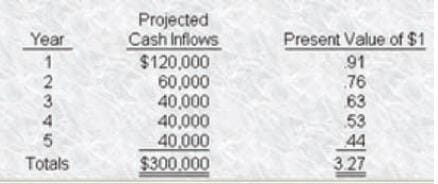

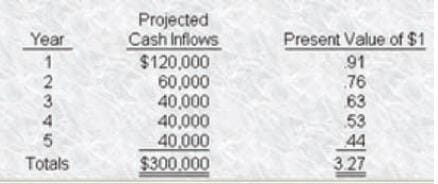

The Keego Company is planning a $200,000 equipment investment which has an estimated 5-year life with no estimated salvage value. The company has projected the following annual cash flows for the investment.

The net present value for the investment is

A. $18,800

B. $218,800

C. $100,000

D. $91,743

-

Question 286:

The Keego Company is planning a $200,000 equipment investment which has an estimated 5-year life with no estimated salvage value. The company has projected the following annual cash flows for the investment.

Assuming that the estimated cash inflows occur evenly during each year, the payback period for the investment is

A. 1.67years.

B. 4.91 years.

C. 2.50 years.

D. 1.96years.

-

Question 287:

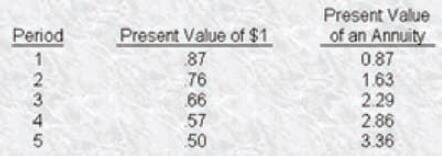

Tonya, Inc. has a cost of capital of 15% and is considering the acquisition of a new machine that costs $800,000 and has a useful life of 5 years. Tonya projects that earnings and cash flow will increase as follows:

Interest rate factors at 15% are as follows: What is the profitability index for the investment?

A. 0.05

B. 0.96

C. 1.05

D. 1.25

-

Question 288:

Tonya, Inc. has a cost of capital of 15% and is considering the acquisition of a new machine that costs $800,000 and has a useful life of 5 years. Tonya projects that earnings and cash flow will increase as follows:

Interest rate factors at 15% are as follows:

The net present value of this investment is

A. $(128,000)

B. $200,000

C. $37,200

D. $400,000

-

Question 289:

Tonya, Inc. has a cost of capital of 15% and is considering the acquisition of a new machine that costs $800,000 and has a useful life of 5 years. Tonya projects that earnings and cash flow will increase as follows:

Interest rate factors at 15% are as follows:

What is the payback period of this investment?

A. 1.Syears.

B. 3.Oyears.

C. 3.3 years.

D. 4.0 years.

-

Question 290:

Don Adams Breweries is considering an expansion project with an investment of $1,500,000. The equipment will be depreciated to zero salvage value on a straight-line basis over 5 years. The expansion will produce incremental operating revenue of $400,000 annually for 5 years. The company's opportunity cost of capital is 12%. Ignore taxes.What is the payback period of the project?

A. 2years.

B. 2.14 years.

C. 3.75years.

D. 5 years.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.